Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(30 pts.) The Nobel Dynamite Company is considering a new packing machine. The existing packing machine cost $500,000 five years ago and is being

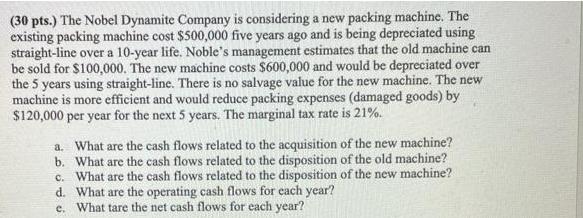

(30 pts.) The Nobel Dynamite Company is considering a new packing machine. The existing packing machine cost $500,000 five years ago and is being depreciated using straight-line over a 10-year life. Noble's management estimates that the old machine can be sold for $100,000. The new machine costs $600,000 and would be depreciated over the 5 years using straight-line. There is no salvage value for the new machine. The new machine is more efficient and would reduce packing expenses (damaged goods) by $120,000 per year for the next 5 years. The marginal tax rate is 21%. a. What are the cash flows related to the acquisition of the new machine? b. What are the cash flows related to the disposition of the old machine? c. What are the cash flows related to the disposition of the new machine? d. What are the operating cash flows for cach year? e. What tare the net cash flows for each year?

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Book1 Excel El J X File Home Insert Page Layout Formulas Data Review View Tell me what you want to d...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started