Answered step by step

Verified Expert Solution

Question

1 Approved Answer

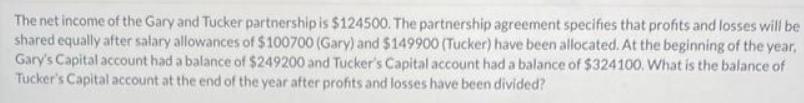

The net income of the Gary and Tucker partnership is $124500. The partnership agreement specifies that profits and losses will be shared equally after

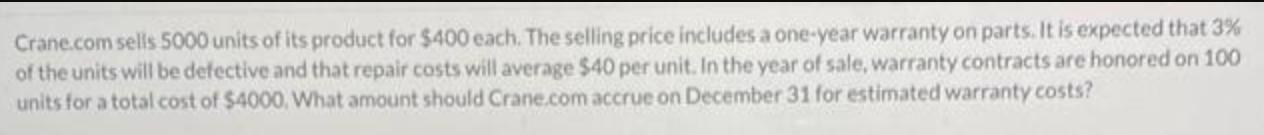

The net income of the Gary and Tucker partnership is $124500. The partnership agreement specifies that profits and losses will be shared equally after salary allowances of $100700 (Gary) and $149900 (Tucker) have been allocated. At the beginning of the year, Gary's Capital account had a balance of $249200 and Tucker's Capital account had a balance of $324100. What is the balance of Tucker's Capital account at the end of the year after profits and losses have been divided? Crane.com sells 5000 units of its product for $400 each. The selling price includes a one-year warranty on parts. It is expected that 3% of the units will be defective and that repair costs will average $40 per unit. In the year of sale, warranty contracts are honored on 100 units for a total cost of $4000, What amount should Crane.com accrue on December 31 for estimated warranty costs?

Step by Step Solution

★★★★★

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Table showing the balance amount of Gary and Tucker after allocation of sa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started