Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The owners of a cocktail bar have the following annual income statement information: Annual sales revenue Cost of sales (30% of sales revenue) $210,000

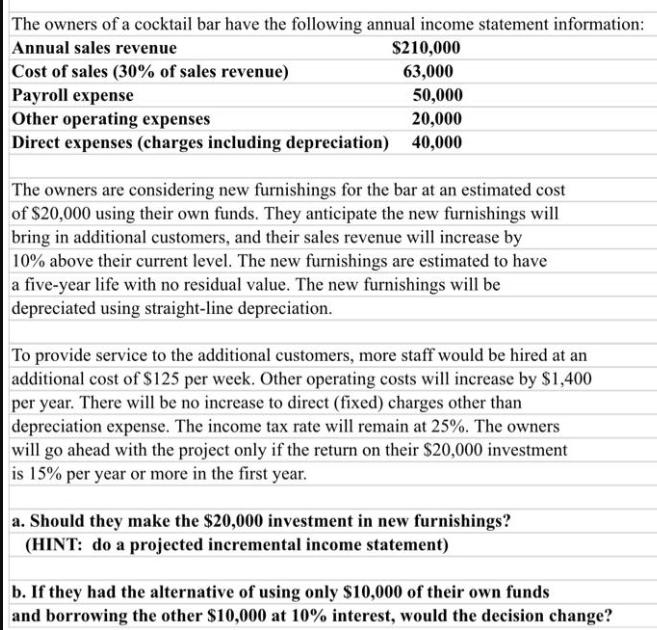

The owners of a cocktail bar have the following annual income statement information: Annual sales revenue Cost of sales (30% of sales revenue) $210,000 63,000 Payroll expense 50,000 Other operating expenses 20,000 Direct expenses (charges including depreciation) 40,000 The owners are considering new furnishings for the bar at an estimated cost of $20,000 using their own funds. They anticipate the new furnishings will bring in additional customers, and their sales revenue will increase by 10% above their current level. The new furnishings are estimated to have a five-year life with no residual value. The new furnishings will be depreciated using straight-line depreciation. To provide service to the additional customers, more staff would be hired at an additional cost of $125 per week. Other operating costs will increase by $1,400 per year. There will be no increase to direct (fixed) charges other than depreciation expense. The income tax rate will remain at 25%. The owners will go ahead with the project only if the return on their $20,000 investment is 15% per year or more in the first year. a. Should they make the $20,000 investment in new furnishings? (HINT: do a projected incremental income statement) b. If they had the alternative of using only $10,000 of their own funds and borrowing the other $10,000 at 10% interest, would the decision change?

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To determine whether the owners should make the 20000 investment in new furnishings we need to analyze the projected incremental income statement This statement will consider the changes in r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started