Answered step by step

Verified Expert Solution

Question

1 Approved Answer

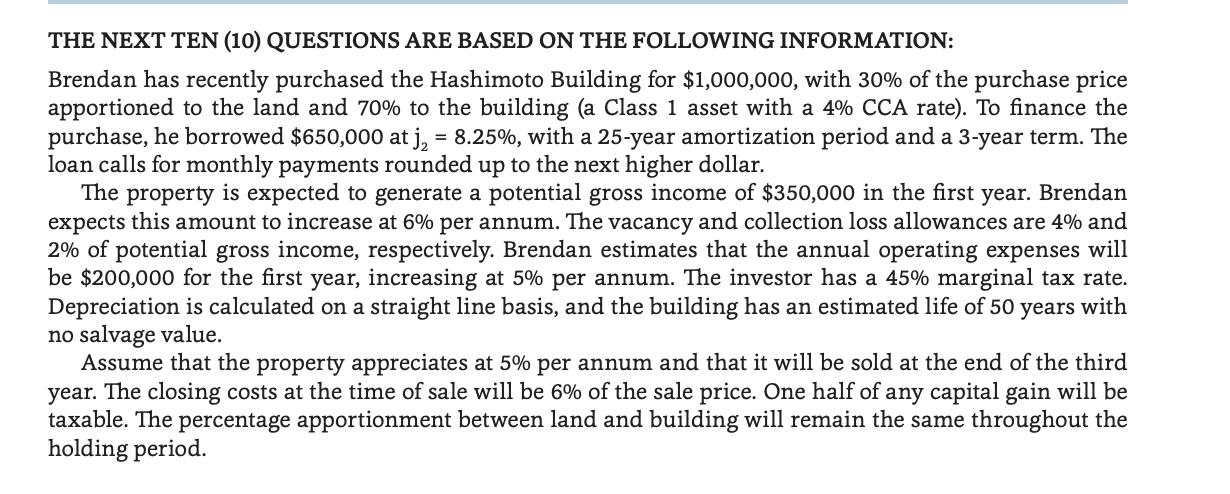

THE NEXT TEN (10) QUESTIONS ARE BASED ON THE FOLLOWING INFORMATION: Brendan has recently purchased the Hashimoto Building for $1,000,000, with 30% of the

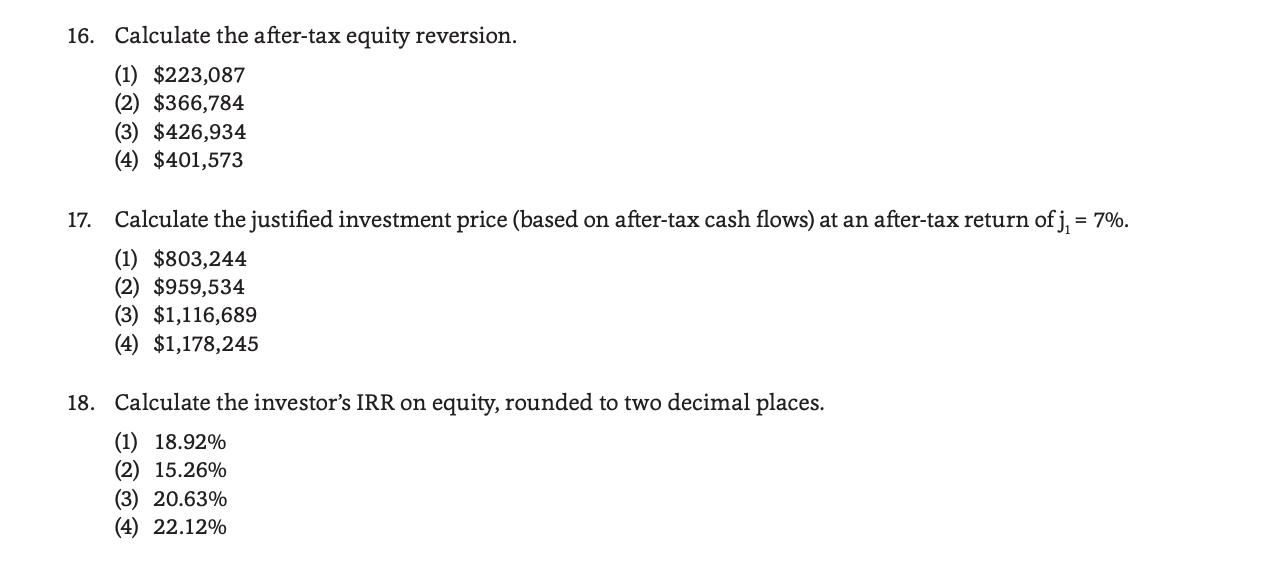

THE NEXT TEN (10) QUESTIONS ARE BASED ON THE FOLLOWING INFORMATION: Brendan has recently purchased the Hashimoto Building for $1,000,000, with 30% of the purchase price apportioned to the land and 70% to the building (a Class 1 asset with a 4% CCA rate). To finance the purchase, he borrowed $650,000 at j = 8.25%, with a 25-year amortization period and a 3-year term. The loan calls for monthly payments rounded up to the next higher dollar. The property is expected to generate a potential gross income of $350,000 in the first year. Brendan expects this amount to increase at 6% per annum. The vacancy and collection loss allowances are 4% and 2% of potential gross income, respectively. Brendan estimates that the annual operating expenses will be $200,000 for the first year, increasing at 5% per annum. The investor has a 45% marginal tax rate. Depreciation is calculated on a straight line basis, and the building has an estimated life of 50 years with no salvage value. Assume that the property appreciates at 5% per annum and that it will be sold at the end of the third year. The closing costs at the time of sale will be 6% of the sale price. One half of any capital gain will be taxable. The percentage apportionment between land and building will remain the same throughout the holding period. 16. Calculate the after-tax equity reversion. (1) $223,087 (2) $366,784 (3) $426,934 (4) $401,573 17. Calculate the justified investment price (based on after-tax cash flows) at an after-tax return of j = 7%. (1) $803,244 (2) $959,534 (3) $1,116,689 (4) $1,178,245 18. Calculate the investor's IRR on equity, rounded to two decimal places. (1) 18.92% (2) 15.26% (3) 20.63% (4) 22.12%

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

16 401573 17 959534 18 2063 WORKING 16 Equity reversion Sa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started