Answered step by step

Verified Expert Solution

Question

1 Approved Answer

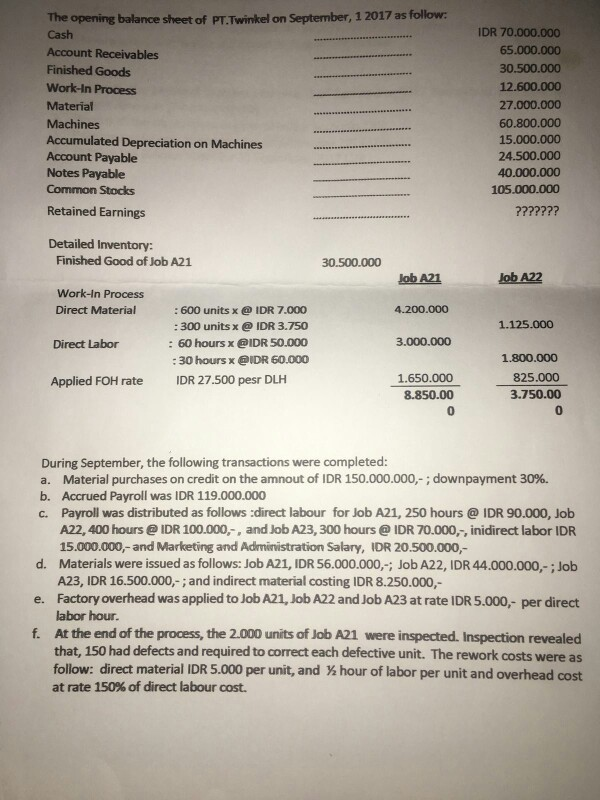

The opening balance sheet of PT.Twinkel on September, 1 2017 as follow: Cash Account Receivables Finished Goods Work-In Process Material Machines Accumulated Depreciation on

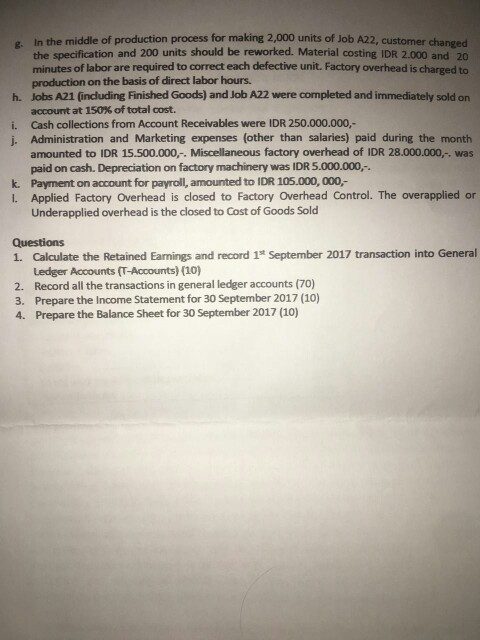

The opening balance sheet of PT.Twinkel on September, 1 2017 as follow: Cash Account Receivables Finished Goods Work-In Process Material Machines Accumulated Depreciation on Machines Account Payable Notes Payable Common Stocks Retained Earnings Detailed Inventory: Finished Good of Job A21 Work-In Process Direct Material Direct Labor Applied FOH rate : 600 units x @ IDR 7.000 : 300 units x @ IDR 3.750 : 60 hours x @IDR 50.000 :30 hours x @IDR 60.000 IDR 27.500 pesr DLH 30.500.000 Job A21 4.200.000 3.000.000 1.650.000 8.850.00 0 IDR 70.000.000 65.000.000 30.500.000 12.600.000 27.000.000 60.800.000 15.000.000 24.500.000 40.000.000 105.000.000 ??????? Job A22 1.125.000 1.800.000 825.000 3.750.00 0 During September, the following transactions were completed: a. Material purchases on credit on the amnout of IDR 150.000.000,-; downpayment 30%. b. Accrued Payroll was IDR 119.000.000 c. Payroll was distributed as follows :direct labour for Job A21, 250 hours @ IDR 90.000, Job A22, 400 hours @ IDR 100.000,-, and Job A23, 300 hours @ IDR 70.000,-, inidirect labor IDR 15.000.000,- and Marketing and Administration Salary, IDR 20.500.000,- d. Materials were issued as follows: Job A21, IDR 56.000.000,-; Job A22, IDR 44.000.000,-; Job A23, IDR 16.500.000,-; and indirect material costing IDR 8.250.000,- e. Factory overhead was applied to Job A21, Job A22 and Job A23 at rate IDR 5.000,- per direct labor hour. f. At the end of the process, the 2.000 units of Job A21 were inspected. Inspection revealed that, 150 had defects and required to correct each defective unit. The rework costs were as follow: direct material IDR 5.000 per unit, and hour of labor per unit and overhead cost at rate 150% of direct labour cost. g. In the middle of production process for making 2,000 units of Job A22, customer changed the specification and 200 units should be reworked. Material costing IDR 2.000 and 20 minutes of labor are required to correct each defective unit. Factory overhead is charged to production on the basis of direct labor hours. h. Jobs A21 (including Finished Goods) and Job A22 were completed and immediately sold on account at 150% of total cost. i. Cash collections from Account Receivables were IDR 250.000.000,- j. Administration and Marketing expenses (other than salaries) paid during the month amounted to IDR 15.500.000,-. Miscellaneous factory overhead of IDR 28.000.000,-. was paid on cash. Depreciation on factory machinery was IDR 5.000.000,-. k. Payment on account for payroll, amounted to IDR 105.000, 000,- 1. Applied Factory Overhead is closed to Factory Overhead Control. The overapplied or Underapplied overhead is the closed to Cost of Goods Sold Questions 1. Calculate the Retained Earnings and record 1st September 2017 transaction into General Ledger Accounts (T-Accounts) (10) 2. Record all the transactions in general ledger accounts (70) 3. Prepare the Income Statement for 30 September 2017 (10) 4. Prepare the Balance Sheet for 30 September 2017 (10)

Step by Step Solution

★★★★★

3.45 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

1 To calculate Retained Earnings we need to add net income to the beginning balance of Retained Earnings and subtract dividends paid We do not have information about dividends paid so lets assume ther...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started