Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The outbreak was identified in Wuhan, China, on November 17, 2019. The World Health Organization declared the outbreak a Public Health Emergency of International

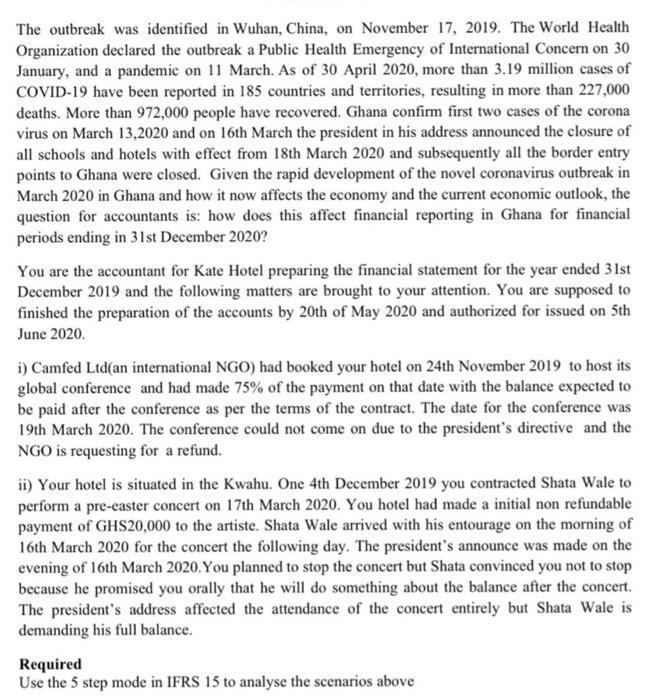

The outbreak was identified in Wuhan, China, on November 17, 2019. The World Health Organization declared the outbreak a Public Health Emergency of International Concern on 30 January, and a pandemic on 11 March. As of 30 April 2020, more than 3.19 million cases of COVID-19 have been reported in 185 countries and territories, resulting in more than 227,000 deaths. More than 972,000 people have recovered. Ghana confirm first two cases of the corona virus on March 13,2020 and on 16th March the president in his address announced the closure of all schools and hotels with effect from 18th March 2020 and subsequently all the border entry points to Ghana were closed. Given the rapid development of the novel coronavirus outbreak in March 2020 in Ghana and how it now affects the economy and the current economic outlook, the question for accountants is: how does this affect financial reporting in Ghana for financial periods ending in 31st December 2020? You are the accountant for Kate Hotel preparing the financial statement for the year ended 3 1st December 2019 and the following matters are brought to your attention. You are supposed to finished the preparation of the accounts by 20th of May 2020 and authorized for issued on 5th June 2020. i) Camfed Ltd(an international NGO) had booked your hotel on 24th November 2019 to host its global conference and had made 75% of the payment on that date with the balance expected to be paid after the conference as per the terms of the contract. The date for the conference was 19th March 2020. The conference could not come on due to the president's directive and the NGO is requesting for a refund. ii) Your hotel is situated in the Kwahu. One 4th December 2019 you contracted Shata Wale to perform a pre-easter concert on 17th March 2020. You hotel had made a initial non refundable payment of GHS20,000 to the artiste. Shata Wale arrived with his entourage on the morning of 16th March 2020 for the concert the following day. The president's announce was made on the evening of 16th March 2020. You planned to stop the concert but Shata convinced you not to stop because he promised you orally that he will do something about the balance after the concert. The president's address affected the attendance of the concert entirely but Shata Wale is demanding his full balance. Required Use the 5 step mode in IFRS 15 to analyse the scenarios above

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

With reference to IFRS 15 a revenue will be recognized by an organization or a company in respect of a contract when the goods or services had been of...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started