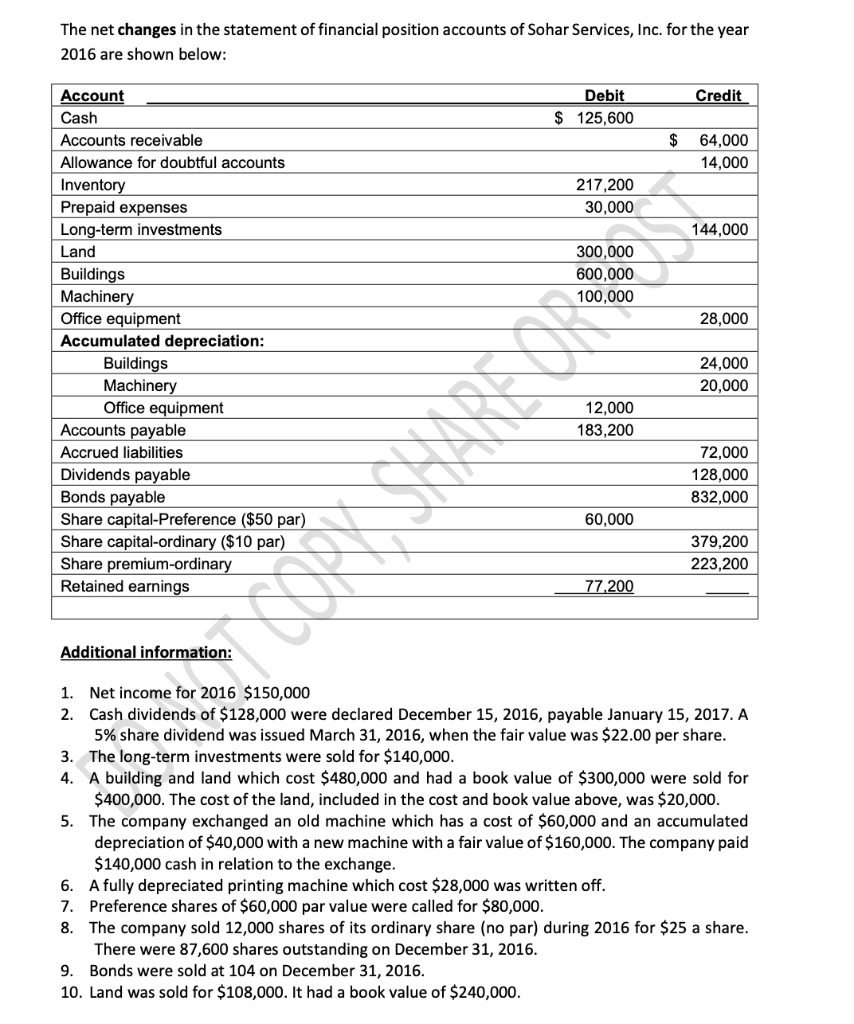

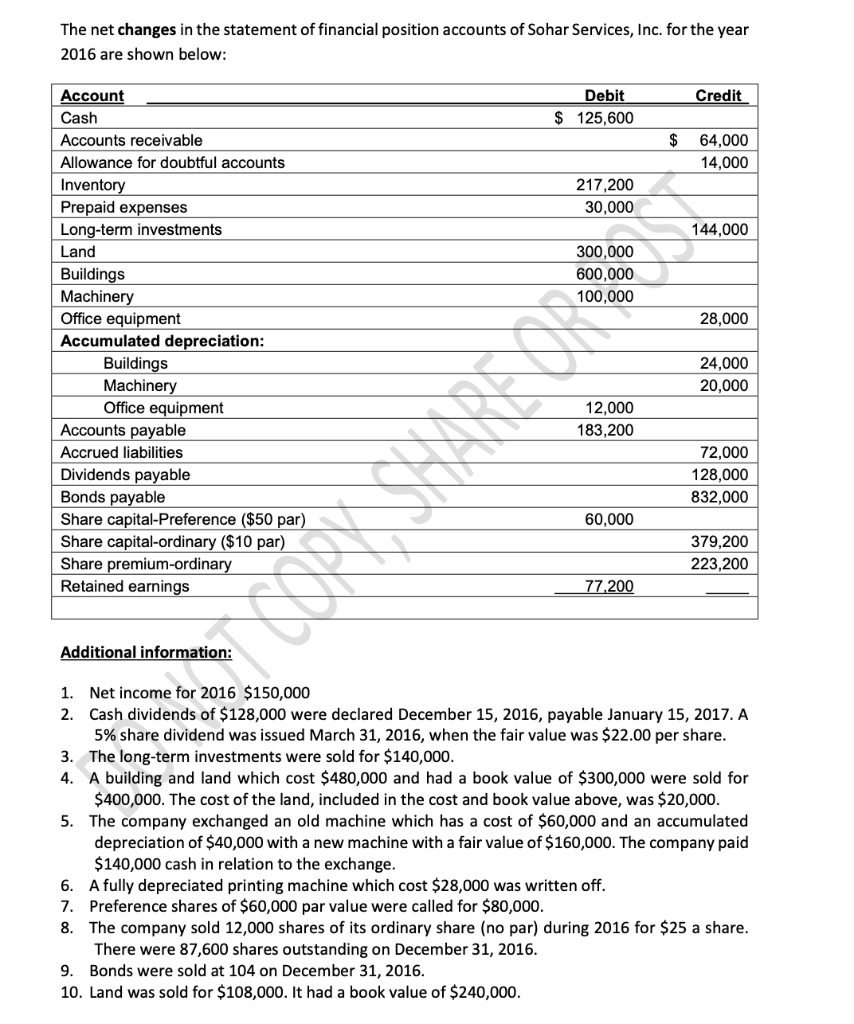

The net changes in the statement of financial position accounts of Sohar Services, Inc. for the year 2016 are shown below: Credit Debit $ 125,600 $ 64,000 14,000 144,000 28,000 Account Cash Accounts receivable Allowance for doubtful accounts Inventory Prepaid expenses Long-term investments Land Buildings Machinery Office equipment Accumulated depreciation: Buildings Machinery Office equipment Accounts payable Accrued liabilities Dividends payable Bonds payable Share capital-Preference ($50 par) Share capital-ordinary ($10 par) Share premium-ordinary Retained earnings 24,000 20,000 12,000 183,200 72,000 128,000 832,000 60,000 379,200 223,200 77,200 Additional information: 1. Net income for 2016 $150,000 2. Cash dividends of $128,000 were declared December 15, 2016, payable January 15, 2017. A 5% share dividend was issued March 31, 2016, when the fair value was $22.00 per share. 3. The long-term investments were sold for $140,000. 4. A building and land which cost $480,000 and had a book value of $300,000 were sold for $400,000. The cost of the land, included in the cost and book value above, was $20,000. 5. The company exchanged an old machine which has a cost of $60,000 and an accumulated depreciation of $40,000 with a new machine with a fair value of $160,000. The company paid $140,000 cash in relation to the exchange. 6. A fully depreciated printing machine which cost $28,000 was written off. 7. Preference shares of $60,000 par value were called for $80,000. 8. The company sold 12,000 shares of its ordinary share (no par) during 2016 for $25 a share. There were 87,600 shares outstanding on December 31, 2016. 9. Bonds were sold at 104 on December 31, 2016. 10. Land was sold for $108,000. It had a book value of $240,000. Q6 cont'd Required For Sohar Services Inc.: Prepare the Cash Flow Statement for 2016 in the correct format using the indirect method The net changes in the statement of financial position accounts of Sohar Services, Inc. for the year 2016 are shown below: Credit Debit $ 125,600 $ 64,000 14,000 144,000 28,000 Account Cash Accounts receivable Allowance for doubtful accounts Inventory Prepaid expenses Long-term investments Land Buildings Machinery Office equipment Accumulated depreciation: Buildings Machinery Office equipment Accounts payable Accrued liabilities Dividends payable Bonds payable Share capital-Preference ($50 par) Share capital-ordinary ($10 par) Share premium-ordinary Retained earnings 24,000 20,000 12,000 183,200 72,000 128,000 832,000 60,000 379,200 223,200 77,200 Additional information: 1. Net income for 2016 $150,000 2. Cash dividends of $128,000 were declared December 15, 2016, payable January 15, 2017. A 5% share dividend was issued March 31, 2016, when the fair value was $22.00 per share. 3. The long-term investments were sold for $140,000. 4. A building and land which cost $480,000 and had a book value of $300,000 were sold for $400,000. The cost of the land, included in the cost and book value above, was $20,000. 5. The company exchanged an old machine which has a cost of $60,000 and an accumulated depreciation of $40,000 with a new machine with a fair value of $160,000. The company paid $140,000 cash in relation to the exchange. 6. A fully depreciated printing machine which cost $28,000 was written off. 7. Preference shares of $60,000 par value were called for $80,000. 8. The company sold 12,000 shares of its ordinary share (no par) during 2016 for $25 a share. There were 87,600 shares outstanding on December 31, 2016. 9. Bonds were sold at 104 on December 31, 2016. 10. Land was sold for $108,000. It had a book value of $240,000. Q6 cont'd Required For Sohar Services Inc.: Prepare the Cash Flow Statement for 2016 in the correct format using the indirect method