Answered step by step

Verified Expert Solution

Question

1 Approved Answer

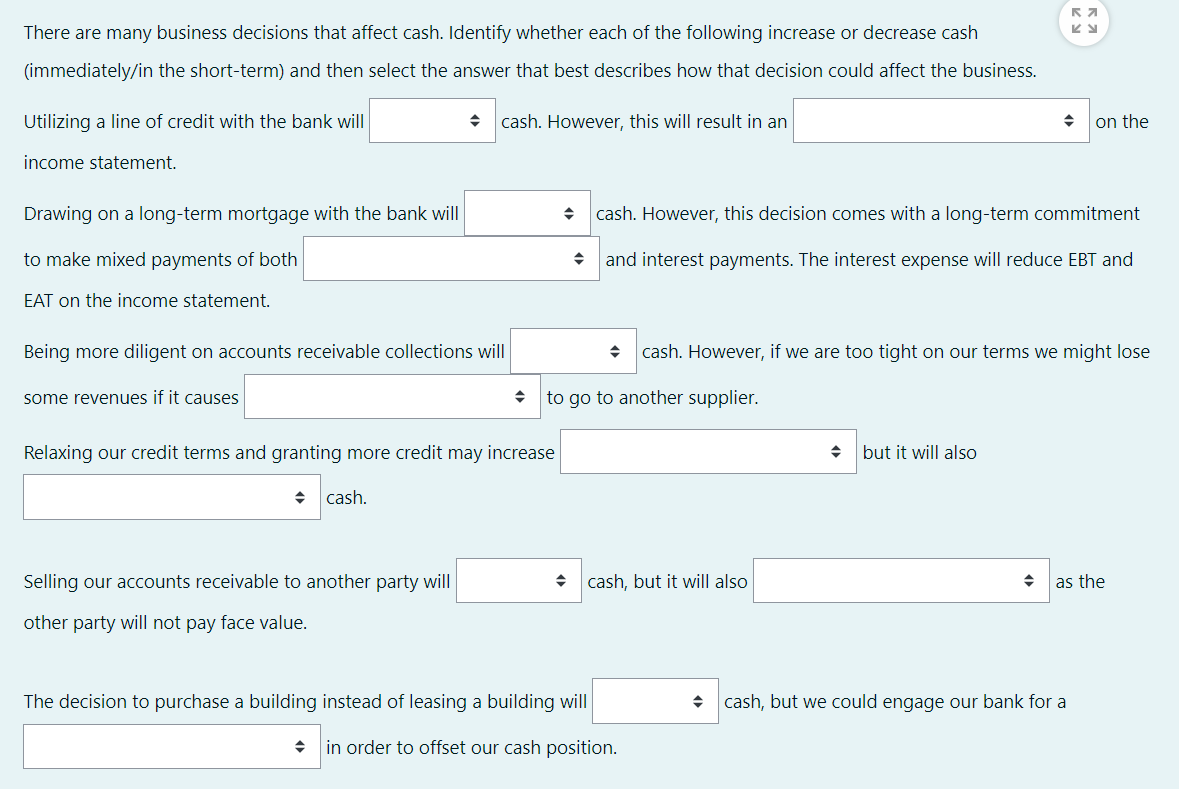

The options that could be selected from the box are as follows; 1 Increase 2 Decrease 3 Interest expense 4 principal 5 customers 6 revenues

The options that could be selected from the box are as follows;

1 Increase

2 Decrease

3 Interest expense

4 principal

5 customers

6 revenues

7 reduce the amount we collect

8 long term loan

There are many business decisions that affect cash. Identify whether each of the following increase or decrease cash (immediately/in the short-term) and then select the answer that best describes how that decision could affect the business. Utilizing a line of credit with the bank will cash. However, this will result in an on the income statement. Drawing on a long-term mortgage with the bank will cash. However, this decision comes with a long-term commitment to make mixed payments of both and interest payments. The interest expense will reduce EBT and EAT on the income statement. Being more diligent on accounts receivable collections will cash. However, if we are too tight on our terms we might lose some revenues if it causes to go to another supplier. Relaxing our credit terms and granting more credit may increase but it will also cash. Selling our accounts receivable to another party will * cash, but it will also as the other party will not pay face value. The decision to purchase a building instead of leasing a building will cash, but we could engage our bank for a in order to offset our cash positionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started