Answered step by step

Verified Expert Solution

Question

1 Approved Answer

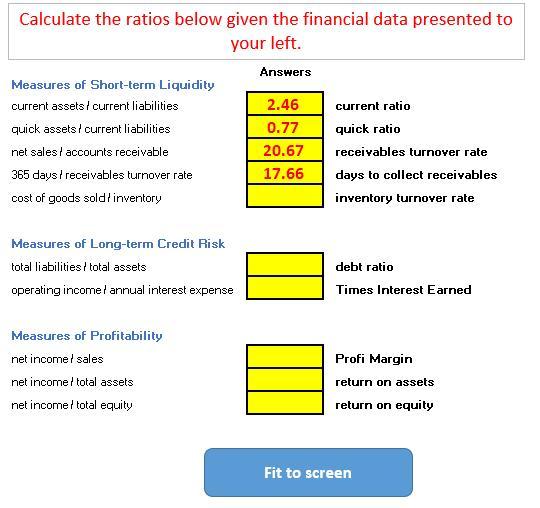

Calculate the ratios below given the financial data presented to your left. Measures of Short-term Liquidity current assets/ current liabilities quick assets current liabilities

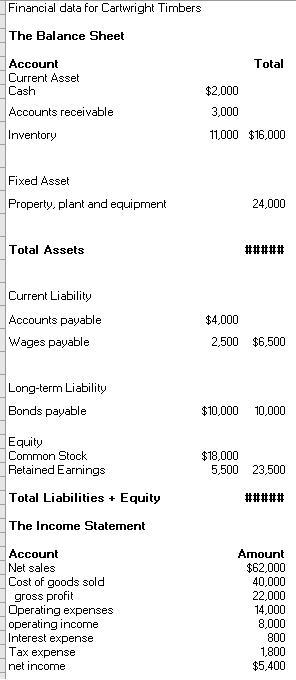

Calculate the ratios below given the financial data presented to your left. Measures of Short-term Liquidity current assets/ current liabilities quick assets current liabilities net sales accounts receivable 365 days/receivables turnover rate cost of goods sold' inventory Measures of Long-term Credit Risk total liabilities total assets operating income annual interest expense Measures of Profitability net income sales net incomel total assets net income total equity Answers 2.46 0.77 20.67 17.66 current ratio quick ratio receivables turnover rate days to collect receivables inventory turnover rate debt ratio Times Interest Earned Profi Margin return on assets return on equity Fit to screen Financial data for Cartwright Timbers The Balance Sheet Account Current Asset Cash Accounts receivable Inventory Fixed Asset Property, plant and equipment Total Assets Current Liability Accounts payable Wages payable Long-term Liability Bonds payable Equity Common Stock Retained Earnings Total Liabilities + Equity The Income Statement Account Net sales Cost of goods sold gross profit Operating expenses operating income Interest expense Tax expense net income Total $2,000 3,000 11,000 $16,000 24,000 $18,000 ##### $4,000 2,500 $6,500 $10,000 10,000 5,500 23,500 ##### Amount $62,000 40,000 22,000 14,000 8,000 800 1,800 $5,400

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

So here we need to calculate the financial ratio 1 Current ratio Current asset Current liabilities 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635e11571c953_181172.pdf

180 KBs PDF File

635e11571c953_181172.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started