Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your client has just won a lottery of $800,000 (received in a single payment). Already financially stable, your client would like to help provide

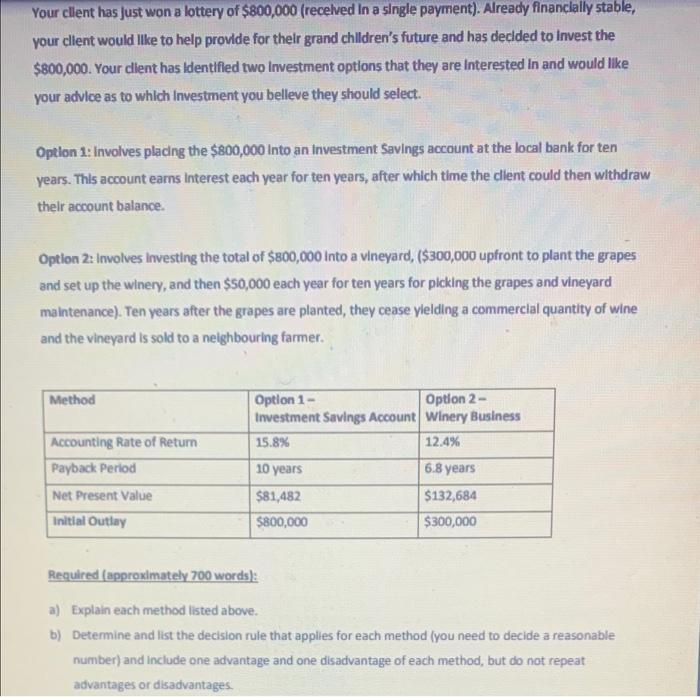

Your client has just won a lottery of $800,000 (received in a single payment). Already financially stable, your client would like to help provide for their grand children's future and has decided to invest the $800,000. Your client has Identified two Investment options that they are Interested in and would like your advice as to which Investment you belleve they should select. Option 1: Involves placing the $800,000 Into an investment Savings account at the local bank for ten years. This account earns Interest each year for ten years, after which time the client could then withdraw their account balance. Option 2: Involves Investing the total of $800,000 Into a vineyard, ($300,000 upfront to plant the grapes and set up the winery, and then $50,000 each year for ten years for picking the grapes and vineyard maintenance). Ten years after the grapes are planted, they cease ylelding a commercial quantity of wine and the vineyard is sold to a neighbouring farmer. Method Accounting Rate of Return Payback Period Net Present Value Initial Outlay Option 1- Option 2- Investment Savings Account Winery Business 15.8% 12.4% 10 years 6.8 years $81,482 $132,684 $800,000 $300,000 Required (approximately 700 words): a) Explain each method listed above. b) Determine and list the decision rule that applies for each method (you need to decide a reasonable number) and include one advantage and one disadvantage of each method, but do not repeat advantages or disadvantages.

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a Explain Each method i Accounting Rate of return ARR Accounting rate of return is nondiscounting method which shows the average net income expected from an investment as compared to initial outlay It ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started