Answered step by step

Verified Expert Solution

Question

1 Approved Answer

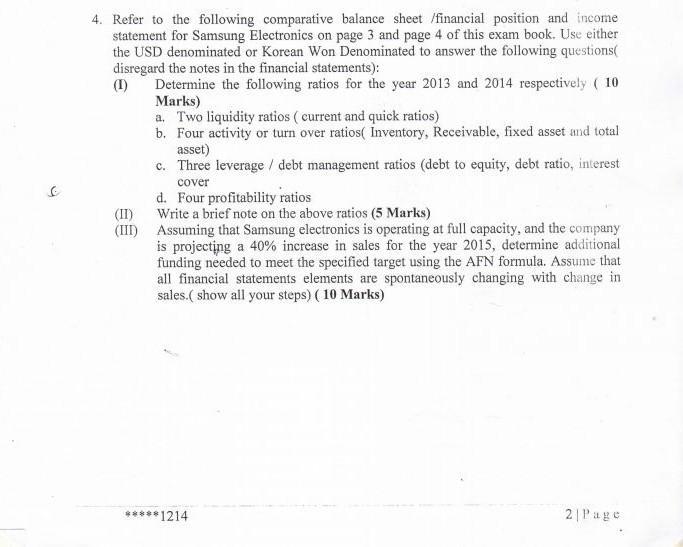

9 4. Refer to the following comparative balance sheet /financial position and income statement for Samsung Electronics on page 3 and page 4 of

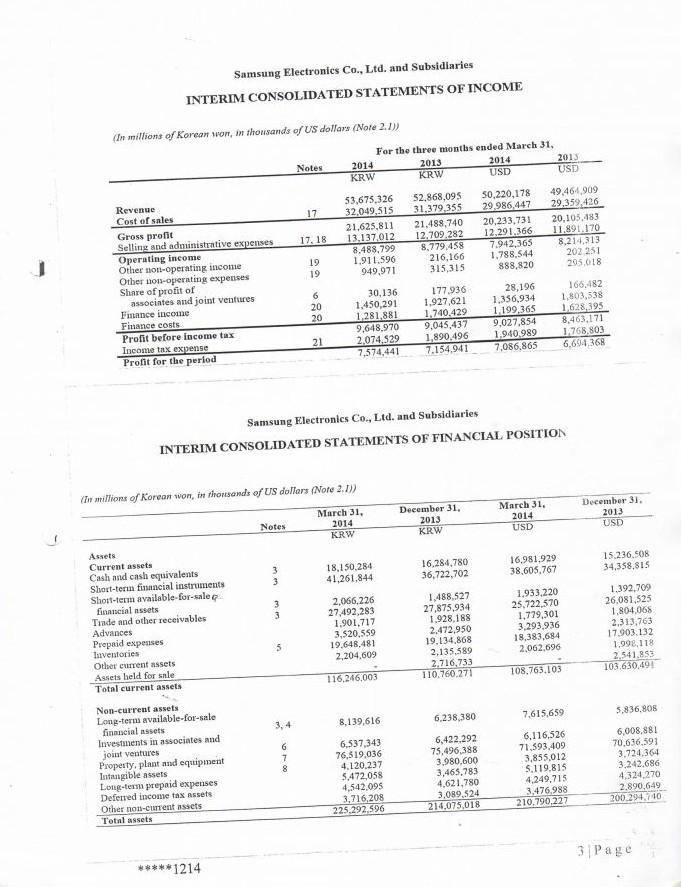

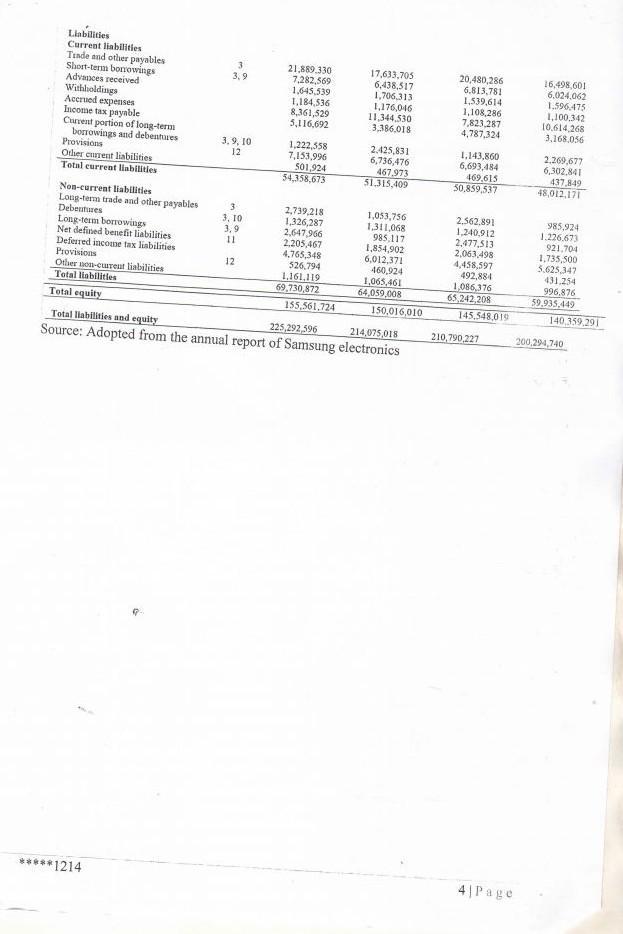

9 4. Refer to the following comparative balance sheet /financial position and income statement for Samsung Electronics on page 3 and page 4 of this exam book. Use either the USD denominated or Korean Won Denominated to answer the following questions( disregard the notes in the financial statements): (I) Determine the following ratios for the year 2013 and 2014 respectively (10 Marks) a. Two liquidity ratios (current and quick ratios) b. Four activity or turn over ratios( Inventory, Receivable, fixed asset and total asset) c. Three leverage / debt management ratios (debt to equity, debt ratio, interest cover d. Four profitability ratios (II) Write a brief note on the above ratios (5 Marks) (III) Assuming that Samsung electronics is operating at full capacity, and the company is projecting a 40% increase in sales for the year 2015, determine additional funding needed to meet the specified target using the AFN formula. Assume that all financial statements elements are spontaneously changing with change in sales.( show all your steps) ( 10 Marks) *****1214 2| Page J (In millions of Korean won, in thousands of US dollars (Note 2.1)) Revenue Cost of sales Samsung Electronics Co., Ltd. and Subsidiaries INTERIM CONSOLIDATED STATEMENTS OF INCOME Gross profit Selling and administrative expenses Operating income Other non-operating income Other non-operating expenses Share of profit of associates and joint ventures Finance income Finance costs Profit before income tax Income tax expense Profit for the period Assets Current assets Cash and cash equivalents Short-term financial instruments Short-term available-for-sale financial assets Trade and other receivables Advances Prepaid expenses Inventories Other current assets Assets held for sale Total current assets Non-current assets. Long-term available-for-sale financial assets Investments in associates and joint ventures Property, plant and equipment Intangible assets Long-term prepaid expenses Deferred income tax assets Other non-current assets Total assets *****1214 Notes 3 3 Notes 3 3 17 3,4 6 7 8 17, 18 19. 19 6 20 20 21 (In millions of Korean won, in thousands of US dollars (Note 2.1)) March 31, 2014 KRW 2014 KRW 53,675,326 32,049,515 For the three months ended March 31, 2013 KRW 21,625,811 21,488,740 13,137,012 12,709,282 8,779,458 216,166 315,315 8,488,799 1,911,596 949,971 30,136 1,450,291 1,281,881 9,648.970 2,074,529 7,574,441 18,150,284 41,261,844 2,066,226 27,492,283 1,901,717 3,520,559 19,648,481 2,204,609 116.246,003 52,868,095 31,379,355 8,139,616 6,537,343 76,519,036 Samsung Electronics Co., Ltd. and Subsidiaries INTERIM CONSOLIDATED STATEMENTS OF FINANCIAL POSITION 4,120,237 5,472,058 4,542,095 3,716,208 225,292,596 177,936 1,927,621 1,740,429 9,045,437 1,890,496 7.154,941 December 31, 2013 KRW 16,284,780 36,722,702 1,488,527 27,875,934 1,928,188 2,472,950 19,134,868 2,135,589 2,716,733 110,760,271 2014 USD 6,238,380 6,422,292 75,496,388 3,980,600 3,465,783 4,621,780 3,089,524 214,075,018 50,220,178 29,986,447 20,233,731 12,291,366 7,942,365 1,788,544 888,820 28,196 1,356,934 1,199,365 9,027,854 1,940,989 7,086,865 March 31, 2014 USD 2013 USD 49,464,909 29,359,426 20,105,483 11.891.170 8,214,313 202 251 205,018 16,981,929 38,605,767 166,4821 1,803,538 1,628,395 8,463,171 1,768,803 6,694 368 1,933,220 25,722,570 1,779,301 3,293,936 18,383,684 2,062,696 108,763.103 7,615,659 6,116,526 71,593,409 3,855,012 5,119,815 4,249,715 3,476,988 210.790,227 December 31. 2013 USD 15.236.508 34,358,815 1.392,709 26,081,525 1,804,068: 2.313,763 17.903.132 1.998,118 2,541.853 103.630,491 5,836.808 6,008,881 70,636.591 3,724.364 3,242,686 4,324,270 2.890,649 200.294.740 3 Page Liabilities Current liabilities Trade and other payables Short-term borrowings Advances received Withholdings Accrued expenses Income tax payable Current portion of long-term borrowings and debentures Provisions Other current liabilities Total current liabilities Non-current liabilities Long-term trade and other payables Debentures Long-term borrowings Net defined benefit liabilities Deferred income tax liabilities Provisions Other non-current liabilities Total liabilities Total equity 3 3,9 *****1214 3,9, 10 12 3 3,10 3.9 11 12 21,889.330 7,282,569 1,645,539 1,184,536 8,361,529 5,116,692 1,222,558 7,153,996 501,924 54,358,673 2,739,218 1,326,287 2,647,966 2,205,467 4,765,348 526,794 1,161,119 69,730,872 155,561,724 17,633,705 6,438,517 1,706,313 1,176,046 11,344,530 3,386,018 2.425,831 6,736,476 467.973 51.315,409 1,053,756 1,311,068 985,117 1,854,902 6,012,371 460,924 1,065,461 64,059,008 Total liabilities and equity 225,292,596 214,075,018 Source: Adopted from the annual report of Samsung electronics 150,016,010 20,480,286 6,813,781 1,539,614 1,108,286 7,823,287 4,787,324 1,143,860 6,693,484 469,615 50,859,537 2,562,891 1,240,912 2,477,513 2,063,498 4,458,597 492,884 1,086,376 65,242,208 145.548,019 210,790,227 4| Page 16,498,601 6,024,062 1.596,475 1,100,342 10,614,268 3,168,056 2,269,677 6,302,841 437,849 48,012,171 985,924 1.226,673 921,704 1,735,500 5.625,347 431.254 996,876 59,935,449 140.359,291 200,294,740

Step by Step Solution

★★★★★

3.56 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Question Step 1 Forgetting the mentioned ratios we will use items of both the balance sheet and the income statements One can use in dollar or Korean currency both will give you the same result And th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started