Question: The objective of this case is to develop skills to apply optimization models to support business decisions. In particular, you will get experience in

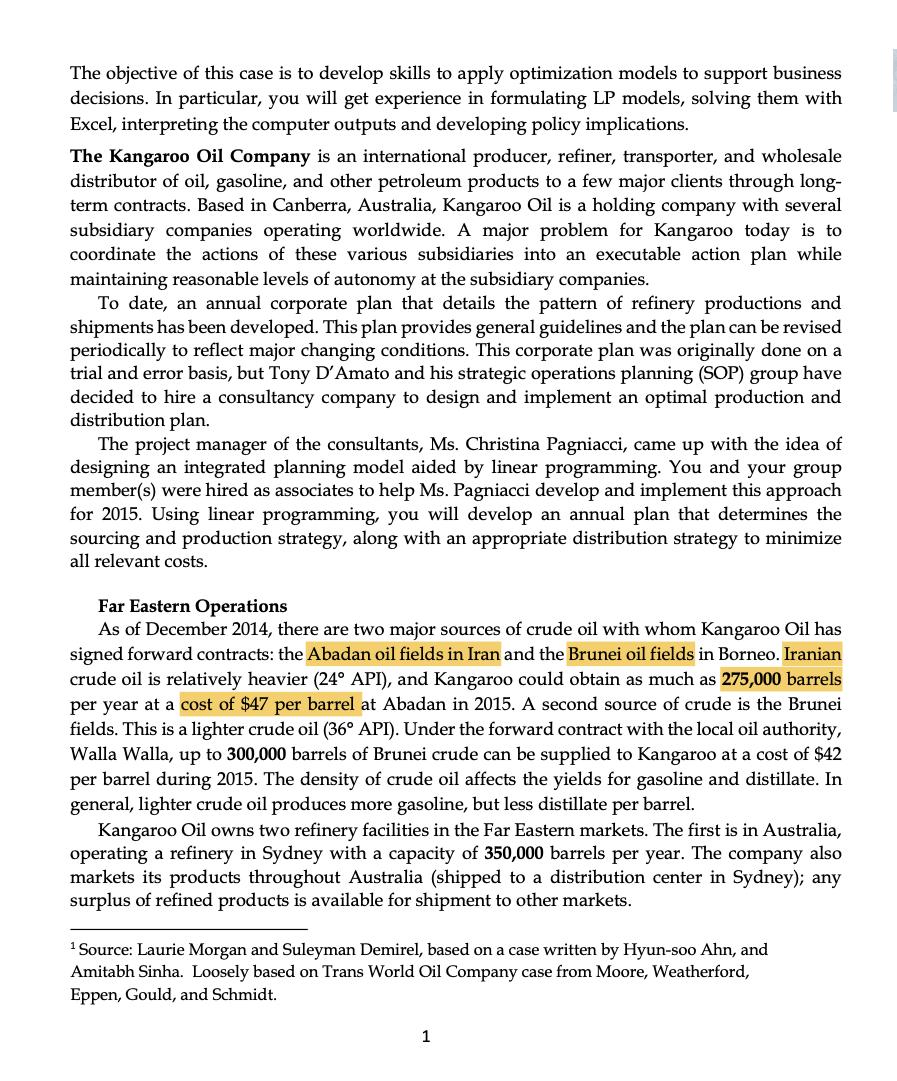

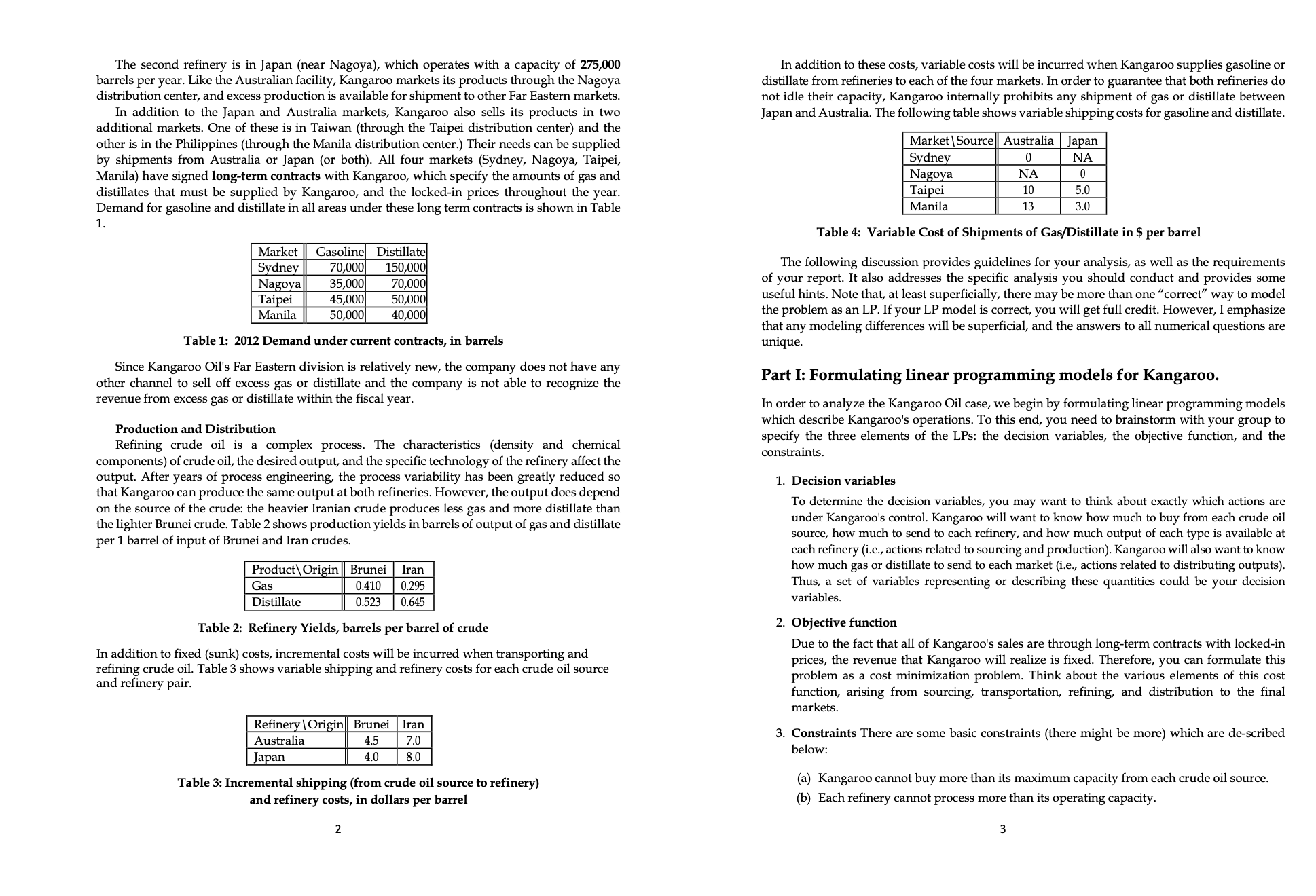

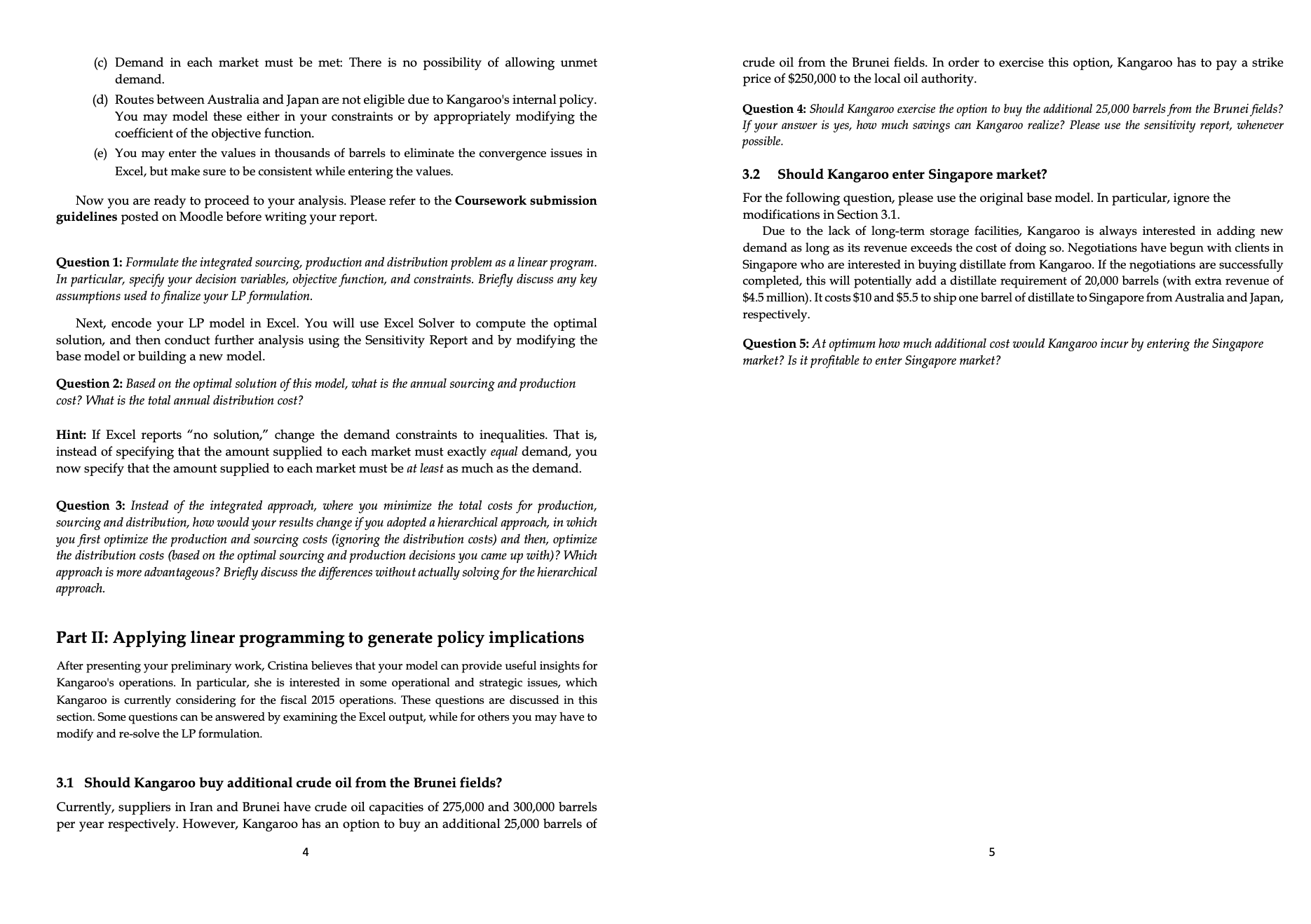

The objective of this case is to develop skills to apply optimization models to support business decisions. In particular, you will get experience in formulating LP models, solving them with Excel, interpreting the computer outputs and developing policy implications. The Kangaroo Oil Company is an international producer, refiner, transporter, and wholesale distributor of oil, gasoline, and other petroleum products to a few major clients through long- term contracts. Based in Canberra, Australia, Kangaroo Oil is a holding company with several subsidiary companies operating worldwide. A major problem for Kangaroo today is to coordinate the actions of these various subsidiaries into an executable action plan while maintaining reasonable levels of autonomy at the subsidiary companies. To date, an annual corporate plan that details the pattern of refinery productions and shipments has been developed. This plan provides general guidelines and the plan can be revised periodically to reflect major changing conditions. This corporate plan was originally done on a trial and error basis, but Tony D'Amato and his strategic operations planning (SOP) group have decided to hire a consultancy company to design and implement an optimal production and distribution plan. The project manager of the consultants, Ms. Christina Pagniacci, came up with the idea of designing an integrated planning model aided by linear programming. You and your group member(s) were hired as associates to help Ms. Pagniacci develop and implement this approach for 2015. Using linear programming, you will develop an annual plan that determines the sourcing and production strategy, along with an appropriate distribution strategy to minimize all relevant costs. Far Eastern Operations As of December 2014, there are two major sources of crude oil with whom Kangaroo Oil has signed forward contracts: the Abadan oil fields in Iran and the Brunei oil fields in Borneo. Iranian crude oil is relatively heavier (24 API), and Kangaroo could obtain as much as 275,000 barrels per year at a cost of $47 per barrel at Abadan in 2015. A second source of crude is the Brunei fields. This is a lighter crude oil (36 API). Under the forward contract with the local oil authority, Walla Walla, up to 300,000 barrels of Brunei crude can be supplied to Kangaroo at a cost of $42 per barrel during 2015. The density of crude oil affects the yields for gasoline and distillate. In general, lighter crude oil produces more gasoline, but less distillate per barrel. Kangaroo Oil owns two refinery facilities in the Far Eastern markets. The first is in Australia, operating a refinery in Sydney with a capacity of 350,000 barrels per year. The company also markets its products throughout Australia (shipped to a distribution center in Sydney); any surplus of refined products is available for shipment to other markets. 1 Source: Laurie Morgan and Suleyman Demirel, based on a case written by Hyun-soo Ahn, and Amitabh Sinha. Loosely based on Trans World Oil Company case from Moore, Weatherford, Eppen, Gould, and Schmidt. 1 The second refinery is in Japan (near Nagoya), which operates with a capacity of 275,000 barrels per year. Like the Australian facility, Kangaroo markets its products through the Nagoya distribution center, and excess production is available for shipment to other Far Eastern markets. In addition to the Japan and Australia markets, Kangaroo also sells its products in two additional markets. One of these is in Taiwan (through the Taipei distribution center) and the other is in the Philippines (through the Manila distribution center.) Their needs can be supplied by shipments from Australia or Japan (or both). All four markets (Sydney, Nagoya, Taipei, Manila) have signed long-term contracts with Kangaroo, which specify the amounts of gas and distillates that must be supplied by Kangaroo, and the locked-in prices throughout the year. Demand for gasoline and distillate in all areas under these long term contracts is shown in Table 1. In addition to these costs, variable costs will be incurred when Kangaroo supplies gasoline or distillate from refineries to each of the four markets. In order to guarantee that both refineries do not idle their capacity, Kangaroo internally prohibits any shipment of gas or distillate between Japan and Australia. The following table shows variable shipping costs for gasoline and distillate. Market Source Australia Japan Sydney Nagoya Taipei Manila 0 NA 0 10 5.0 13 3.0 Market Gasoline Sydney Distillate 70,000 150,000 Nagoya 35,000 70,000 Taipei 45,000 50,000 Manila 50,000 40,000 Table 1: 2012 Demand under current contracts, in barrels Since Kangaroo Oil's Far Eastern division is relatively new, the company does not have any other channel to sell off excess gas or distillate and the company is not able to recognize the revenue from excess gas or distillate within the fiscal year. Production and Distribution Refining crude oil is a complex process. The characteristics (density and chemical components) of crude oil, the desired output, and the specific technology of the refinery affect the output. After years of process engineering, the process variability has been greatly reduced so that Kangaroo can produce the same output at both refineries. However, the output does depend on the source of the crude: the heavier Iranian crude produces less gas and more distillate than the lighter Brunei crude. Table 2 shows production yields in barrels of output of gas and distillate per 1 barrel of input of Brunei and Iran crudes. Product\Origin || Brunei Iran Gas Distillate 0.410 0.295 0.523 0.645 Table 2: Refinery Yields, barrels per barrel of crude In addition to fixed (sunk) costs, incremental costs will be incurred when transporting and refining crude oil. Table 3 shows variable shipping and refinery costs for each crude oil source and refinery pair. Refinery Origin|| Brunei Iran Australia Japan 4.5 7.0 4.0 8.0 Table 3: Incremental shipping (from crude oil source to refinery) and refinery costs, in dollars per barrel 2 Table 4: Variable Cost of Shipments of Gas/Distillate in $ per barrel The following discussion provides guidelines for your analysis, as well as the requirements of your report. It also addresses the specific analysis you should conduct and provides some useful hints. Note that, at least superficially, there may be more than one "correct" way to model the problem as an LP. If your LP model is correct, you will get full credit. However, I emphasize that any modeling differences will be superficial, and the answers to all numerical questions are unique. Part I: Formulating linear programming models for Kangaroo. In order to analyze the Kangaroo Oil case, we begin by formulating linear programming models which describe Kangaroo's operations. To this end, you need to brainstorm with your group to specify the three elements of the LPs: the decision variables, the objective function, and the constraints. 1. Decision variables To determine the decision variables, you may want to think about exactly which actions are under Kangaroo's control. Kangaroo will want to know how much to buy from each crude oil source, how much to send to each refinery, and how much output of each type is available at each refinery (i.e., actions related to sourcing and production). Kangaroo will also want to know how much gas or distillate to send to each market (i.e., actions related to distributing outputs). Thus, a set of variables representing or describing these quantities could be your decision variables. 2. Objective function Due to the fact that all of Kangaroo's sales are through long-term contracts with locked-in prices, the revenue that Kangaroo will realize is fixed. Therefore, you can formulate this problem as a cost minimization problem. Think about the various elements of this cost function, arising from sourcing, transportation, refining, and distribution to the final markets. 3. Constraints There are some basic constraints (there might be more) which are de-scribed below: (a) Kangaroo cannot buy more than its maximum capacity from each crude oil source. (b) Each refinery cannot process more than its operating capacity. 3 (c) Demand in each market must be met: There is no possibility of allowing unmet demand. (d) Routes between Australia and Japan are not eligible due to Kangaroo's internal policy. You may model these either in your constraints or by appropriately modifying the coefficient of the objective function. (e) You may enter the values in thousands of barrels to eliminate the convergence issues in Excel, but make sure to be consistent while entering the values. Now you are ready to proceed to your analysis. Please refer to the Coursework submission guidelines posted on Moodle before writing your report. Question 1: Formulate the integrated sourcing, production and distribution problem as a linear program. In particular, specify your decision variables, objective function, and constraints. Briefly discuss any key assumptions used to finalize your LP formulation. Next, encode your LP model in Excel. You will use Excel Solver to compute the optimal solution, and then conduct further analysis using the Sensitivity Report and by modifying the base model or building a new model. Question 2: Based on the optimal solution of this model, what is the annual sourcing and production cost? What is the total annual distribution cost? Hint: If Excel reports "no solution," change the demand constraints to inequalities. That is, instead of specifying that the amount supplied to each market must exactly equal demand, you now specify that the amount supplied to each market must be at least as much as the demand. Question 3: Instead of the integrated approach, where you minimize the total costs for production, sourcing and distribution, how would your results change if you adopted a hierarchical approach, in which you first optimize the production and sourcing costs (ignoring the distribution costs) and then, optimize the distribution costs (based on the optimal sourcing and production decisions you came up with)? Which approach is more advantageous? Briefly discuss the differences without actually solving for the hierarchical approach. Part II: Applying linear programming to generate policy implications After presenting your preliminary work, Cristina believes that your model can provide useful insights for Kangaroo's operations. In particular, she is interested in some operational and strategic issues, which Kangaroo is currently considering for the fiscal 2015 operations. These questions are discussed in this section. Some questions can be answered by examining the Excel output, while for others you may have to modify and re-solve the LP formulation. crude oil from the Brunei fields. In order to exercise this option, Kangaroo has to pay a strike price of $250,000 to the local oil authority. Question 4: Should Kangaroo exercise the option to buy the additional 25,000 barrels from the Brunei fields? If your answer is yes, how much savings can Kangaroo realize? Please use the sensitivity report, whenever possible. 3.2 Should Kangaroo enter Singapore market? For the following question, please use the original base model. In particular, ignore the modifications in Section 3.1. Due to the lack of long-term storage facilities, Kangaroo is always interested in adding new demand as long as its revenue exceeds the cost of doing so. Negotiations have begun with clients in Singapore who are interested in buying distillate from Kangaroo. If the negotiations are successfully completed, this will potentially add a distillate requirement of 20,000 barrels (with extra revenue of $4.5 million). It costs $10 and $5.5 to ship one barrel of distillate to Singapore from Australia and Japan, respectively. Question 5: At optimum how much additional cost would Kangaroo incur by entering the Singapore market? Is it profitable to enter Singapore market? 3.1 Should Kangaroo buy additional crude oil from the Brunei fields? Currently, suppliers in Iran and Brunei have crude oil capacities of 275,000 and 300,000 barrels per year respectively. However, Kangaroo has an option to buy an additional 25,000 barrels of 4 5

Step by Step Solution

There are 3 Steps involved in it

To begin formulating the linear programming model for Kangaroo Oil Company we need to establish Decision Variables 1 Amount of crude oil sourced from ... View full answer

Get step-by-step solutions from verified subject matter experts