Answered step by step

Verified Expert Solution

Question

1 Approved Answer

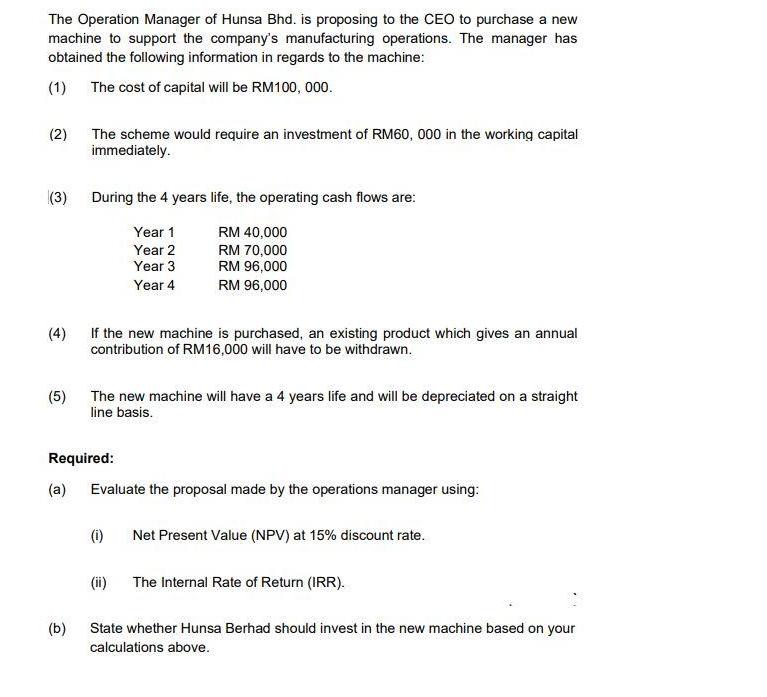

The Operation Manager of Hunsa Bhd. is proposing to the CEO to purchase a new machine to support the company's manufacturing operations. The manager

The Operation Manager of Hunsa Bhd. is proposing to the CEO to purchase a new machine to support the company's manufacturing operations. The manager has obtained the following information in regards to the machine: (1) The cost of capital will be RM100, 000. (2) (3) (5) (4) If the new machine is purchased, an existing product which gives an annual contribution of RM16,000 will have to be withdrawn. The scheme would require an investment of RM60, 000 in the working capital immediately. (a) During the 4 years life, the operating cash flows are: Year 1 RM 40,000 Year 2 RM 70,000 Year 3 RM 96,000 Year 4 RM 96,000 (b) Required: The new machine will have a 4 years life and will be depreciated on a straight line basis. Evaluate the proposal made by the operations manager using: (1) (ii) Net Present Value (NPV) at 15% discount rate. The Internal Rate of Return (IRR). State whether Hunsa Berhad should invest in the new machine based on your calculations above.

Step by Step Solution

★★★★★

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

A 2 Solution 3 Part a i 4 Year 5 6 7 8 9 10 11 13 Part ii 14 Year 15 16 17 18 19 20 21 IRR 22 23 24 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started