Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The numbers above are correct. Please help me complete it correctly. Thank you! Acquisition Cost, Equity Method, Eliminating Entries, Second Year Peak Entertainment acquires all

The numbers above are correct. Please help me complete it correctly. Thank you!

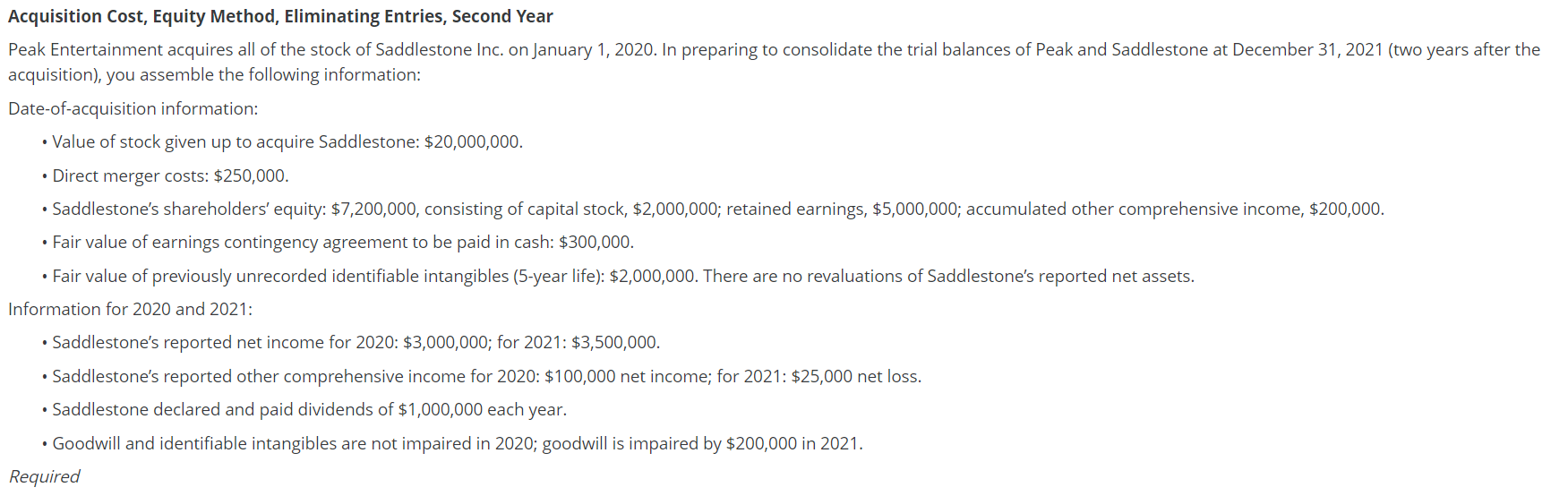

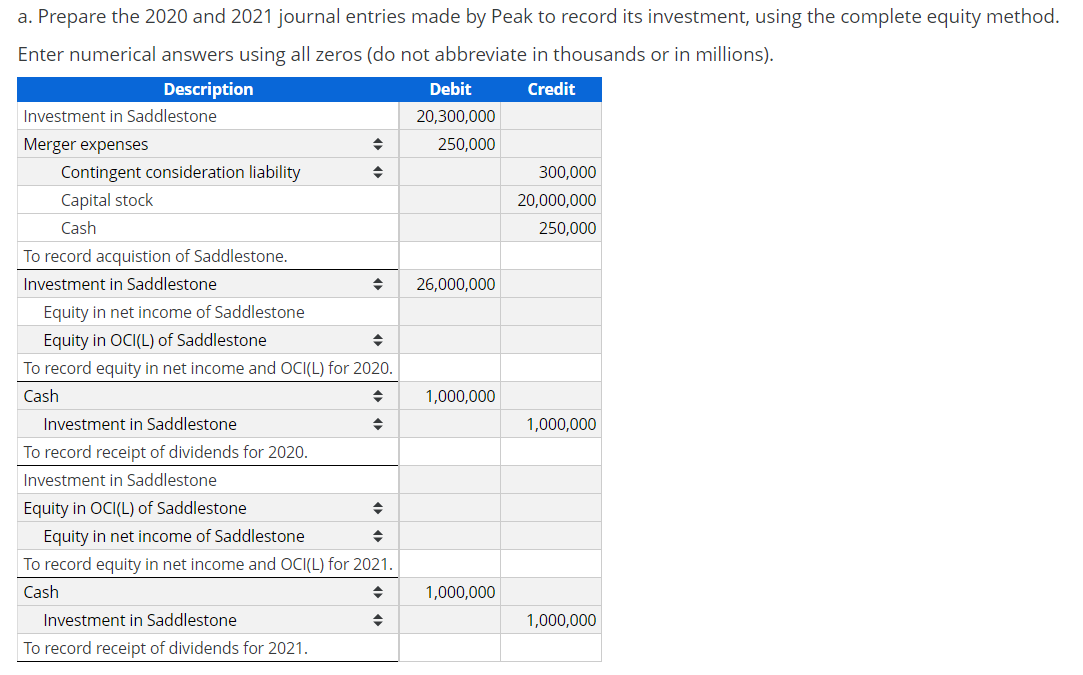

Acquisition Cost, Equity Method, Eliminating Entries, Second Year Peak Entertainment acquires all of the stock of Saddlestone Inc. on January 1, 2020. In preparing to consolidate the trial balances of Peak and Saddlestone at December 31, 2021 (two years after the acquisition), you assemble the following information: Date-of-acquisition information: Value of stock given up to acquire Saddlestone: $20,000,000. Direct merger costs: $250,000. Saddlestone's shareholders' equity: $7,200,000, consisting of capital stock, $2,000,000; retained earnings, $5,000,000; accumulated other comprehensive income, $200,000. Fair value of earnings contingency agreement to be paid in cash: $300,000. Fair value of previously unrecorded identifiable intangibles (5-year life): $2,000,000. There are no revaluations of Saddlestone's reported net assets. Information for 2020 and 2021: Saddlestone's reported net income for 2020: $3,000,000; for 2021: $3,500,000. Saddlestone's reported other comprehensive income for 2020: $100,000 net income; for 2021: $25,000 net loss. Saddlestone declared and paid dividends of $1,000,000 each year. Goodwill and identifiable intangibles are not impaired in 2020; goodwill is impaired by $200,000 in 2021. Required a. Prepare the 2020 and 2021 journal entries made by Peak to record its investment, using the complete equity method. Enter numerical answers using all zeros (do not abbreviate in thousands or in millions). Description Debit Credit Investment in Saddlestone 20,300,000 Merger expenses 250,000 Contingent consideration liability 300,000 Capital stock 20,000,000 Cash 250,000 To record acquistion of Saddlestone. Investment in Saddlestone 26,000,000 Equity in net income of Saddlestone Equity in OCI(L) of Saddlestone To record equity in net income and OCI(L) for 2020. Cash 1,000,000 Investment in Saddlestone 1,000,000 To record receipt of dividends for 2020. Investment in Saddlestone Equity in OCI(L) of Saddlestone Equity in net income of Saddlestone To record equity in net income and OCI(L) for 2021. Cash 1,000,000 Investment in Saddlestone 1,000,000 To record receipt of dividends for 2021. b. Prepare the consolidation eliminating entries made at December 31, 2021. Enter numerical answers using all zeros (do not abbreviate in thousands or in millions). Ref. Description Debit Credit (C) Equity in net income of Saddlestone Equity in OCI(L) of Saddlestone Dividends-Saddlestone 1,000,000 Investment in Saddlestone (E) Capital stock Retained earnings Accumulated OCI Investment in Saddlestone (R) Identifiable intangibles Goodwill Investment in Saddlestone (O) Amortization expense Goodwill impairment loss Indentifiable intangibles Goodwill . . . Acquisition Cost, Equity Method, Eliminating Entries, Second Year Peak Entertainment acquires all of the stock of Saddlestone Inc. on January 1, 2020. In preparing to consolidate the trial balances of Peak and Saddlestone at December 31, 2021 (two years after the acquisition), you assemble the following information: Date-of-acquisition information: Value of stock given up to acquire Saddlestone: $20,000,000. Direct merger costs: $250,000. Saddlestone's shareholders' equity: $7,200,000, consisting of capital stock, $2,000,000; retained earnings, $5,000,000; accumulated other comprehensive income, $200,000. Fair value of earnings contingency agreement to be paid in cash: $300,000. Fair value of previously unrecorded identifiable intangibles (5-year life): $2,000,000. There are no revaluations of Saddlestone's reported net assets. Information for 2020 and 2021: Saddlestone's reported net income for 2020: $3,000,000; for 2021: $3,500,000. Saddlestone's reported other comprehensive income for 2020: $100,000 net income; for 2021: $25,000 net loss. Saddlestone declared and paid dividends of $1,000,000 each year. Goodwill and identifiable intangibles are not impaired in 2020; goodwill is impaired by $200,000 in 2021. Required a. Prepare the 2020 and 2021 journal entries made by Peak to record its investment, using the complete equity method. Enter numerical answers using all zeros (do not abbreviate in thousands or in millions). Description Debit Credit Investment in Saddlestone 20,300,000 Merger expenses 250,000 Contingent consideration liability 300,000 Capital stock 20,000,000 Cash 250,000 To record acquistion of Saddlestone. Investment in Saddlestone 26,000,000 Equity in net income of Saddlestone Equity in OCI(L) of Saddlestone To record equity in net income and OCI(L) for 2020. Cash 1,000,000 Investment in Saddlestone 1,000,000 To record receipt of dividends for 2020. Investment in Saddlestone Equity in OCI(L) of Saddlestone Equity in net income of Saddlestone To record equity in net income and OCI(L) for 2021. Cash 1,000,000 Investment in Saddlestone 1,000,000 To record receipt of dividends for 2021. b. Prepare the consolidation eliminating entries made at December 31, 2021. Enter numerical answers using all zeros (do not abbreviate in thousands or in millions). Ref. Description Debit Credit (C) Equity in net income of Saddlestone Equity in OCI(L) of Saddlestone Dividends-Saddlestone 1,000,000 Investment in Saddlestone (E) Capital stock Retained earnings Accumulated OCI Investment in Saddlestone (R) Identifiable intangibles Goodwill Investment in Saddlestone (O) Amortization expense Goodwill impairment loss Indentifiable intangibles GoodwillStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started