Question

The owner of commercial property that has a Fish-Fil-A on the property is expected to produce net operating cash flows annually, as follows, at the

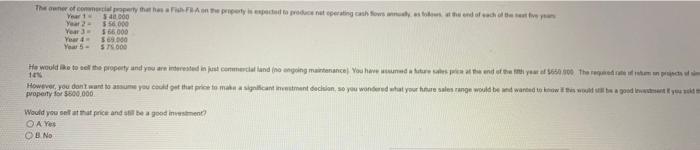

The owner of commercial property that has a Fish-Fil-A on the property is expected to produce net operating cash flows annually, as follows, at the end of each of the next five years:

Year 1 = $48,000

Year 2 = $56,000

Year 3 = $66,000

Year 4 = $69,000

Year 5 = $75,000

He would like to sell the property and you are interested in just commercial land (no ongoing maintenance). You have assumed a future sales price at the end of the fifth year of $650,000. The required rate of return on projects of similar risk is 14%. However, you dont want to assume you could get that price to make a significant investment decision, so you wondered what your future sales range would be and wanted to know if this would still be a good investment if you sold the property for $600,000.

Would you sell at that price and still be a good investment?

A. Yes

B. No

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started