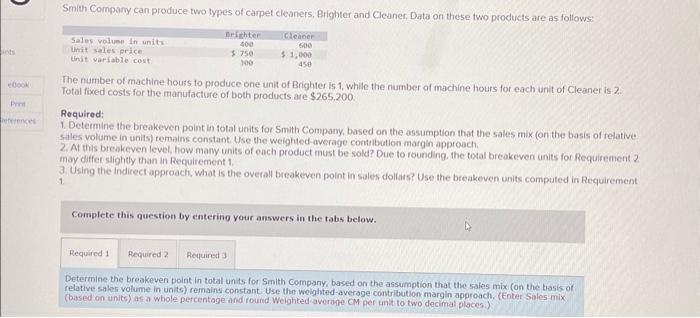

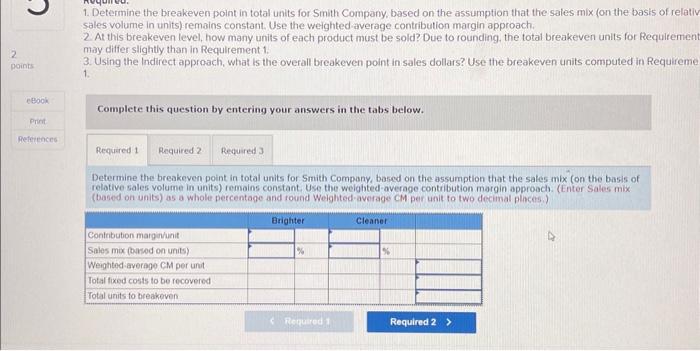

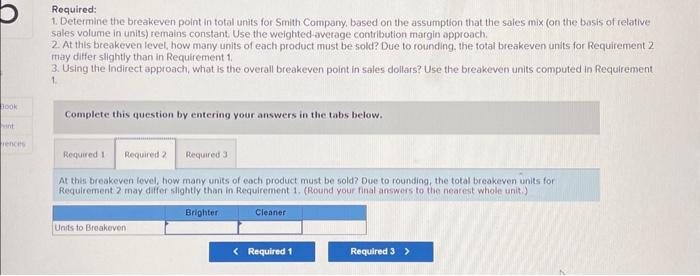

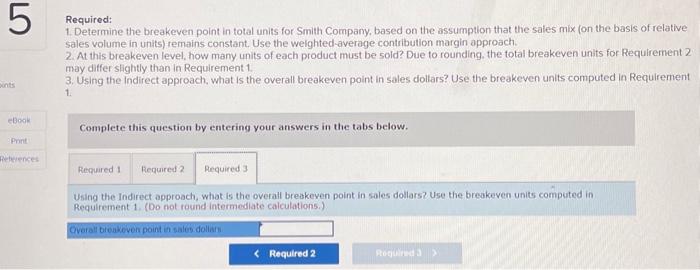

The number of machine houss to produce one unit of Brighter is 1 , while the number of machine hours for each unit of Cleaner is 2 . Total fixed costs for the manufacture of both products are $265,200. Required: 1. Determine the breakeven point in total units for Smith Company, based on the assumption that the sales mix con the basis of relative sales volume in units) remains constant. Use the weighted-average contibution margin approach. 2. At this breakeven level, how many units of each product must be sold? Due to rounding. the total breakeven units for Requirement 2 may differ slightly than in Requirement 1. 3. Using the Indirect approach, what is the overall breakeven point in sales dollats? Use the breakeven units computed in Requirement 1. Complete this question by enterino your answers in the tabs below. Determine the breakeven point in total units for Smith Company, based on the assumption that the sales mix (on the basis of relative sales volume in units) remains constant Use tho weighted-average contribution margin approach. (Enter Siles mix (based on units) as a whole percentage and round. Weighted average CM per unit to two decimal places.) 1. Determine the breakeven point in total units for Smith Company, based on the assumption that the sales mix (on the basis of relatis sales volume in units) remains constant. Use the weighted average contribution margin approach. 2 At this breakeven level, how many units of each product must be sold? Due to rounding, the total breakeven units for Requiremen may differ slightly than in Requirement 1. 3. Using the Indirect approach, what is the overall breakeven point in sales dollars? Use the breakeven units computed in Requireme 1. Complete this question by entering your answers in the tabs below. Determine the breakeven point in total units for Smith Company, based on the assumption that the sales mbx (on the basis of relative sales volume in units) remains constant. Use the welghted-average contribution margin approach. (Enter Sales mix (based on units) as a whole percentage and round Weighted-average CM per unit to two decimal places.) Required: 1. Determine the breakeven point in total units for Smith Company, based on the assumption that the sales mix (on the basis of relative sales volume in units) remains constant. Use the weighted average contribution margin approach. 2. At this breakeven level, how mary units of each product must be sold? Due to rounding. the total breakeven unts for Requirement 2 may differ sllightly than in Requirement 1. 3. Using the Indirect approach, what is the overall breakeven point in sales dollars? Use the breakeven units computed in Requirement 1. Complete this question by entering your answers in the tabs below. At this breakeven level, how many units of each product must be sold? Due to rounding, the total breakeven units for Requirement? may differ slightly than in Requirement 1. (Round your final answers to the nearest whole unit.) Required: 1. Determine the breakeven point in total units for Smith Company, based on the assumption that the sales mix (on the basis of relative sales volume in units) remains constant. Use the weighted-average contribution margin approach. 2. At this breakeven level, how many units of each product must be sold? Due to rounding, the total breakeven units for Requirement may differ sightly than in Requirement 1. 3. Using the Indirect approach. what is the overall breakeven point in sales dollars? Use the breakeven units computed in Requirement 1. Complete this question by entering your answers in the tabs below. Using the Indirect approach, what is the overall breakeven point in sales dollars? Use the breakeven units computed in Requirement 1. (Do not round intermediate calculations.)