Question

The Newport Company is planning to expand its current spindle product line. The required machinery would cost $630,000. The building that will house the new

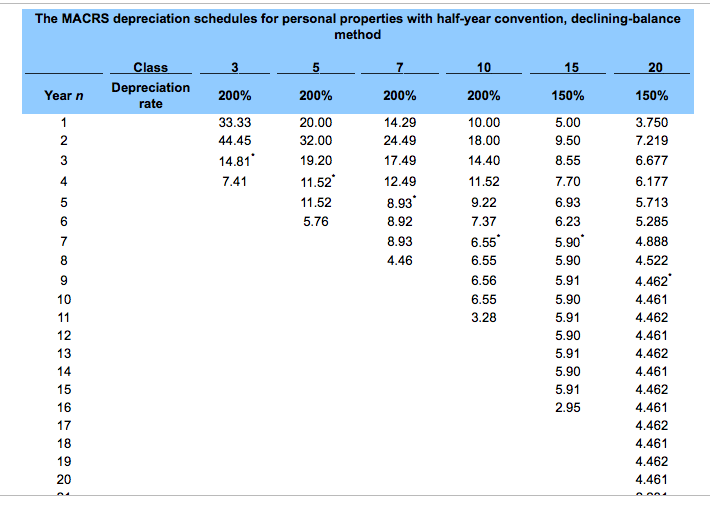

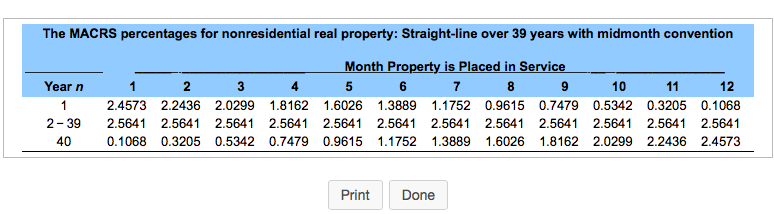

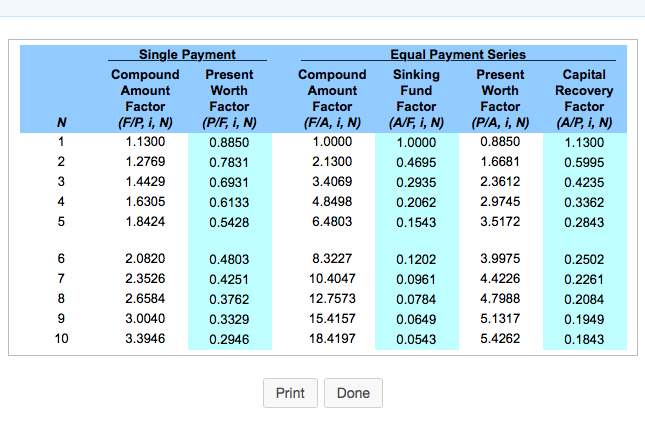

The Newport Company is planning to expand its current spindle product line. The required machinery would cost $630,000. The building that will house the new production facility would cost $0.9 million. The land would cost $340,000, and $290,000 working capital would be required. The product is expected to result in additional sales of $815,000 per year for 10 years, at which time the land can be sold for $480,000, the building for $500,000, and the equipment for $50,000. All of the working capital will be recovered. The annual disbursements for labor, materials, and all other expenses are estimated to be $385,000. The firms income tax rate is 40%, and any capital gains will be taxed at 35%. The buildings will be depreciated according to a 39-year property class. The manufacturing facility will be classified as a seven-year MACRS. The firms MARR is known to be 15% after taxes.

Determine the projected net after-tax cash flows from this investment. Is the expansion justified?

Compare the IRR of this project with that of a situation with no working capital.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started