Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The owner of Lazy Inn has been requested by First National Bank to submit a cash budget for the next calendar year. With that

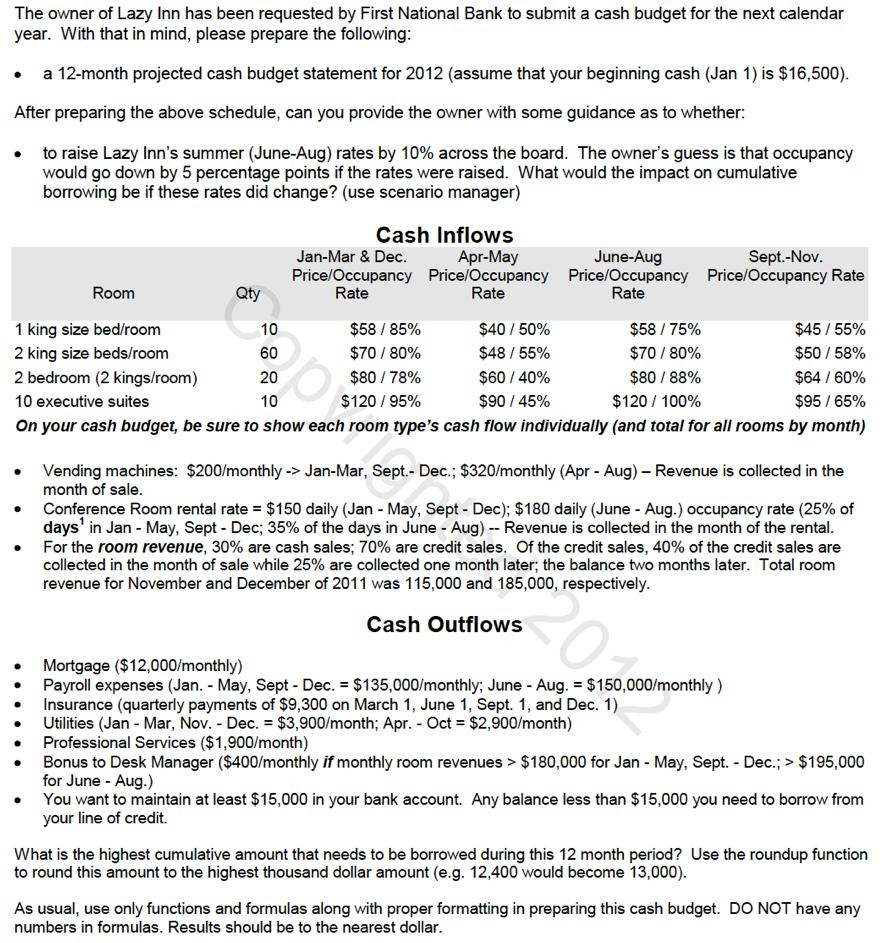

The owner of Lazy Inn has been requested by First National Bank to submit a cash budget for the next calendar year. With that in mind, please prepare the following: a 12-month projected cash budget statement for 2012 (assume that your beginning cash (Jan 1) is $16,500). After preparing the above schedule, can you provide the owner with some guidance as to whether: to raise Lazy Inn's summer (June-Aug) rates by 10% across the board. The owner's guess is that occupancy would go down by 5 percentage points if the rates were raised. What would the impact on cumulative borrowing be if these rates did change? (use scenario manager) Cash Inflows Apr-May Sept.-Nov. Jan-Mar & Dec. Price/Occupancy Price/Occupancy Price/Occupancy Price/Occupancy Rate Rate June-Aug Room Qty Rate Rate $58 / 85% $40 / 50% $48 / 55% $60 / 40% $90 / 45% $58 / 75% $70 / 80% $80 / 88% $120 / 100% 1 king size bed/room 10 $45 / 55% 2 king size beds/room 60 $70 / 80% $50 / 58% $80 / 78% $120 / 95% On your cash budget, be sure to show each room type's cash flow individually (and total for all rooms by month) 2 bedroom (2 kings/room) 20 $64 / 60% 10 executive suites 10 $95 / 65% Vending machines: $200/monthly -> Jan-Mar, Sept.- Dec.; $320/monthly (Apr - Aug) Revenue is collected in the month of sale. Conference Room rental rate = $150 daily (Jan - May, Sept - Dec); $180 daily (June - Aug.) occupancy rate (25% of days' in Jan - May, Sept - Dec; 35% of the days in June - Aug) -- Revenue is collected in the month of the rental. For the room revenue, 30% are cash sales; 70% are credit sales. Of the credit sales, 40% of the credit sales are collected in the month of sale while 25% are collected one month later; the balance two months later. Total room revenue for November and December of 2011 was 115,000 and 185,000, respectively. Cash Outflows Mortgage ($12,000/monthly) Payroll expenses (Jan. - May, Sept - Dec. = $135,000/monthly; June - Aug. = $150,000/monthly) Insurance (quarterly payments of $9,300 on March 1, June 1, Sept. 1, and Dec. 1) Utilities (Jan - Mar, Nov. - Dec. = $3,900/month; Apr. - Oct = $2,900/month) Professional Services ($1,900/month) Bonus to Desk Manager ($400/monthly if monthly room revenues > $180,000 for Jan - May, Sept. - Dec.; > $195,000 for June - Aug.) You want to maintain at least $15,000 in your bank account. Any balance less than $15,000 you need to borrow from your line of credit. What is the highest cumulative amount that needs to be borrowed during this 12 month period? Use the roundup function to round this amount to the highest thousand dollar amount (e.g. 12,400 would become 13,000). As usual, use only functions and formulas along with proper formatting in preparing this cash budget. DO NOT have any numbers in formulas. Results should be to the nearest dollar. 202

Step by Step Solution

★★★★★

3.40 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Use spreadsheet to prepare the budget Enter values and formulas in the spreadsheet as shown in the i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started