Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The nominal net cash flows in the table below are for two mutually exclusive investments. 3.1 What are the nominal NPVs of each investment

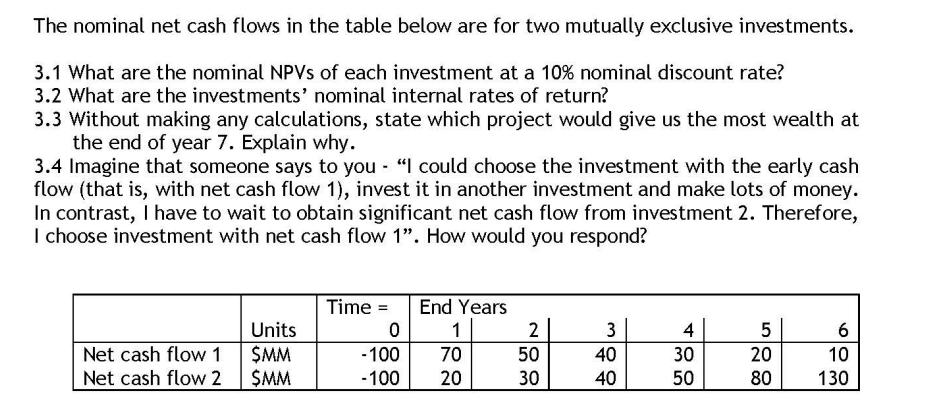

The nominal net cash flows in the table below are for two mutually exclusive investments. 3.1 What are the nominal NPVs of each investment at a 10% nominal discount rate? 3.2 What are the investments' nominal internal rates of return? 3.3 Without making any calculations, state which project would give us the most wealth at the end of year 7. Explain why. 3.4 Imagine that someone says to you - "I could choose the investment with the early cash flow (that is, with net cash flow 1), invest it in another investment and make lots of money. In contrast, I have to wait to obtain significant net cash flow from investment 2. Therefore, I choose investment with net cash flow 1". How would you respond? Time = Units 0 End Years 1 2 3 4 5 6 Net cash flow 1 $MM -100 70 50 40 30 Net cash flow 2 SMM -100 20 30 40 50 280 10 130

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started