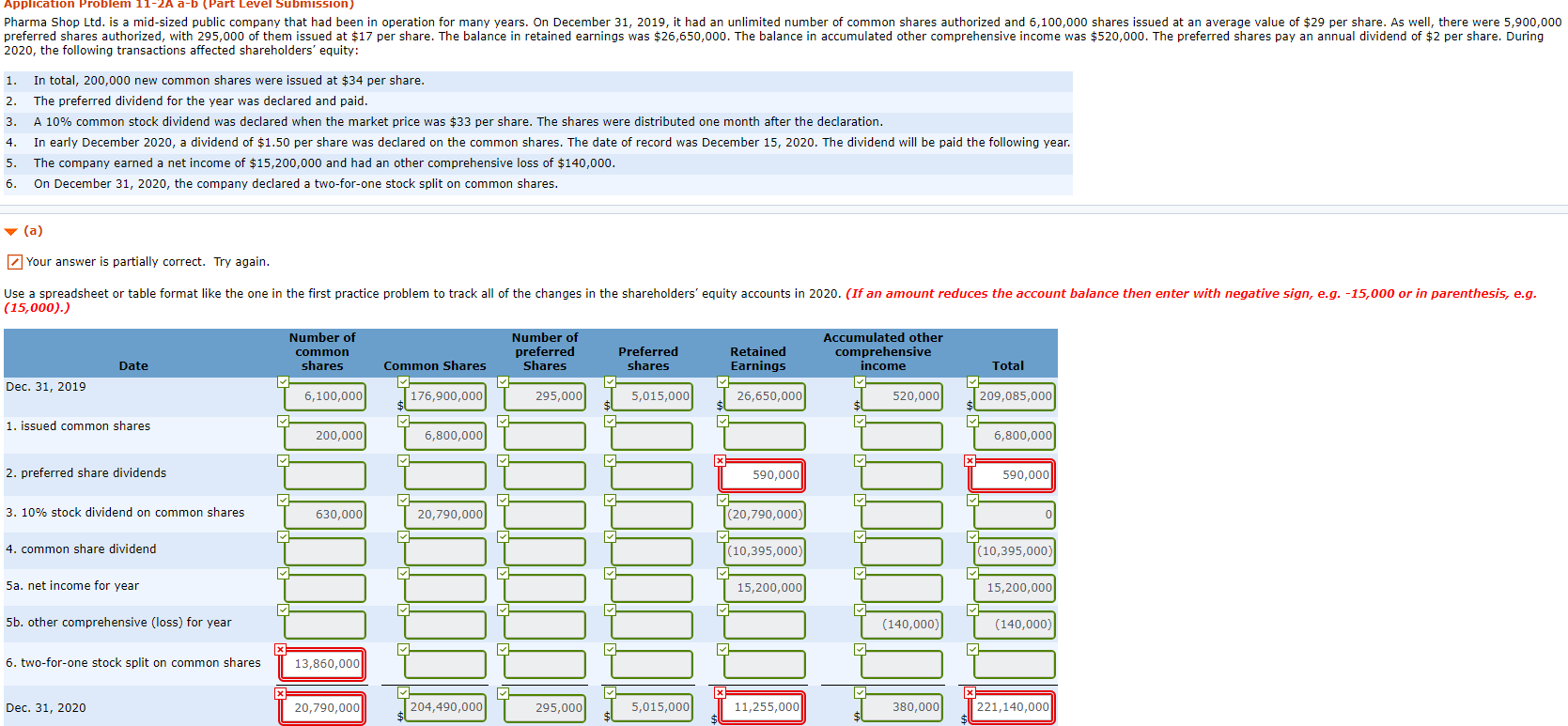

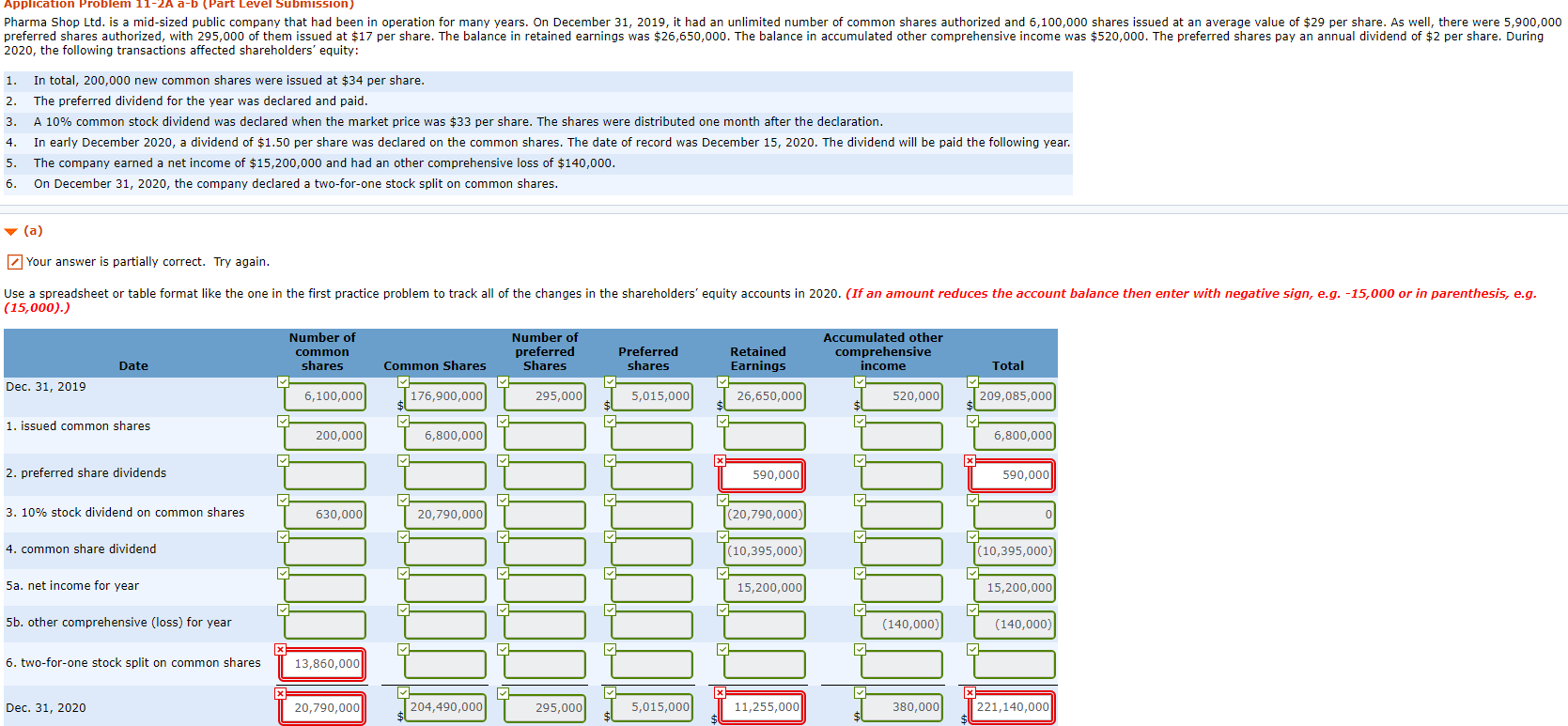

the one in red is wrong

the one in red is wrong

Application Problem 11-2A a-b (Part Level Submission) Pharma Shop Ltd. is a mid-sized public company that had been in operation for many years. On December 31, 2019, it had an unlimited number of common shares authorized and 6,100,000 shares issued at an average value of $29 per share. As well, there were 5,900,000 preferred shares authorized, with 295,000 of them issued at $17 per share. The balance in retained earnings was $26,650,000. The balance in accumulated other comprehensive income was $520,000. The preferred shares pay an annual dividend of $2 per share. During 2020, the following transactions affected shareholders' equity: In total, 200,000 new common shares were issued at $34 per share. 1. The preferred dividend for the year was declared and paid. 2. A 10% common stock dividend was declared when the market price was $33 per share. The shares were distributed one month after the declaration. 3. In early December 2020, a dividend of $1.50 per share was declared on the common shares. The date of record was December 15, 2020. The dividend will be paid the following year. 4. The company earned a net income of $15,200,000 and had an other comprehensive loss of $140,000. 5. On December 31, 2020, the company declared a two-for-one stock split on common shares. 6. v (a) Z Your answer is partially correct. Try again. Use a spreadsheet or table format like the one in the first practice problem to track all of the changes in the shareholders' equity accounts in 2020. (If an amount reduces the account balance then enter with negative sign, e.g. -15,000 or in parenthesis, e.g. (15,000).) Accumulated other comprehensive income Number of Number of preferred Shares Preferred Retained common shares shares Earnings Total Date Common Shares Dec. 31, 2019 209,085,000 26,650,000 6,100,000 5,015,000 176,900,000 295,000 520,000 1. issued common shares 200,000 6,800,000 6,800,000 2. preferred share dividends 590,000 590,000 (20,790,000) 3. 10% stock dividend on common shares 20,790,000 630,000 4. common share dividend (10,395,000) (10,395,000) 5a. net income for year 15,200,000 15,200,000 5b. other comprehensive (loss) for year (140,000) (140,000) 6. two-for-one stock split on common shares 13,860,000 221,140,000 20,790,000 380,000 5,015,000 11,255,000 204,490,000 295,000 Dec. 31, 2020

the one in red is wrong

the one in red is wrong