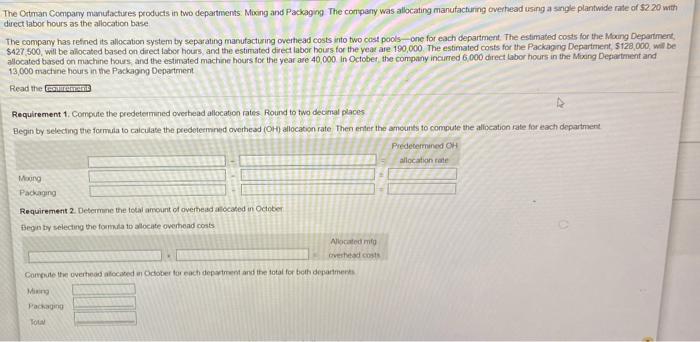

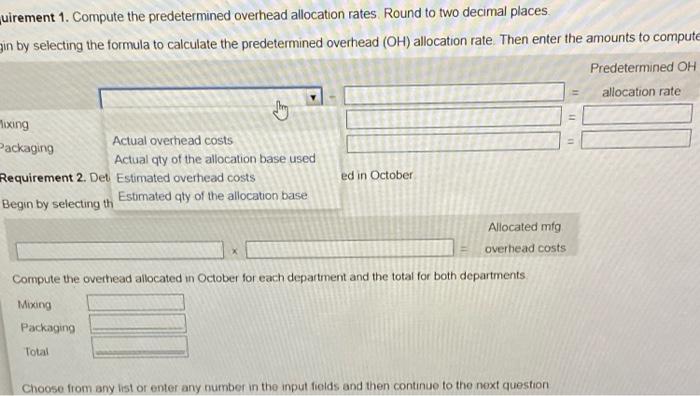

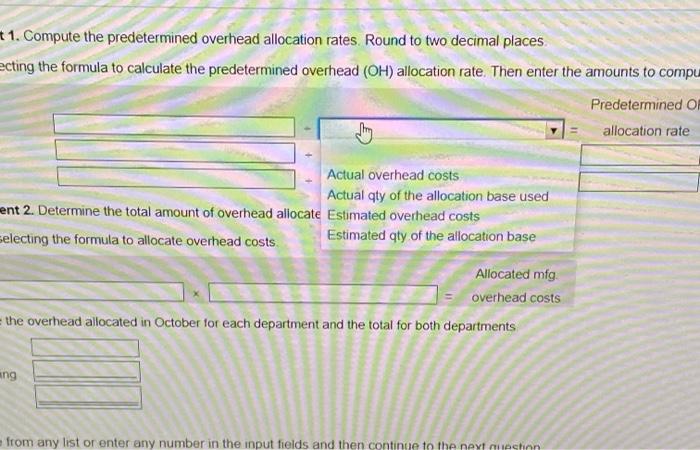

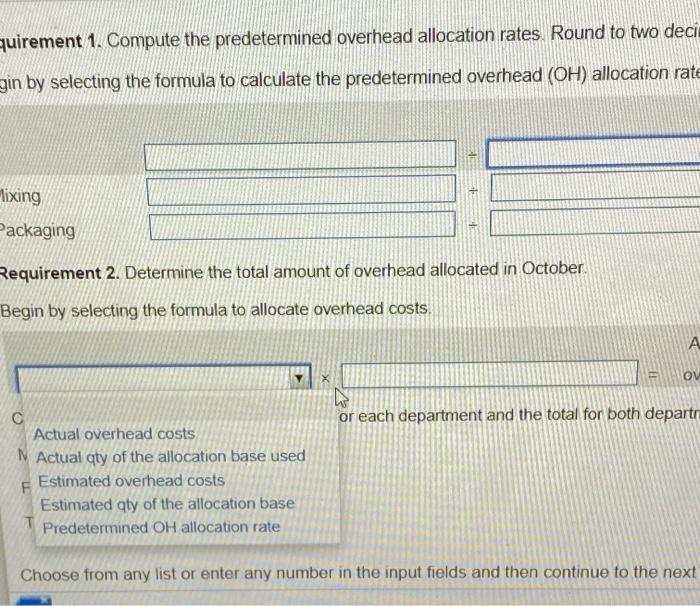

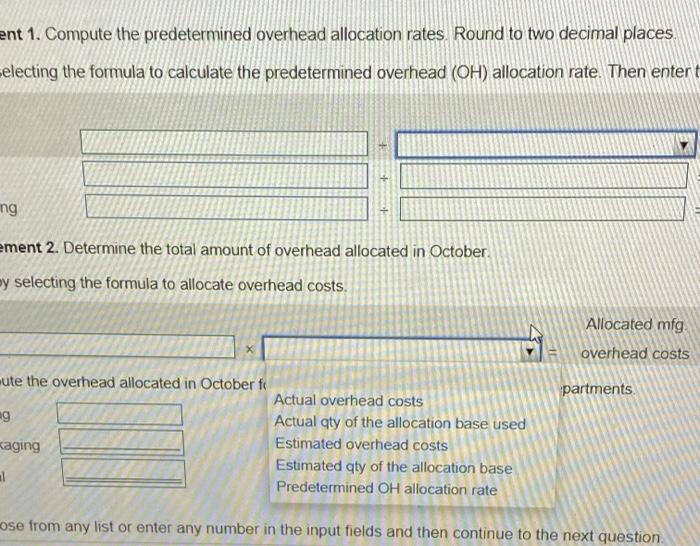

The Ortman Company manufactures products in two departments Mixing and Packaging The company was allocating manufacturing overhead using a single plantwide rate of 52 20 with direct labor hours as the allocation base The company has refined its allocation system by separating manufacturing overhead costs into two cost pools one for each department. The estimated costs for the Moung Department $427.500, will be allocated based on direct labor hours and the estimated direct labor hours for the year are 190,000. The estimated costs for the Packaging Department, $128.000, will be allocated based on machine hours and the estimated machine hours for the year are 40,000 in October, the company incurred 6.000 direct labor hours in the Mixing Department and 13,000 machine hours in the Packaging Department Read the couremem Requirement 1. Compute the predetermined overhead allocation rates Round to two decimal places Begin by selecting the formula to calculate the predetermined overhead (OH) allocation rate Then enter the amounts to compute the allocation rate for each department Predetermined OH allocation rate Moving Packaging Requirement 2. Determine the total amount of overhead located in October Begint selecting the found to allocate overhead costs Allocated mil veshead costs Compute the overhead alocated in October for each department and the total for both departments Ming Packaging Tou! verhead allocation rates. Round to two decimal places Requirements 1. Compute the predetermined overhead allocation rates. Round to two decimal places. 2. Determine the total amount of overhead allocated in October Print Done overhead costs G 11 uirement 1. Compute the predetermined overhead allocation rates Round to two decimal places gin by selecting the formula to calculate the predetermined overhead (OH) allocation rate. Then enter the amounts to compute Predetermined OH allocation rate Tixing Packaging Actual overhead costs Actual qty of the allocation base used Requirement 2. Det Estimated overhead costs ed in October Begin by selecting th Estimated qty of the allocation base Allocated mig overhead costs Compute the overhead allocated in October for each department and the total for both departments Mixing Packaging Total Choose from any list or enter any number in the input fields and then continue to the next question t1. Compute the predetermined overhead allocation rates. Round to two decimal places ecting the formula to calculate the predetermined overhead (OH) allocation rate. Then enter the amounts to compu Predetermined 0 allocation rate - Actual overhead costs Actual qty of the allocation base used went 2. Determine the total amount of overhead allocate Estimated overhead costs selecting the formula to allocate overhead costs Estimated qty of the allocation base Allocated mfg = overhead costs the overhead allocated in October for each department and the total for both departments ang from any list or enter any number in the input fields and then continue to the next question quirement 1. Compute the predetermined overhead allocation rates. Round to two deci egin by selecting the formula to calculate the predetermined overhead (OH) allocation rate lixing Packaging Requirement 2. Determine the total amount of overhead allocated in October Begin by selecting the formula to allocate overhead costs. A OV or each department and the total for both departra C Actual overhead costs N Actual qty of the allocation base used F Estimated overhead costs Estimated qty of the allocation base T Predetermined OH allocation rate Choose from any list or enter any number in the input fields and then continue to the next ent 1. Compute the predetermined overhead allocation rates Round to two decimal places electing the formula to calculate the predetermined overhead (OH) allocation rate. Then entert ng ement 2. Determine the total amount of overhead allocated in October y selecting the formula to allocate overhead costs Allocated mfg overhead costs partments ute the overhead allocated in October fe Actual overhead costs eg Actual qty of the allocation base used kaging Estimated overhead costs Estimated qty of the allocation base Predetermined OH allocation rate ! ose from any list or enter any number in the input fields and then continue to the next