Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Ogden Company retails two products: a standard and a deluxe version of a luggage carrier. The budgeted income statement for next period is

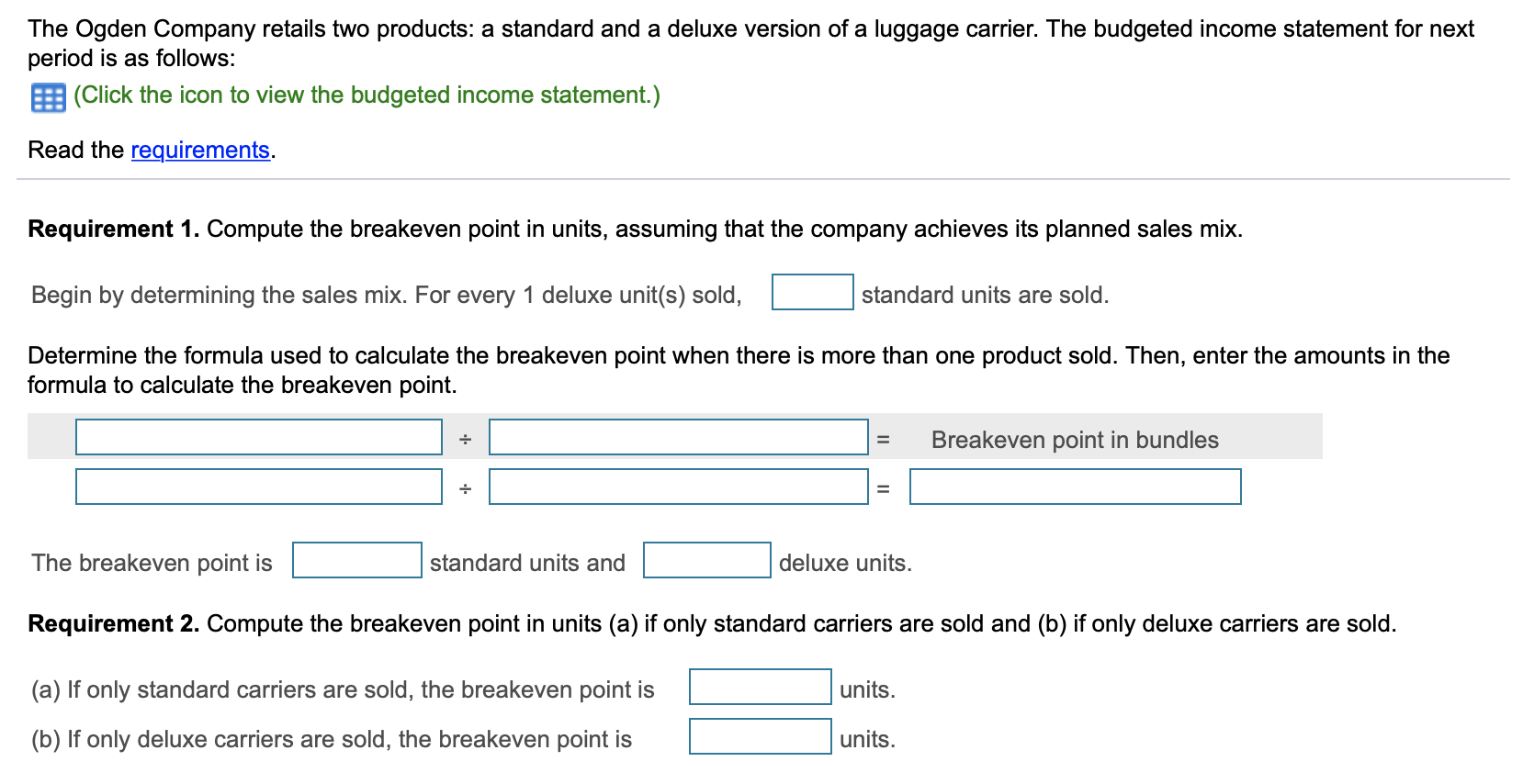

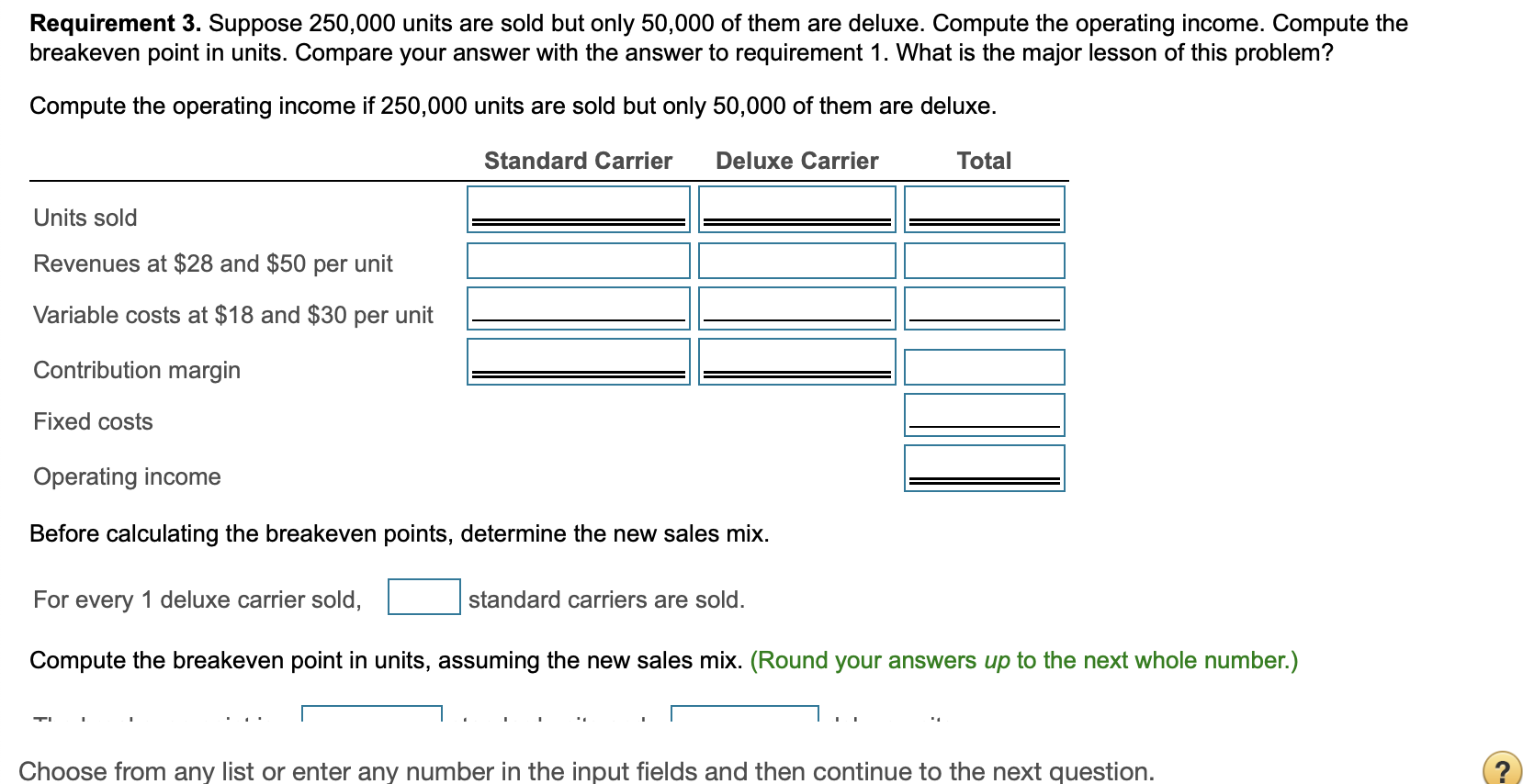

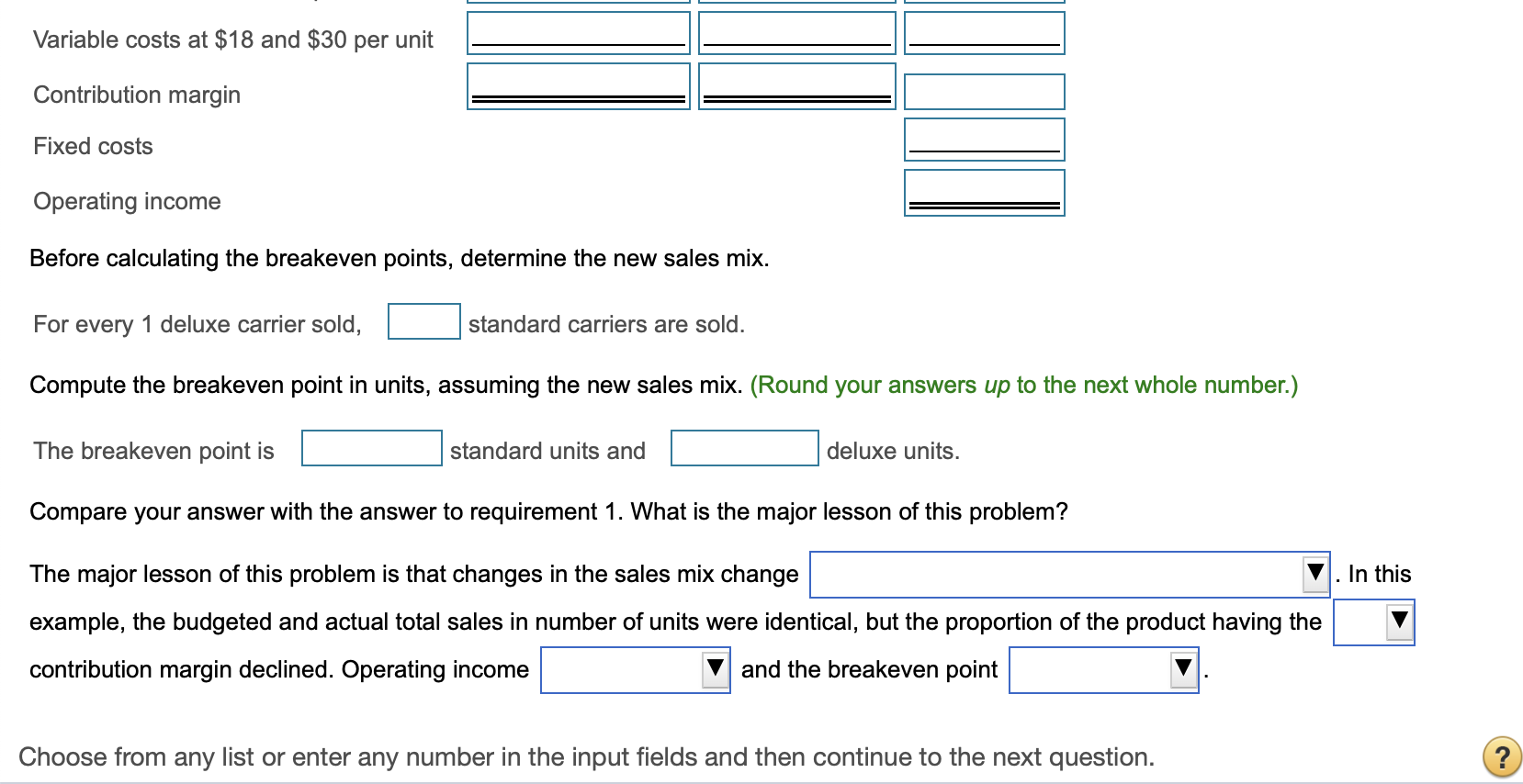

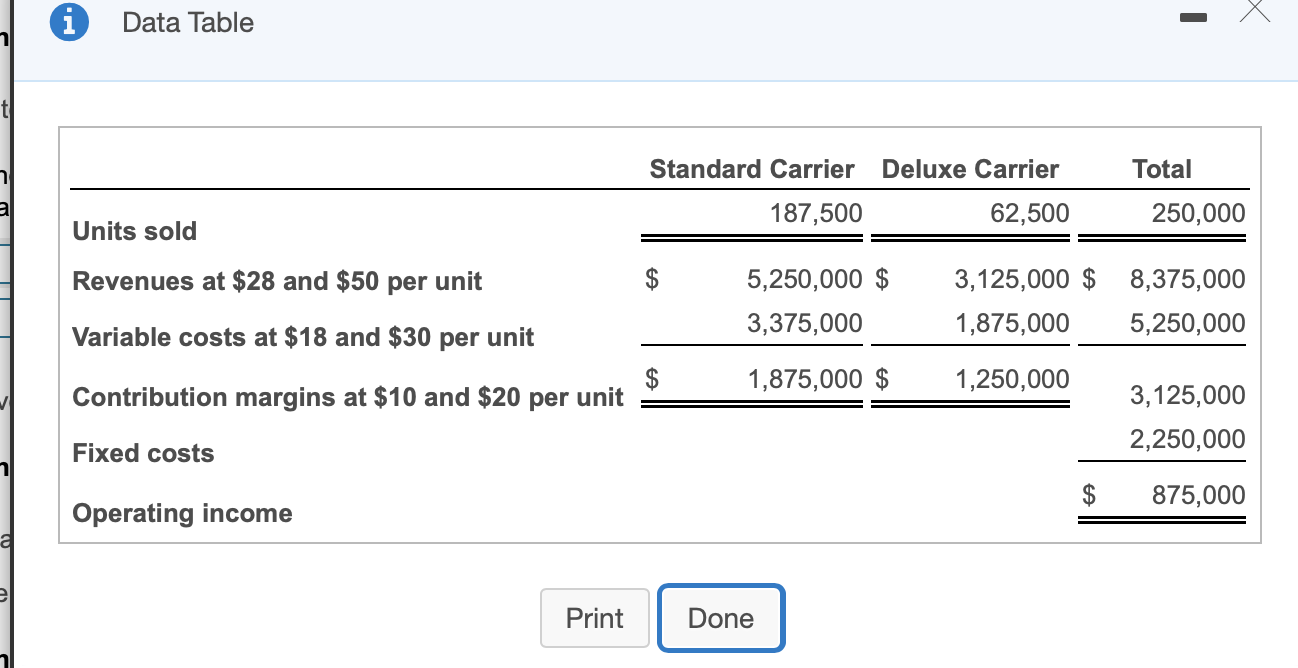

The Ogden Company retails two products: a standard and a deluxe version of a luggage carrier. The budgeted income statement for next period is as follows: (Click the icon to view the budgeted income statement.) Read the requirements. Requirement 1. Compute the breakeven point in units, assuming that the company achieves its planned sales mix. Begin by determining the sales mix. For every 1 deluxe unit(s) sold, standard units are sold. Determine the formula used to calculate the breakeven point when there is more than one product sold. Then, enter the amounts in the formula to calculate the breakeven point. + = Breakeven point in bundles + = The breakeven point is standard units and deluxe units. Requirement 2. Compute the breakeven point in units (a) if only standard carriers are sold and (b) if only deluxe carriers are sold. (a) If only standard carriers are sold, the breakeven point is units. (b) If only deluxe carriers are sold, the breakeven point is units. Requirement 3. Suppose 250,000 units are sold but only 50,000 of them are deluxe. Compute the operating income. Compute the breakeven point in units. Compare your answer with the answer to requirement 1. What is the major lesson of this problem? Compute the operating income if 250,000 units are sold but only 50,000 of them are deluxe. Standard Carrier Deluxe Carrier Total Units sold Revenues at $28 and $50 per unit Variable costs at $18 and $30 per unit Contribution margin Fixed costs Operating income Before calculating the breakeven points, determine the new sales mix. For every 1 deluxe carrier sold, standard carriers are sold. Compute the breakeven point in units, assuming the new sales mix. (Round your answers up to the next whole number.) Choose from any list or enter any number in the input fields and then continue to the next question. Variable costs at $18 and $30 per unit Contribution margin Fixed costs Operating income Before calculating the breakeven points, determine the new sales mix. For every 1 deluxe carrier sold, standard carriers are sold. Compute the breakeven point in units, assuming the new sales mix. (Round your answers up to the next whole number.) The breakeven point is standard units and deluxe units. Compare your answer with the answer to requirement 1. What is the major lesson of this problem? The major lesson of this problem is that changes in the sales mix change In this example, the budgeted and actual total sales in number of units were identical, but the proportion of the product having the contribution margin declined. Operating income and the breakeven point Choose from any list or enter any number in the input fields and then continue to the next question. 7 Data Table Standard Carrier Deluxe Carrier 187,500 62,500 Units sold Revenues at $28 and $50 per unit $ 5,250,000 $ 3,125,000 $ 3,375,000 1,875,000 Variable costs at $18 and $30 per unit 1,875,000 $ 1,250,000 Contribution margins at $10 and $20 per unit Fixed costs Operating income Print Done $ Total 250,000 8,375,000 5,250,000 3,125,000 2,250,000 875,000

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

requirement 1 computation of break even point in units assuming compa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started