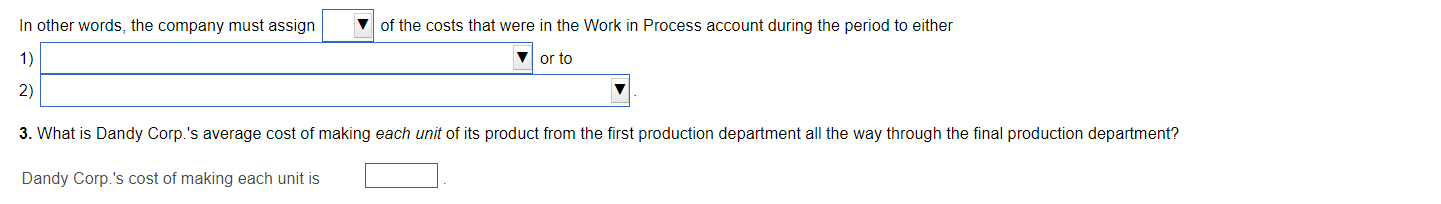

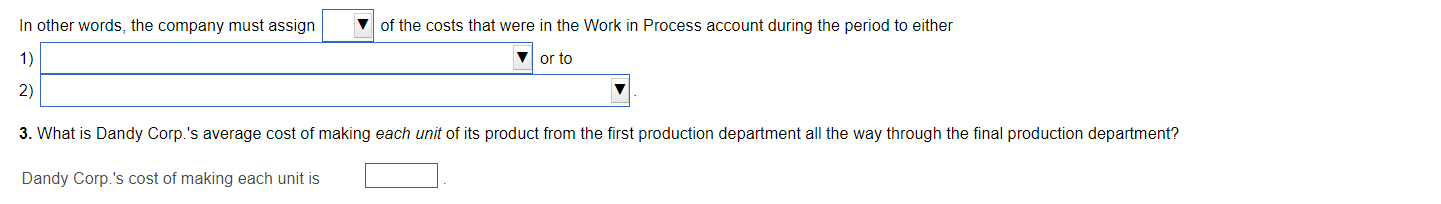

The options of the box in Part 2 are The first box is: All, Most Some, None The second box is: The units started production in the period, The units were completed and transferred out during the period The third box is: The units in beginning work in progress inventory, The units that are still in ending work in progress inventory at the end of the period

The options of the box in Part 2 are The first box is: All, Most Some, None The second box is: The units started production in the period, The units were completed and transferred out during the period The third box is: The units in beginning work in progress inventory, The units that are still in ending work in progress inventory at the end of the period

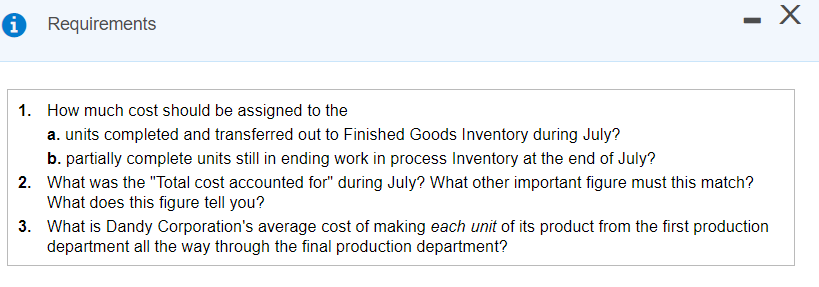

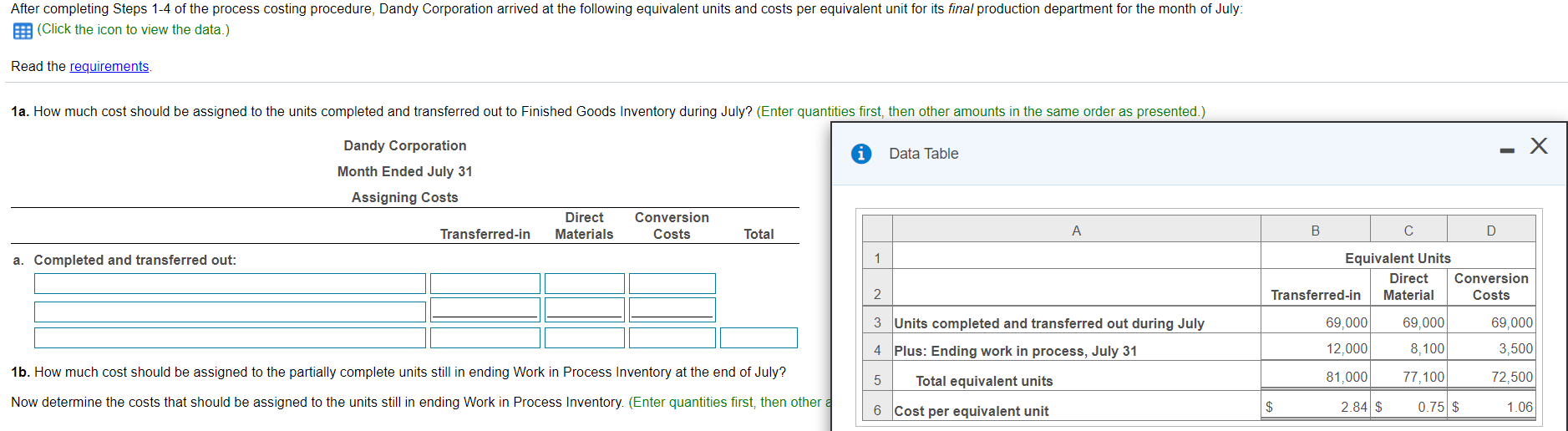

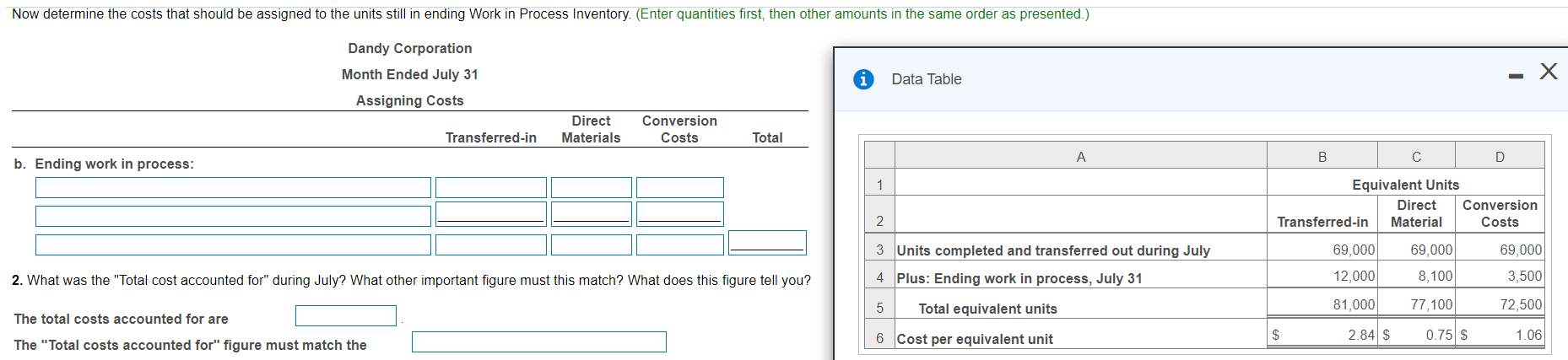

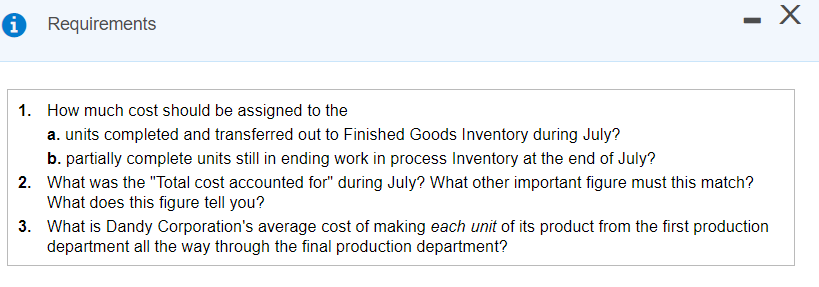

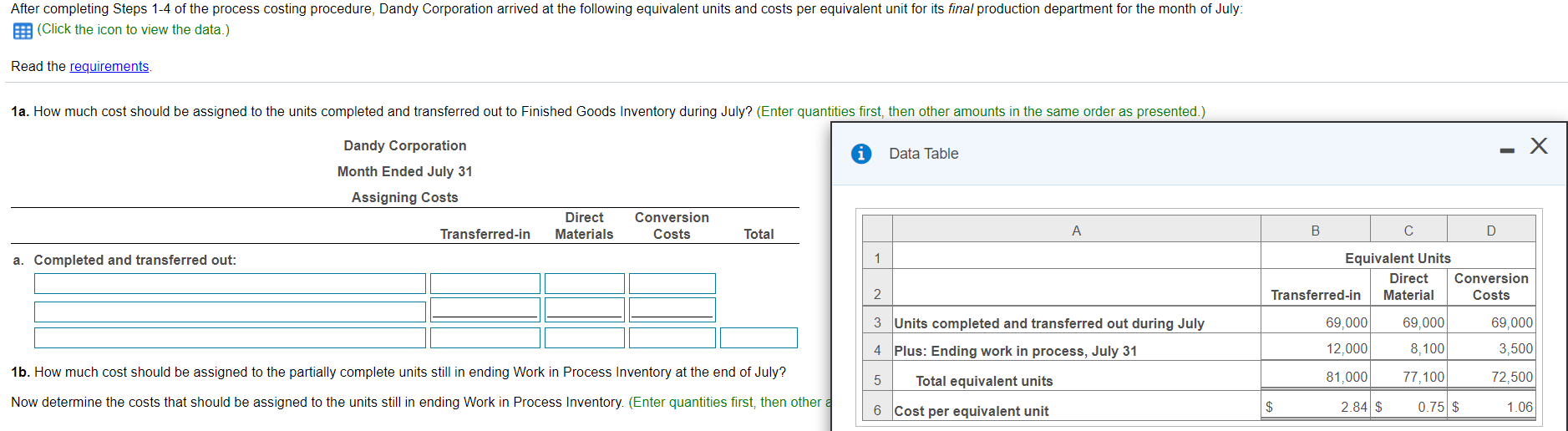

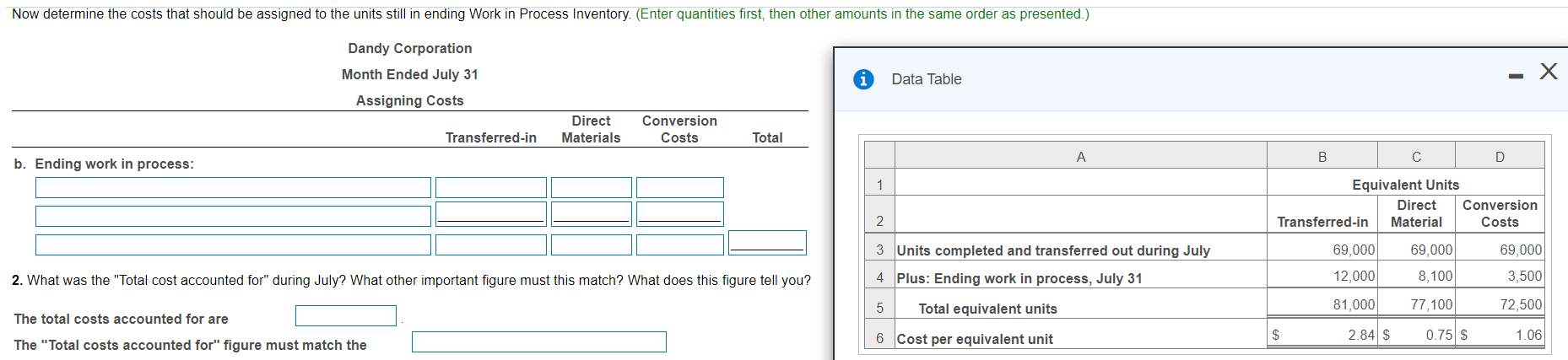

A Requirements - X 1. How much cost should be assigned to the a. units completed and transferred out to Finished Goods Inventory during July? b. partially complete units still in ending work in process Inventory at the end of July? 2. What was the "Total cost accounted for" during July? What other important figure must this match? What does this figure tell you? 3. What is Dandy Corporation's average cost of making each unit of its product from the first production department all the way through the final production department? After completing Steps 1-4 of the process costing procedure, Dandy Corporation arrived at the following equivalent units and costs per equivalent unit for its final production department for the month of July E (Click the icon to view the data.) Read the requirements. 1a. How much cost should be assigned to the units completed and transferred out to Finished Goods Inventory during July? (Enter quantities first, then other amounts in the same order as presented.) Dandy Corporation - Data Table Month Ended July 31 Assigning Costs Direct Materials Conversion Costs Transferred-in Total A B D a. Completed and transferred out: 1 Equivalent Units Direct Conversion Transferred-in Material Costs 2 69,000 69,000 69,000 3 Units completed and transferred out during July 4 Plus: Ending work in process, July 31 12,000 8,100 3,500 1b. How much cost should be assigned to the partially complete units still in ending Work in Process Inventory at the end of July? 81,000 77,100 72,500 Now determine the costs that should be assigned to the units still in ending Work in Process Inventory. (Enter quantities first, then other a 5 Total equivalent units 6 Cost per equivalent unit $ 2.84 $ 0.75 $ 1.06 Now determine the costs that should be assigned to the units still in ending Work in Process Inventory. (Enter quantities first, then other amounts in the same order as presented.) Dandy Corporation Month Ended July 31 Assigning Costs x Data Table Direct Materials Conversion Costs Transferred-in Total A B D b. Ending work in process: 1 Equivalent Units Direct Conversion Transferred-in Material Costs 2 3 Units completed and transferred out during July 4 Plus: Ending work in process, July 31 69,000 12,000 69,000 8,100 2. What was the "Total cost accounted for" during July? What other important figure must this match? What does this figure tell you? 69,000 3,500 72,500 5 Total equivalent units 81,000 77,100 The total costs accounted for are $ 6 Cost per equivalent unit 2.84 $ 0.75 $ 1.06 The "Total costs accounted for" figure must match the In other words, the company must assign of the costs that were in the Work in Process account during the period to either 1) or to 2) 3. What is Dandy Corp's average cost of making each unit of its product from the first production department all the way through the final production department? Dandy Corp.'s cost of making each unit is

The options of the box in Part 2 are The first box is: All, Most Some, None The second box is: The units started production in the period, The units were completed and transferred out during the period The third box is: The units in beginning work in progress inventory, The units that are still in ending work in progress inventory at the end of the period

The options of the box in Part 2 are The first box is: All, Most Some, None The second box is: The units started production in the period, The units were completed and transferred out during the period The third box is: The units in beginning work in progress inventory, The units that are still in ending work in progress inventory at the end of the period