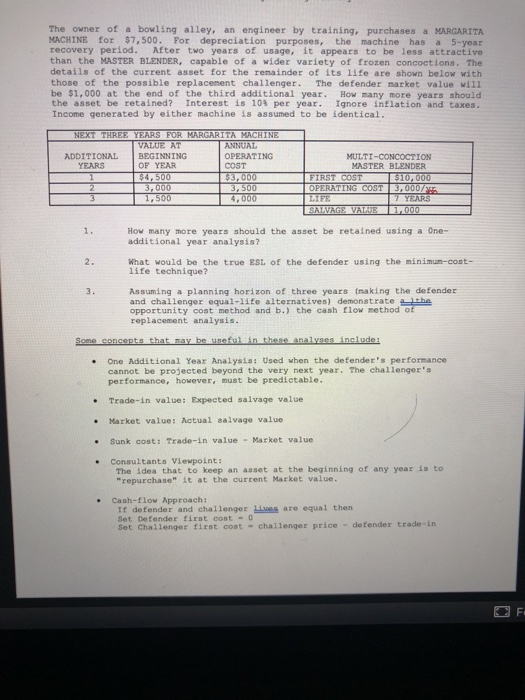

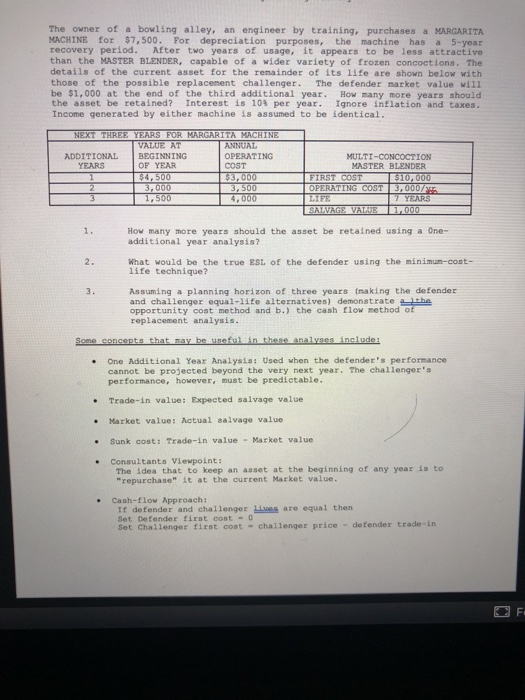

The owner of a bowling alley, an engineer by training, purchases a MARGARITA MACHINE for $7,500. For depreciation purposes, the machine has a 5-year recovery period. After two years of usage, it appears to be less attractive than the MASTER BLENDER, capable of a wider variety of frozen concoctions. The details of the current asset for the remainder of its life are shown below with those of the possible replacement challenger. The defender market value will be $1,000 at the end of the third additional year. How many more years should the asset be retained? Interest is 10$ per year. Ignore inflation and taxes. Income generated by either machine is assumed to be identical. NEXT THREE YEARS FOR MARGARITA MACHINE VALUE AT 1 ANNUAL ADDITIONAL BEGINNING OPERATING YEARS OF YEAR COST $4.500 $3,000 3,500 1,500 T4,000 MULTI-CONCOCTION MASTER BISNDER FIRST COST $10,000 OPERATING COST 3,000/ TAFE 17 YEARS SALVAGE VALUE 1.000 How many more years should the asset be retained using a One- additional year analysis? What would be the true ESL of the defender using the minimum-cost- 11fe technique ? Assuming a planning horizon of three years making the defender and challenger equal-life alternatives) demonstrate althe opportunity cost method and b.) the cash flow method of replacement analysis. Some concepts that may be useful in these analyses include: One Additional Year Analysis: Used when the defender's performance cannot be projected beyond the very next year. The challenger's performance, however, must be predictable. Trade-in value: Expected salvage value Market value: Actual salvage value Sunk cost: Trade-in value - Market value Consultants Viewpoint: The idea that to keep an asset at the beginning of any year is to "repurchase" it at the current Market value Cash-flow Approach: If defender and challenger Les are equal then Set Defender first cost - 0 Set Challenger first cost - challenger price - defender trade-in The owner of a bowling alley, an engineer by training, purchases a MARGARITA MACHINE for $7,500. For depreciation purposes, the machine has a 5-year recovery period. After two years of usage, it appears to be less attractive than the MASTER BLENDER, capable of a wider variety of frozen concoctions. The details of the current asset for the remainder of its life are shown below with those of the possible replacement challenger. The defender market value will be $1,000 at the end of the third additional year. How many more years should the asset be retained? Interest is 10$ per year. Ignore inflation and taxes. Income generated by either machine is assumed to be identical. NEXT THREE YEARS FOR MARGARITA MACHINE VALUE AT 1 ANNUAL ADDITIONAL BEGINNING OPERATING YEARS OF YEAR COST $4.500 $3,000 3,500 1,500 T4,000 MULTI-CONCOCTION MASTER BISNDER FIRST COST $10,000 OPERATING COST 3,000/ TAFE 17 YEARS SALVAGE VALUE 1.000 How many more years should the asset be retained using a One- additional year analysis? What would be the true ESL of the defender using the minimum-cost- 11fe technique ? Assuming a planning horizon of three years making the defender and challenger equal-life alternatives) demonstrate althe opportunity cost method and b.) the cash flow method of replacement analysis. Some concepts that may be useful in these analyses include: One Additional Year Analysis: Used when the defender's performance cannot be projected beyond the very next year. The challenger's performance, however, must be predictable. Trade-in value: Expected salvage value Market value: Actual salvage value Sunk cost: Trade-in value - Market value Consultants Viewpoint: The idea that to keep an asset at the beginning of any year is to "repurchase" it at the current Market value Cash-flow Approach: If defender and challenger Les are equal then Set Defender first cost - 0 Set Challenger first cost - challenger price - defender trade-in