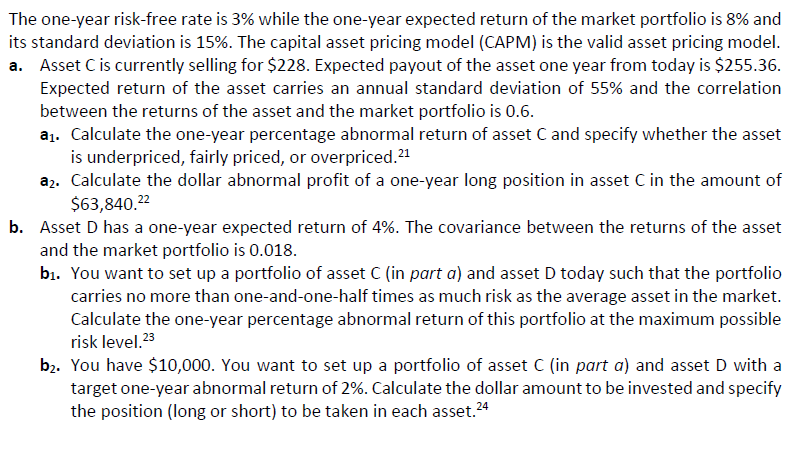

The one-year risk-free rate is 3% while the one-year expected return of the market portfolio is 8% and its standard deviation is 15%. The capital asset pricing model (CAPM) is the valid asset pricing model. a. Asset C is currently selling for $228. Expected payout of the asset one year from today is $255.36. Expected return of the asset carries an annual standard deviation of 55% and the correlation between the returns of the asset and the market portfolio is 0.6. al. Calculate the one-year percentage abnormal return of asset C and specify whether the asset is underpriced, fairly priced, or overpriced. 21 a2. Calculate the dollar abnormal profit of a one-year long position in asset C in the amount of $63,840.22 b. Asset D has a one-year expected return of 4%. The covariance between the returns of the asset and the market portfolio is 0.018. b. You want to set up a portfolio of asset C (in part a) and asset D today such that the portfolio carries no more than one-and-one-half times as much risk as the average asset in the market. Calculate the one-year percentage abnormal return of this portfolio at the maximum possible risk level.23 b2. You have $10,000. You want to set up a portfolio of asset C (in part a) and asset D with a target one-year abnormal return of 2%. Calculate the dollar amount to be invested and specify the position (long or short) to be taken in each asset.24 The one-year risk-free rate is 3% while the one-year expected return of the market portfolio is 8% and its standard deviation is 15%. The capital asset pricing model (CAPM) is the valid asset pricing model. a. Asset C is currently selling for $228. Expected payout of the asset one year from today is $255.36. Expected return of the asset carries an annual standard deviation of 55% and the correlation between the returns of the asset and the market portfolio is 0.6. al. Calculate the one-year percentage abnormal return of asset C and specify whether the asset is underpriced, fairly priced, or overpriced. 21 a2. Calculate the dollar abnormal profit of a one-year long position in asset C in the amount of $63,840.22 b. Asset D has a one-year expected return of 4%. The covariance between the returns of the asset and the market portfolio is 0.018. b. You want to set up a portfolio of asset C (in part a) and asset D today such that the portfolio carries no more than one-and-one-half times as much risk as the average asset in the market. Calculate the one-year percentage abnormal return of this portfolio at the maximum possible risk level.23 b2. You have $10,000. You want to set up a portfolio of asset C (in part a) and asset D with a target one-year abnormal return of 2%. Calculate the dollar amount to be invested and specify the position (long or short) to be taken in each asset.24