Question

The newest gadget model of ABC Co. will be released next month and will be sold for P21,000 per unit. Pre-release costs already incurred totaled

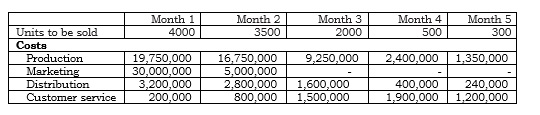

The newest gadget model of ABC Co. will be released next month and will be sold for P21,000 per unit. Pre-release costs already incurred totaled P1,200,000. Forecasted data over the product life cycle of five months are as follows:

Customer service costs will still be incurred for another 6 months. It is estimated to be P500,000 for the period.

Required: Product life cycle income statement for the new gadget model. Write the peso amounts in millions (e.g. if the total sales amount is P120,000,000, write 120).

PROBLEM 1-2:

An upgraded point-of-sale system is being considered by a firm. The firm would be incurring P300,000 for the purchase and installation of the system. Additionally, a one-time training fee of P10,000 will be incurred by firm. The system is expected to be used over a period of 5 years. Annual maintenance fee at the end of the second, third and fourth years will be P20,000, P25,000 and P25,000 respectively.

The relevant interest rate is 8%.

Required:

1. What is the present value of the total net cash flows relating to the acquisition and use of the point-of-sale system?

2. What is the equivalent annual cost of the system?

Units to be sold Month 1 4000 Month 2 3500 Month 3 2000 Month 4 500 Month 5 300 Costs Production 19,750,000 16,750,000 9,250,000 2,400,000 1,350,000 Marketing 30,000,000 5,000,000 Distribution 3,200,000 2,800,000 1,600,000 400,000 240,000 Customer service 200,000 800,000 1,500,000 1,900,000 1,200,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

PROBLEM 11 Product Life Cycle Income Statement for the New Gadget Model Given information Selling price per unit P21000 Prerelease costs already incur...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started