Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The next page shows Walgreen Boots Alliance's balance sheet and related inventory note (below) from the 10-K for yearend August 31, 2021. The amounts

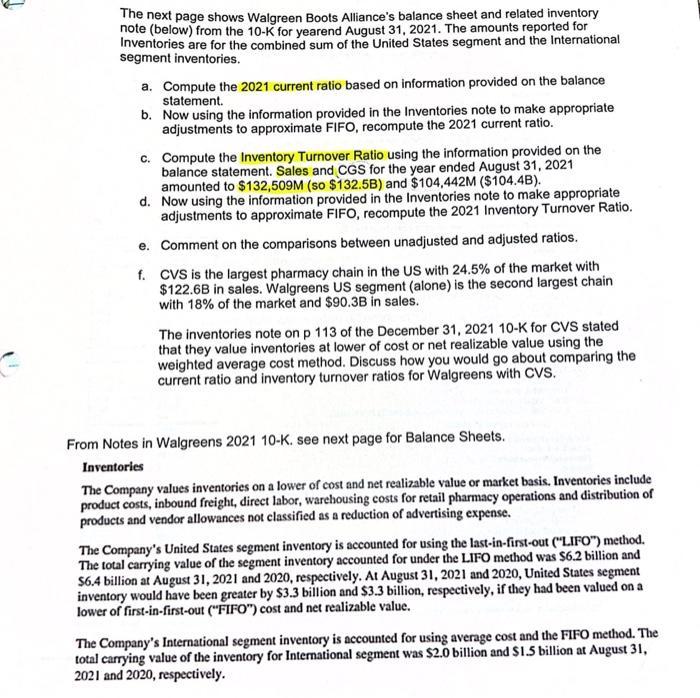

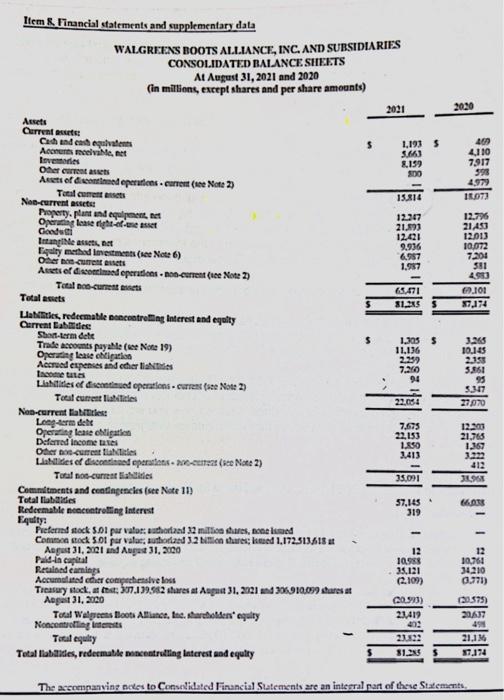

The next page shows Walgreen Boots Alliance's balance sheet and related inventory note (below) from the 10-K for yearend August 31, 2021. The amounts reported for Inventories are for the combined sum of the United States segment and the International segment inventories. a. Compute the 2021 current ratio based on information provided on the balance statement. b. Now using the information provided in the Inventories note to make appropriate adjustments to approximate FIFO, recompute the 2021 current ratio. c. Compute the Inventory Turnover Ratio using the information provided on the balance statement. Sales and CGS for the year ended August 31, 2021 amounted to $132,509M (so $132.5B) and $104,442M ($104.4B). d. Now using the information provided in the Inventories note to make appropriate adjustments to approximate FIFO, recompute the 2021 Inventory Turnover Ratio. Comment on the comparisons between unadjusted and adjusted ratios. e. f. CVS is the largest pharmacy chain in the US with 24.5% of the market with $122.6B in sales. Walgreens US segment (alone) is the second largest chain with 18% of the market and $90.3B in sales. The inventories note on p 113 of the December 31, 2021 10-K for CVS stated that they value inventories at lower of cost or net realizable value using the weighted average cost method. Discuss how you would go about comparing the current ratio and inventory turnover ratios for Walgreens with CVS. From Notes in Walgreens 2021 10-K. see next page for Balance Sheets. Inventories The Company values inventories on a lower of cost and net realizable value or market basis. Inventories include product costs, inbound freight, direct labor, warehousing costs for retail pharmacy operations and distribution of products and vendor allowances not classified as a reduction of advertising expense. The Company's United States segment inventory is accounted for using the last-in-first-out ("LIFO") method. The total carrying value of the segment inventory accounted for under the LIFO method was $6.2 billion and $6.4 billion at August 31, 2021 and 2020, respectively. At August 31, 2021 and 2020, United States segment inventory would have been greater by $3.3 billion and $3.3 billion, respectively, if they had been valued on a lower of first-in-first-out ("FIFO") cost and net realizable value. The Company's International segment inventory is accounted for using average cost and the FIFO method. The total carrying value of the inventory for International segment was $2.0 billion and $1.5 billion at August 31, 2021 and 2020, respectively. Item & Financial statements and supplementary data Assets Current assets: WALGREENS BOOTS ALLIANCE, INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS At August 31, 2021 and 2020 (in millions, except shares and per share amounts) Cash and cash equivalents Accounts meelvable, net Inventories Other current assets Assets of discontioned operations current (se Note 2) Total coment assets Non-current assets: Property, plant and equipment, net Operating lease right-of-se asset dutti Intangible assets, net Equity method Investments (see Note 6) Other non-current assets Assets of discontinand operations-non-current (Note 2) Total non-current assets Total assets Liabilities, redeemable noncontrolling Interest and equity Current Eabides Short-term dett Trade accounts payable (se Note 19) Operating lease ehitigation Accrued expenses and other lates Income taxes Liabilities of discontinued operations-current (see Note 2) Total current liabilities Non-current liabilities: Long-term det Operating lease obligation Deferred Income taxes Other non-current tables Liabilities of discontinued operations-200-eurent (see Note 2) Total non-current liabilities Commitments and contingencies (see Note 11) Total liabides Redeemable nencontrolling Interest Equity: Preferred stock 5.01 par valor authorized 32 million shares, none isted Common stock 5.01 par valar; authorized 3.2 billion shares; med 1,172.513618 at August 31, 2021 and August 31, 2000 Paid-in capital Retained earnings Accumulated other comprehensive loss Treasury stock, at fest; 307.139582 shares at August 31, 2021 and 306910,099 shares at August 31, 2020 Total Walgreens Boots Alliance, Inc. shareholders' equity Noncontrolling Interests Total equity Total liabilities, redeemable noncontrolling interest and equity - S S 2021 1,193 S 5.663 8.159 500 15,814 12.347 21,393 12,421 9.936 6.957 1,987 65,471 81,235 1,305 S 11,136 2,259 7,250 94 22,054 7,675 22,153 1,850 35,091 57,145 319 - 12 10,988 35.121 (2.109) (20.993) 23,419 402 23.822 $1,285 2020 460 4,110 7917 598 4,979 18.073 12,796 21,453 12.013 10,072 7.204 581 4,953 9.101 87,174 3,265 10.145 2.358 5.861 95 5.347 27,070 12.203 21,765 1.367 3.222 412 31,968 66.038 12 10,761 34,210 (0.771) (20.575) 20,637 495 21.13 87,174 The accompanying notes to Consolidated Financial Statements are an integral part of these Statements,

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

STEP ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started