Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The objective of hedge accounting is to represent, in the financial statements, the effect of an entity's risk management activities that use financial instruments

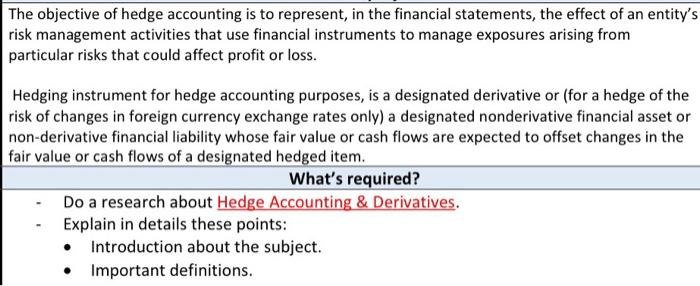

The objective of hedge accounting is to represent, in the financial statements, the effect of an entity's risk management activities that use financial instruments to manage exposures arising from particular risks that could affect profit or loss. Hedging instrument for hedge accounting purposes, is a designated derivative or (for a hedge of the risk of changes in foreign currency exchange rates only) a designated nonderivative financial asset or non-derivative financial liability whose fair value or cash flows are expected to offset changes in the fair value or cash flows of a designated hedged item. What's required? Do a research about Hedge Accounting & Derivatives. Explain in details these points: Introduction about the subject. Important definitions.

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Hedge accounting is an accounting method used to reflect the offsetting impact of financial instruments and transactions used to manage risks The obje...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started