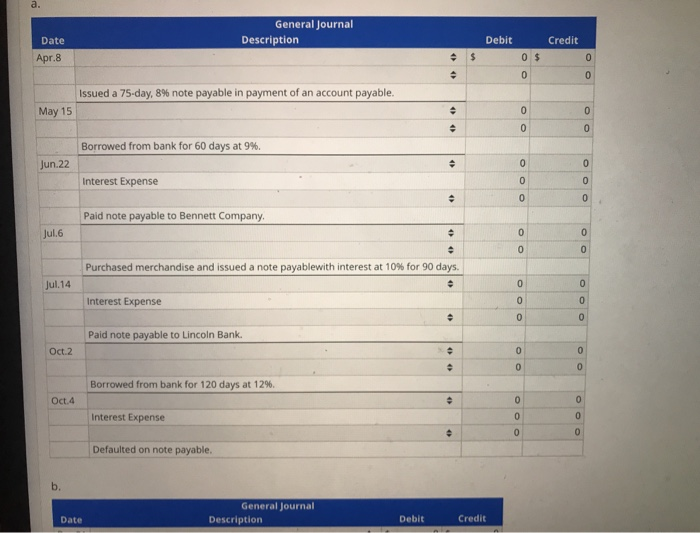

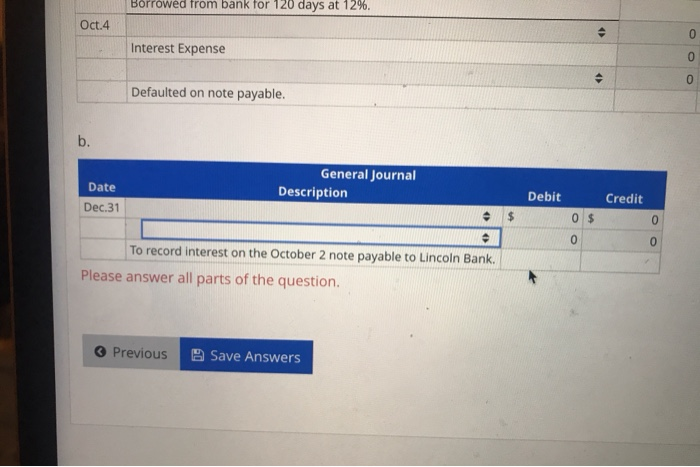

the options for the general journal description are listed in one of the pictures

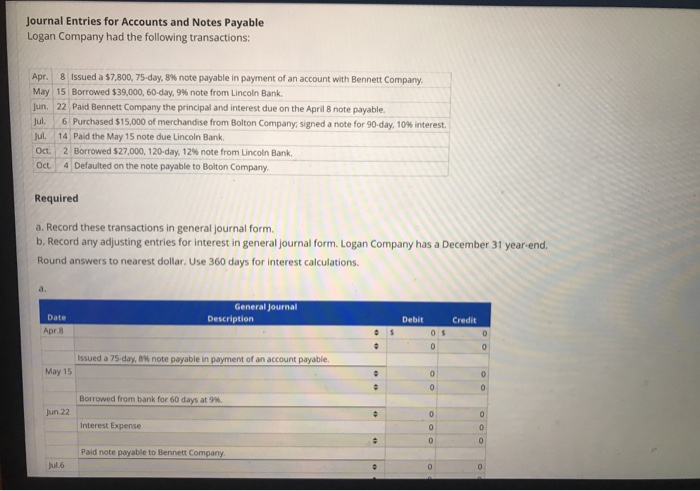

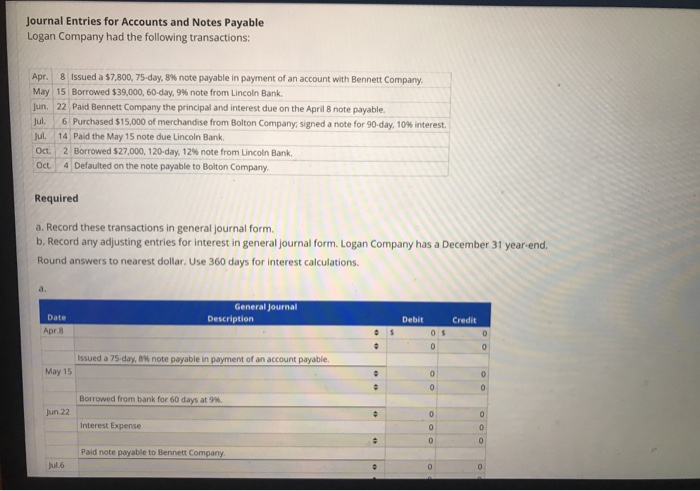

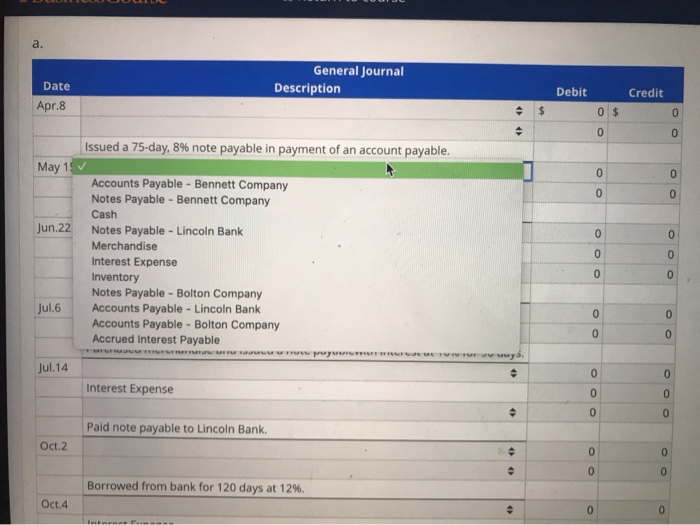

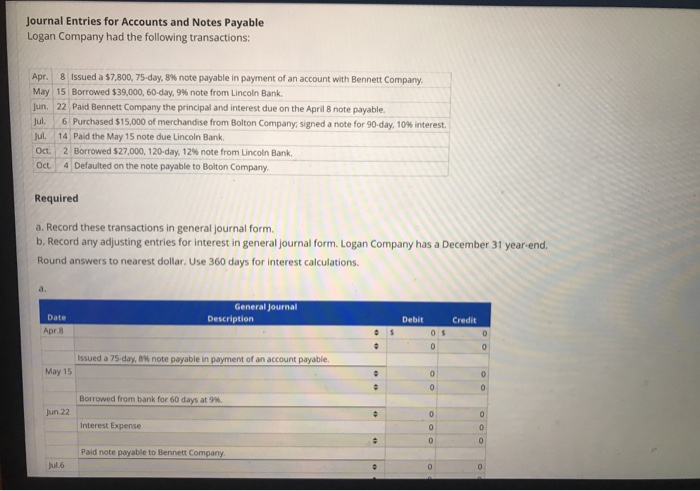

Journal Entries for Accounts and Notes Payable Logan Company had the following transactions: Apr. 8 issued a 57,800, 75-day, 8% note payable in payment of an account with Bennett Company May 15 Borrowed $39,000, 60-day, 9 note from Lincoln Bank. Jun. 22 Paid Bennett Company the principal and interest due on the April 8 note payable. Jul 6 Purchased $15,000 of merchandise from Bolton Company, signed a note for 90 day, 10% interest. Jul 14 Paid the May 15 note due Lincoln Bank. Oct. 2 Borrowed $27.000, 120-day, 12% note from Lincoln Bank Oct 4 Defaulted on the note payable to Bolton Company Required a. Record these transactions in general journal form. b. Record any adjusting entries for interest in general journal form. Logan Company has a December 31 year-end. Round answers to nearest dollar. Use 360 days for interest calculations. General Journal Description Date Debit Credit 0 0 0 Issued a 75-day, 8 note payable in payment of an account payable May 15 Borrowed from bank for 6 days at Jun 22 Interest Expense oooooo Paid note payable to Bennett Company General Journal Description Debit Credit Date Apr.8 Issued a 75-day, 8% note payable in payment of an account payable. May 15 Borrowed from bank for 60 days at 9%. Jun.22 Interest Expense Paid note payable to Bennett Company. Jul.6 Purchased merchandise and issued a note payablewith interest at 10% for 90 days. Jul.14 Interest Expense Paid note payable to Lincoln Bank Oct 2 Borrowed from bank for 120 days at 12%. Oct.4 Interest Expense Defaulted on note payable. General Journal Description Date Debit Credit General Journal Description Debit Credit Date Apr.8 Issued a 75-day, 8% note payable in payment of an account payable. May 1 Jun.22 Accounts Payable - Bennett Company Notes Payable - Bennett Company Cash Notes Payable - Lincoln Bank Merchandise Interest Expense Inventory Notes Payable - Bolton Company Accounts Payable - Lincoln Bank Accounts Payable - Bolton Company Accrued Interest Payable Jul.6 + wys. Jul. 14 Interest Expense Paid note payable to Lincoln Bank, Oct.2 Borrowed from bank for 120 days at 12%. Oct.4 torrowed from bank for 120 days at 12%. Oct.4 Interest Expense Defaulted on note payable. General Journal Description Debit Credit Date Dec.31 To record interest on the October 2 note payable to Lincoln Bank, Please answer all parts of the question.