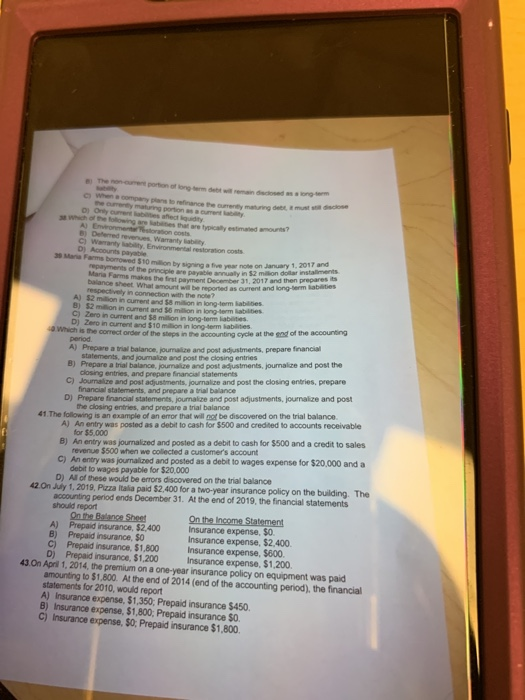

The non-aurent porton of lone tem de wil mn decosed abty ong whena ompany plans to refinance te ourrently maturing debe, a must stil disclose the oumenty maturing portion as a curent labty o Only oument abes afect liqudity 2Which of the following are labities that are typically estimated amounts? A) Envronmeroaon costs Defemed revenues Wamanty lablity Ci Environmental restoration costs lability Accounts payable 39 Mara Fams bomowed 510 million by signing a five year note on January 1, 2017 and repayments of the principle are payable annualy in $2 milion dollar installments Mara Farms makes the first payment December 31, 2017 and then prepares its balance aheet What amount will be reported as ourrent and long-lerm labites respectively in A) $2 million in curent and $8 million in long-term labilbes B) $2 million in qurent and $6 million in long-term labilibes C) Zero in curent and $8 million in long-term liabiities. D) Zero in current and $10 mion in long-temm iabilities Which is the correct onrder of the steps in the accounting cycle at the end of the accounting period A) Prepare a trial balance, joumalize and post adiustments, prepare financial statements, and jounalize and post the closing entries B) Prepare a trial balance, joumalize and post adjustments, journalize and post the closing entries, and prepare financial statements c) Jounalize and post adjustments, journalize and post the closing entries, prepare financial statements, and prepare a trial balance D) Prepare financial statements, jounalize and post adjustments, journalize and post the closing entries, and prepare a trial balance connection with the note? 41.The following is an example of an error that will not be discovered on the trial balance. A) An entry was posted as a debit to cash for $500 and credited to accounts receivable for $5,000 B) An entry was journalized and posted as a debit to cash for $500 and a credit to sales. revenue $500 when we collected a customer's account C) An entry was jounalized and posted as a debit to wages expense for $20,000 and a debit to wages payable for $20,000 D) All of these would be errors discovered on the trial balance 42.On July 1, 2019, Pizza Italia paid $2,400 for a two-year insurance policy on the building. The accounting period ends December 31. At the end of 2019, the financial statements should report On the Balance Sheet A) Prepaid insurance, $2,400 B) Prepaid insurance, $0 C) Prepaid insurance. $1,800 D) Prepaid insurance, $1,200 On the Income Statement Insurance expense, $0 Insurance expense, $2,400 Insurance expense, $600. Insurance expense, $1,200 43 On April 1, 2014, the premium on a one-year insurance policy on equipment was paid amounting to $1,800. At the end of 2014 (end of the accounting period), the financial statements for 2010, would report A) Insurance exxpense, $1,350, Prepaid insurance $450. B) Insurance expense, $1,800, Prepaid insurance $0. C) Insurance expense, $0, Prepaid insurance $1,800