Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jen Novinska and Jeff Quinlan form a partnership by combining assets of their separate businesses. The following balance sheet information is provided by Novinska from

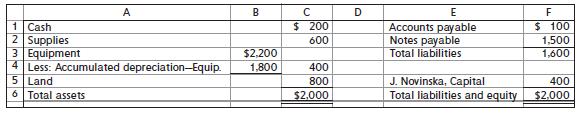

Jen Novinska and Jeff Quinlan form a partnership by combining assets of their separate businesses. The following balance sheet information is provided by Novinska from her sole proprietorship.

The new partners obtain appraised values and agree to accept the book values for Novinska's assets and liabilities except for the following: Equipment is valued at $1,000, and land is worth $1,600.

Required

Prepare the partnership's journal entry to record Novinska's investment.

A D E $ 200 Accounts payable Notes payable Total liabilities $ 100 1|Cash 2 Supplies 3 Equipment 4 Less: Accumulated depreciation-Equip. 5 Land 6 Total assets 600 1,500 $2,200 1,600 1,800 400 J. Novinska, Capital Total liabilities and equity 800 400 $2,000 $2.000

Step by Step Solution

★★★★★

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

transaction general journal Dr Cr 1 Cash ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635de6a1e26b1_179823.pdf

180 KBs PDF File

635de6a1e26b1_179823.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started