Answered step by step

Verified Expert Solution

Question

1 Approved Answer

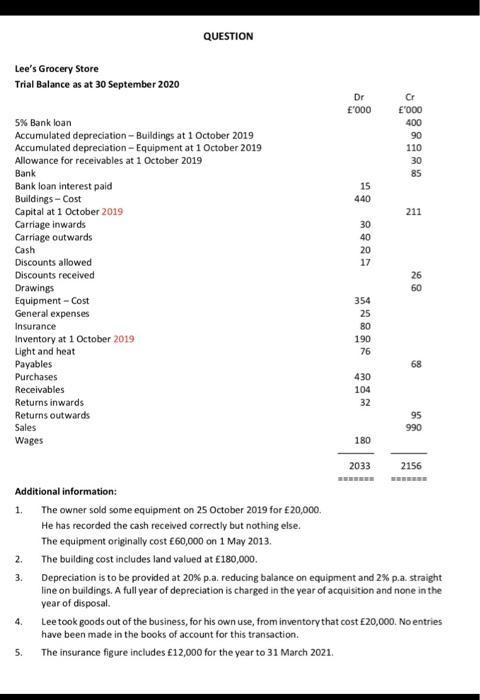

Lee's Grocery Store Trial Balance as at 30 September 2020 5% Bank loan Accumulated depreciation - Buildings at 1 October 2019 Accumulated depreciation -

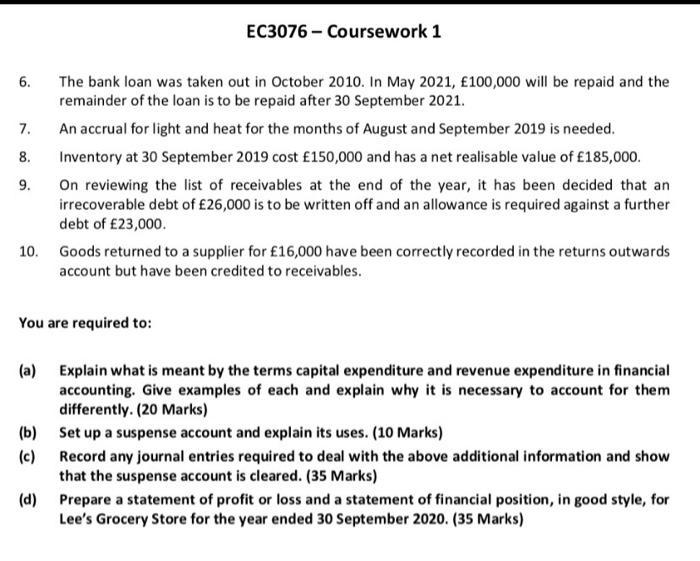

Lee's Grocery Store Trial Balance as at 30 September 2020 5% Bank loan Accumulated depreciation - Buildings at 1 October 2019 Accumulated depreciation - Equipment at 1 October 2019 Allowance for receivables at 1 October 2019 Bank Bank loan interest paid Buildings - Cost Capital at 1 October 2019 Carriage inwards Carriage outwards Cash Discounts allowed Discounts received Drawings Equipment - Cost General expenses Insurance Inventory at 1 October 2019 Light and heat Payables Purchases Receivables Returns inwards Returns outwards Sales Wages QUESTION Additional information: 1. The owner sold some equipment on 25 October 2019 for 20,000. He has recorded the cash received correctly but nothing else. The equipment originally cost 60,000 on 1 May 2013. 2. The building cost includes land valued at 180,000. 3. 4. 5. Dr '000 15 440 30 40 20 17 354 25 80 190 76 430 104 32 180 2033 ******* Cr '000 400 90 110 30 85 211 26 60 68 95 990 2156 Depreciation is to be provided at 20% p.a. reducing balance on equipment and 2% p.a. straight line on buildings. A full year of depreciation is charged in the year of acquisition and none in the year of disposal. Lee took goods out of the business, for his own use, from inventory that cost 20,000. No entries have been made in the books of account for this transaction. The insurance figure includes 12,000 for the year to 31 March 2021. 6. 7. 8. 9. 10. Goods returned to a supplier for 16,000 have been correctly recorded in the returns outwards account but have been credited to receivables. You are required to: (a) (b) (c) EC3076 - Coursework 1 The bank loan was taken out in October 2010. In May 2021, 100,000 will be repaid and the remainder of the loan is to be repaid after 30 September 2021. An accrual for light and heat for the months of August and September 2019 is needed. Inventory at 30 September 2019 cost 150,000 and has a net realisable value of 185,000. On reviewing the list of receivables at the end of the year, it has been decided that an irrecoverable debt of 26,000 is to be written off and an allowance is required against a further debt of 23,000. (d) Explain what is meant by the terms capital expenditure and revenue expenditure in financial accounting. Give examples of each and explain why it is necessary to account for them differently. (20 Marks) Set up a suspense account and explain its uses. (10 Marks) Record any journal entries required to deal with the above additional information and show that the suspense account is cleared. (35 Marks) Prepare a statement of profit or loss and a statement of financial position, in good style, for Lee's Grocery Store for the year ended 30 September 2020. (35 Marks)

Step by Step Solution

★★★★★

3.58 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started