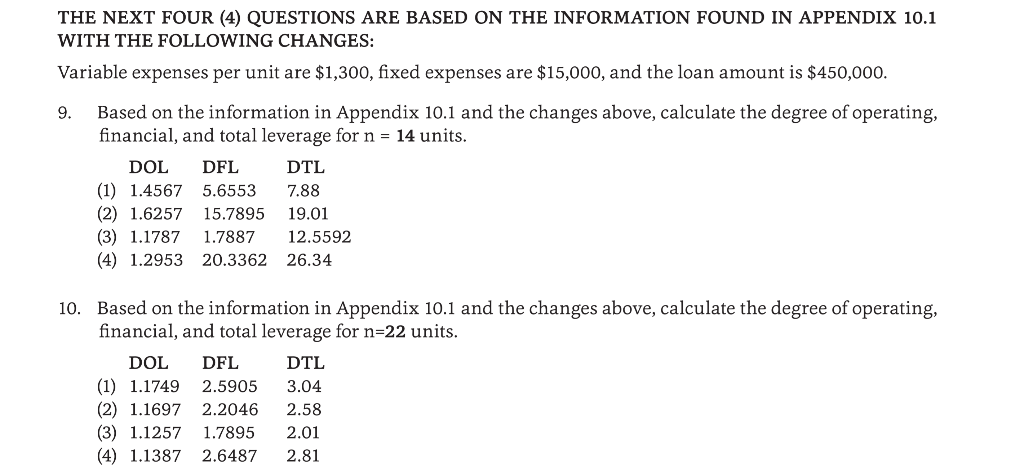

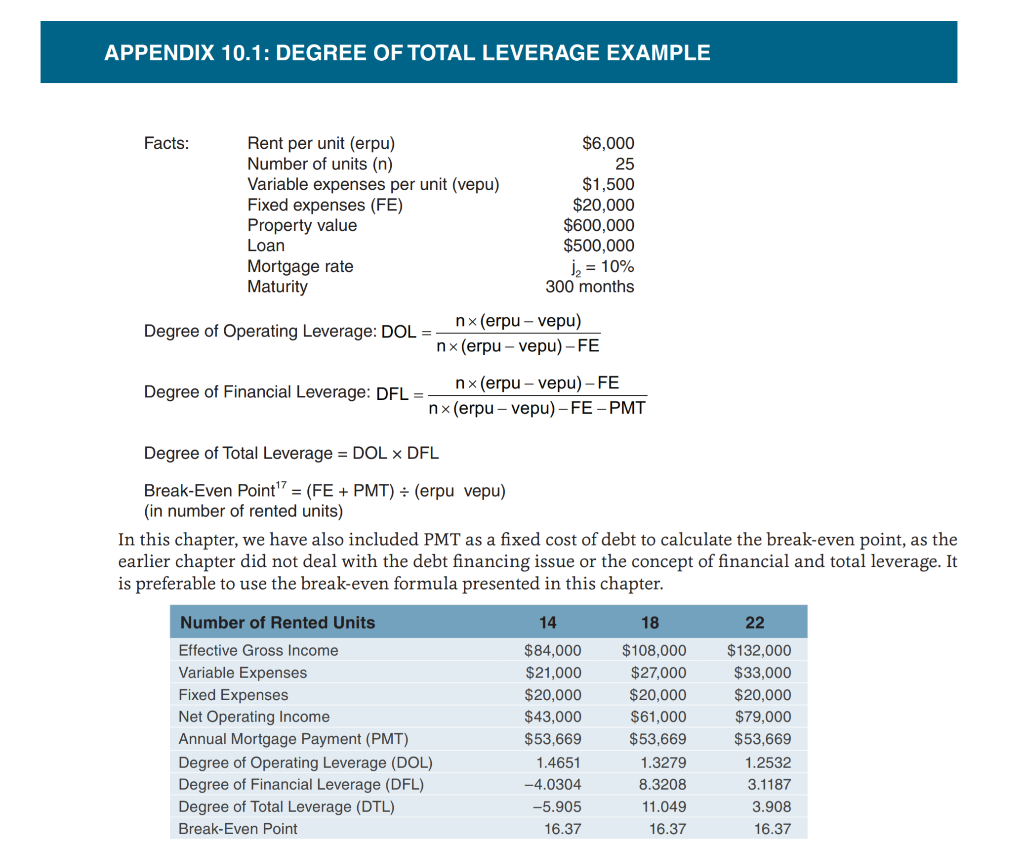

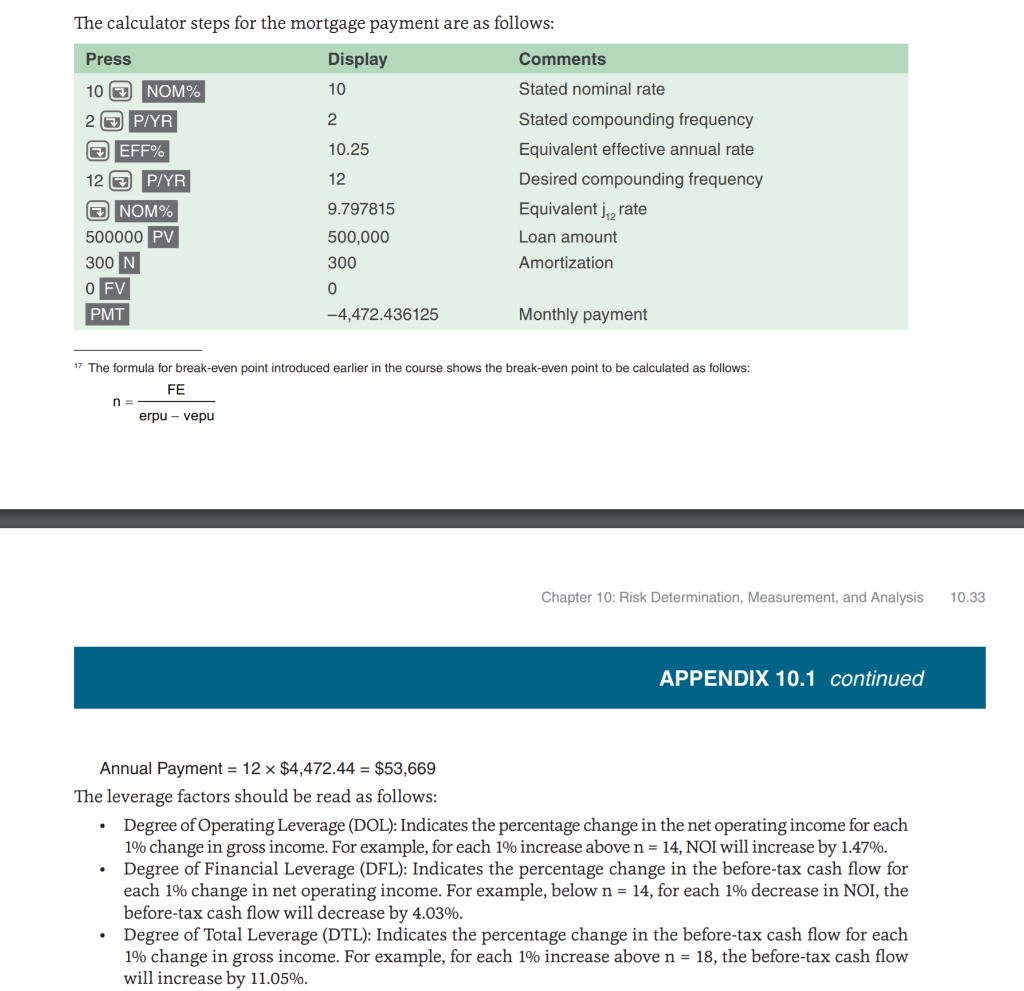

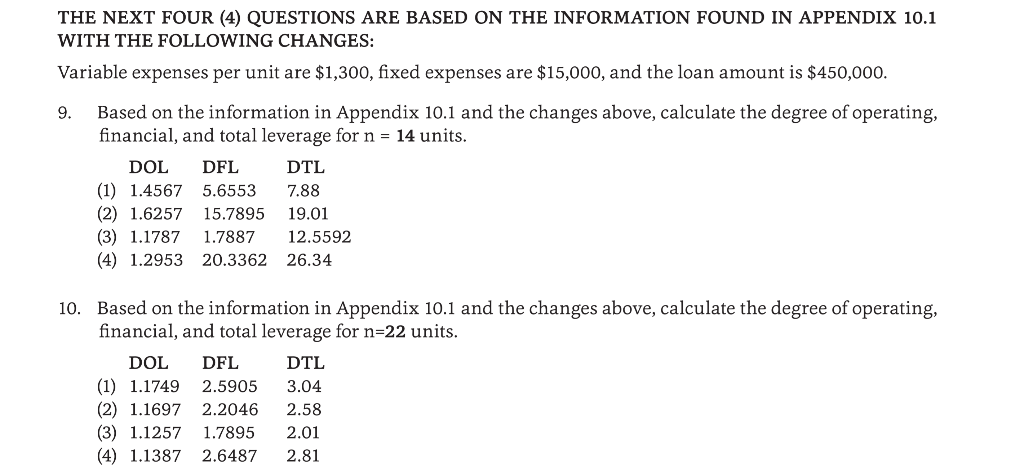

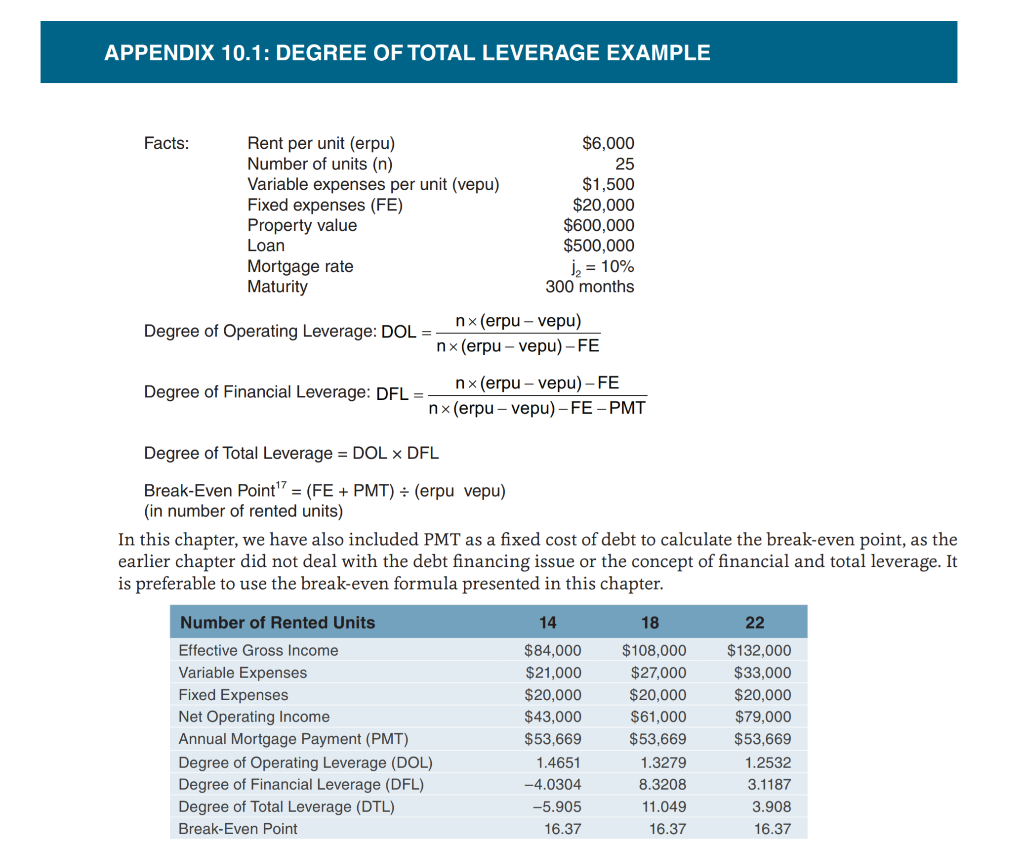

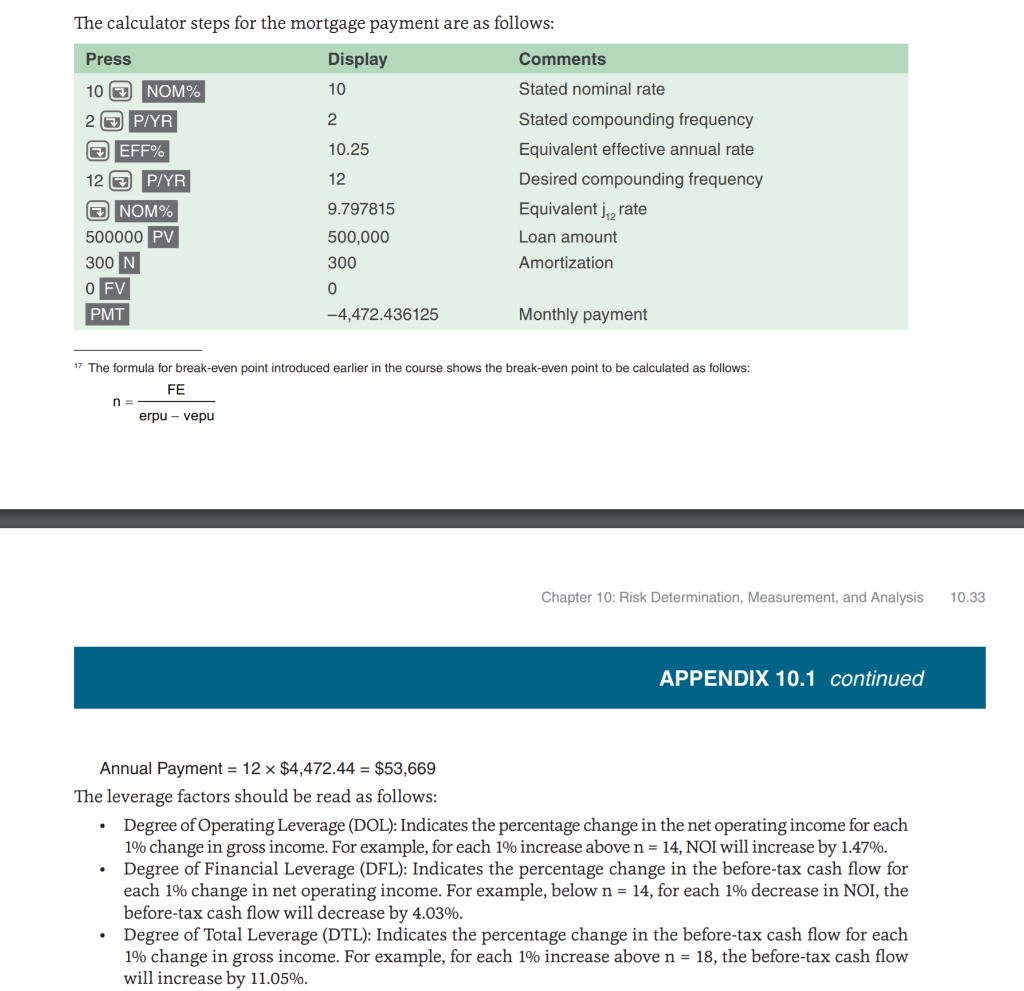

THE NEXT FOUR (4) QUESTIONS ARE BASED ON THE INFORMATION FOUND IN APPENDIX 10.1 WITH THE FOLLOWING CHANGES: Variable expenses per unit are $1,300, fixed expenses are $15,000, and the loan amount is $450,000. 9. Based on the information in Appendix 10.1 and the changes above, calculate the degree of operating, financial, and total leverage for n = 14 units. DOL DFL DTL (1) 1.4567 5.6553 7.88 (2) 1.6257 15.7895 19.01 (3) 1.1787 1.7887 12.5592 (4) 1.2953 20.3362 26.34 10. Based on the information in Appendix 10.1 and the changes above, calculate the degree of operating, financial, and total leverage for n=22 units. DOL DFL DTL (1) 1.1749 2.5905 3.04 (2) 1.1697 2.2046 2.58 (3) 1.1257 1.7895 2.01 (4) 1.1387 2.6487 2.81 APPENDIX 10.1: DEGREE OF TOTAL LEVERAGE EXAMPLE Facts: Rent per unit (erpu) $6,000 Number of units (n) 25 Variable expenses per unit (vepu) $1,500 Fixed expenses (FE) $20,000 Property value $600,000 Loan $500,000 Mortgage rate Maturity 300 months Degree of Operating Leverage: DOL = nx (erpu - vepu) nx (erpu - vepu)-FE je = 10% Degree of Financial Leverage: DFL = nx (erpu - vepu) - FE nx (erpu-vepu) - FE-PMT Degree of Total Leverage = DOL DFL Break-Even Point" = (FE+ PMT) + (erpu vepu) (in number of rented units) In this chapter, we have also included PMT as a fixed cost of debt to calculate the break-even point, as the earlier chapter did not deal with the debt financing issue or the concept of financial and total leverage. It is preferable to use the break-even formula presented in this chapter. Number of Rented Units 14 18 22 Effective Gross Income Variable Expenses Fixed Expenses Net Operating Income Annual Mortgage Payment (PMT) Degree of Operating Leverage (DOL) Degree of Financial Leverage (DFL) Degree of Total Leverage (DTL) Break-Even Point $84,000 $21,000 $20,000 $43,000 $53,669 1.4651 -4.0304 -5.905 16.37 $108,000 $27,000 $20,000 $61,000 $53,669 1.3279 8.3208 11.049 16.37 $132,000 $33,000 $20,000 $79,000 $53,669 1.2532 3.1187 3.908 16.37 The calculator steps for the mortgage payment are as follows: Press Display Comments 10 NOM% 10 Stated nominal rate 2 P/YR 2 Stated compounding frequency EFF% 10.25 Equivalent effective annual rate 12 P/YR 12 Desired compounding frequency NOM% 9.797815 Equivalent ji, rate 500000 PV 500,000 Loan amount 300 N 300 Amortization O FV 0 PMT -4.472.436125 Monthly payment 1 The formula for break-even point introduced earlier in the course shows the break-even point to be calculated as follows: FE n erpu - vepu Chapter 10: Risk Determination, Measurement, and Analysis 10.33 APPENDIX 10.1 continued Annual Payment = 12 x $4,472.44 = $53,669 The leverage factors should be read as follows: Degree of Operating Leverage (DOL): Indicates the percentage change in the net operating income for each 1% change in gross income. For example, for each 1% increase above n = 14, NOI will increase by 1.47%. Degree of Financial Leverage (DFL): Indicates the percentage change in the before-tax cash flow for each 1% change in net operating income. For example, below n = 14, for each 1% decrease in NOI, the before-tax cash flow will decrease by 4.03%. Degree of Total Leverage (DTL): Indicates the percentage change in the before-tax cash flow for each 1% change in gross income. For example, for each 1% increase above n = 18, the before-tax cash flow will increase by 11.05%