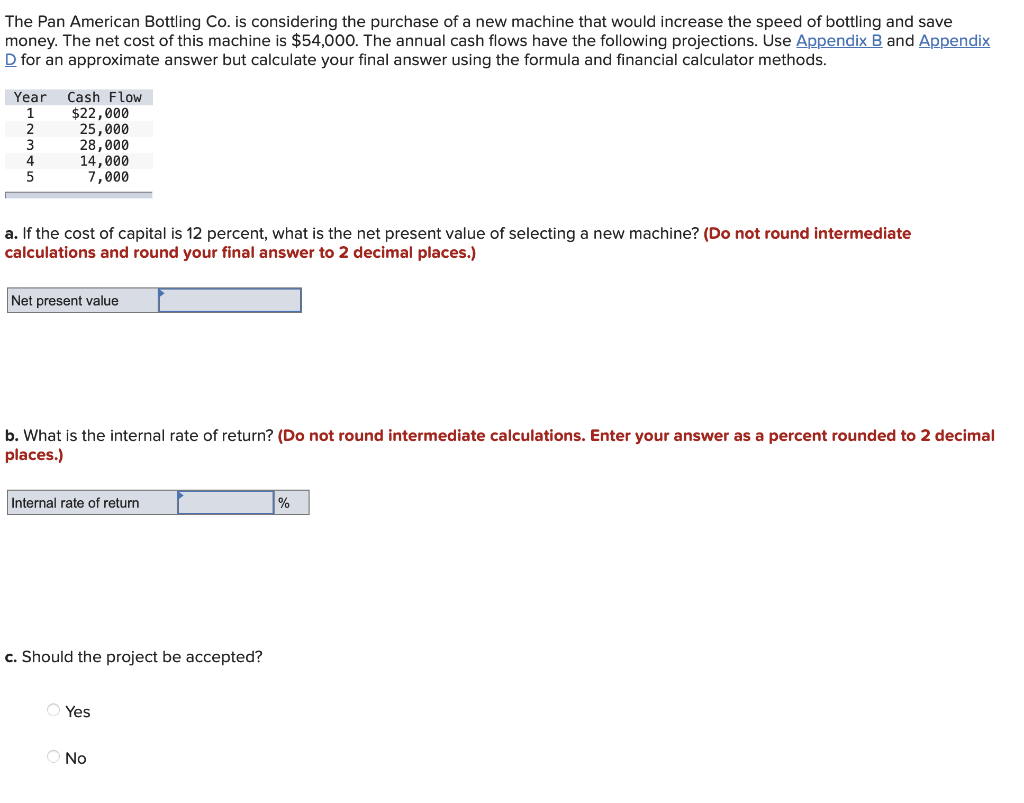

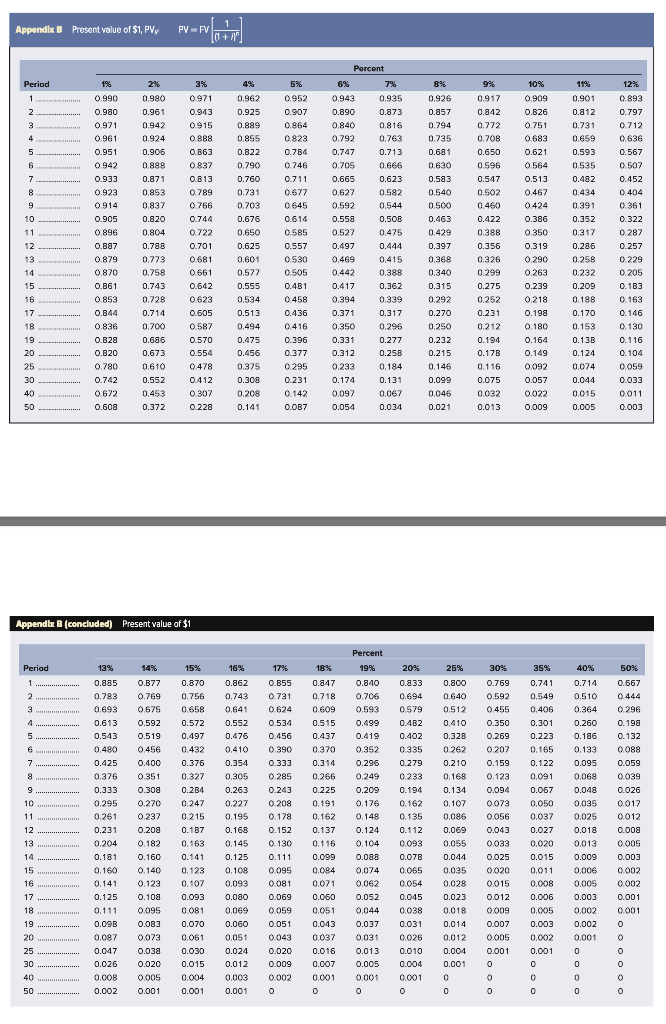

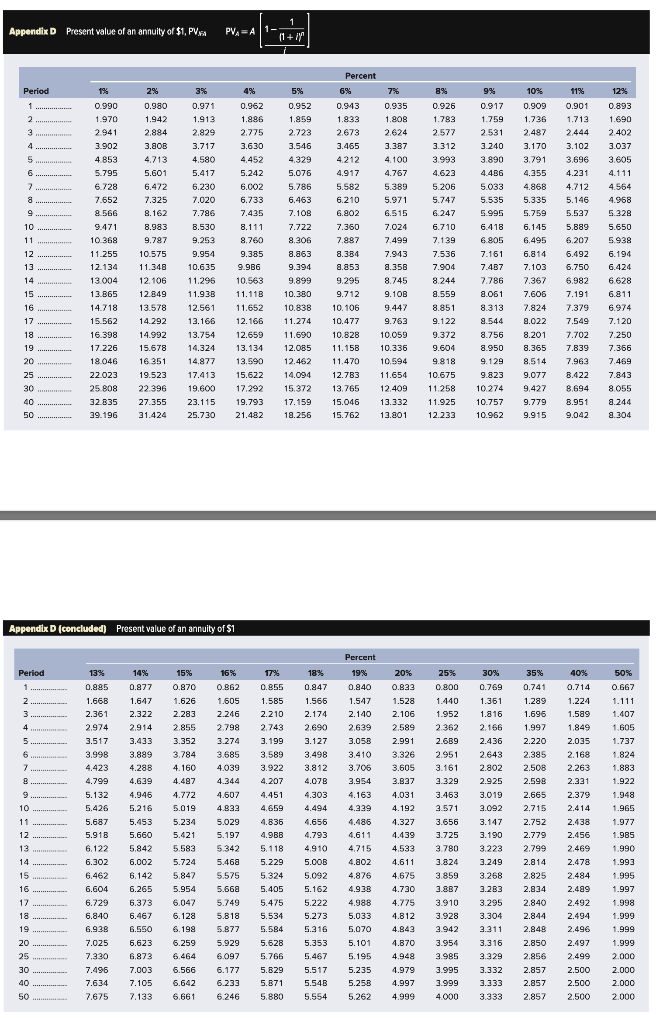

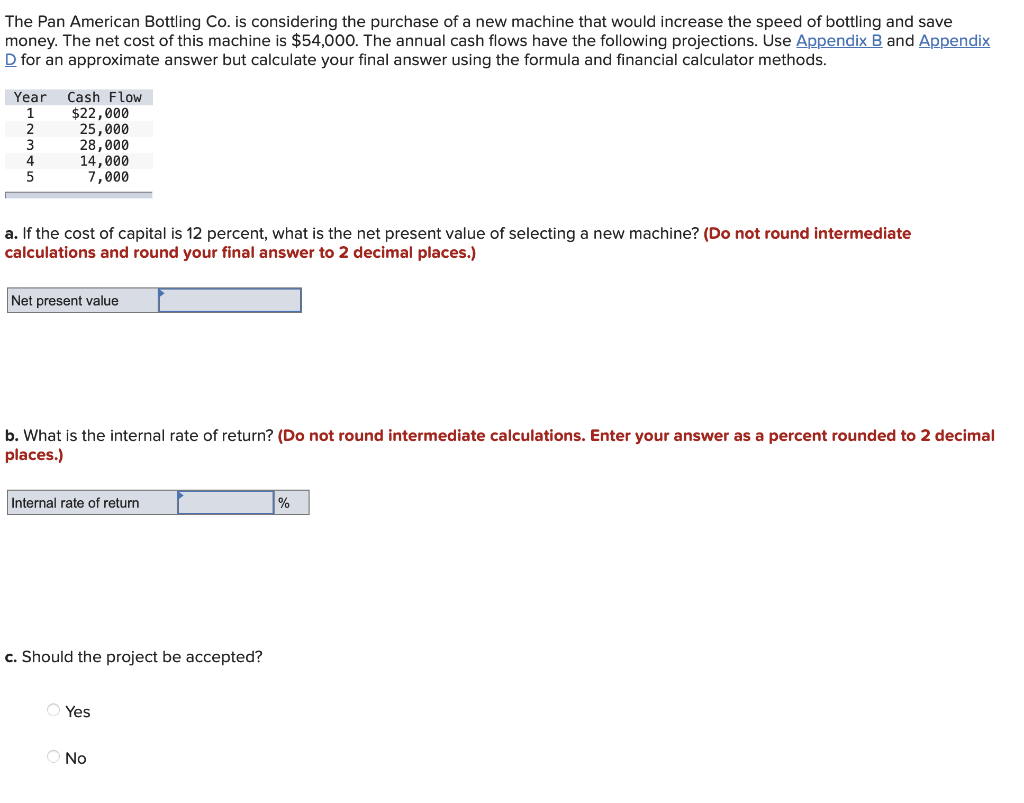

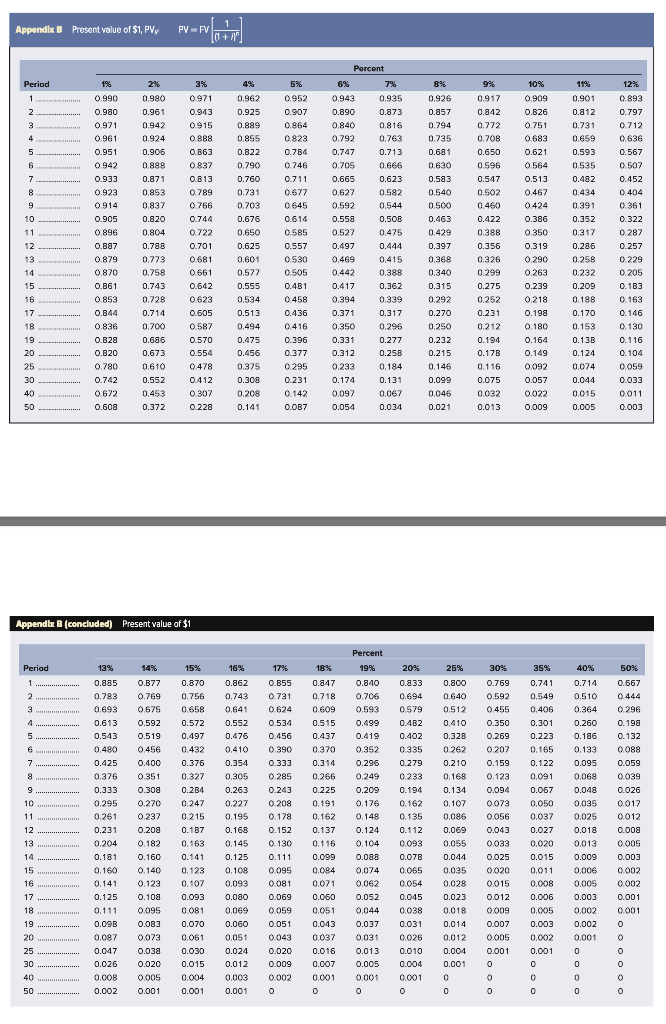

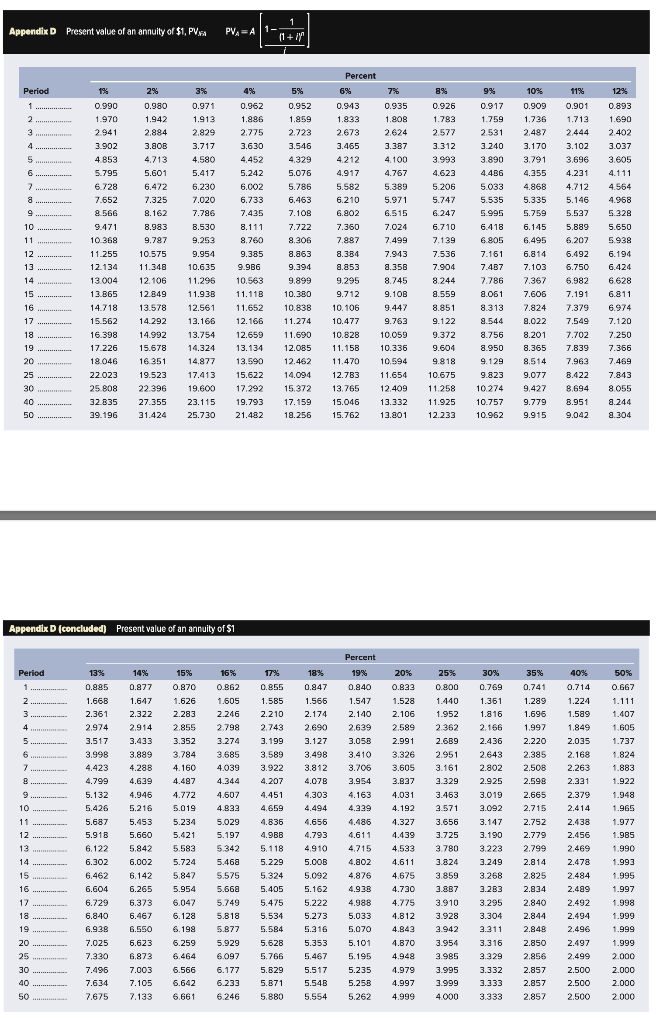

The Pan American Bottling Co. is considering the purchase of a new machine that would increase the speed of bottling and save money. The net cost of this machine is $54,000. The annual cash flows have the following projections. Use Appendix B and Appendix D for an approximate answer but calculate your final answer using the formula and financial calculator methods. Year 1 2 3 4 5 Cash Flow $22,000 25,000 28,000 14,000 7,000 a. If the cost of capital is 12 percent, what is the net present value of selecting a new machine? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Net present value b. What is the internal rate of return? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Internal rate of return % c. Should the project be accepted? Yes NO Appendix B Present value of $1, PV PVFV 1 (1+1 Percent Period 1% 2% 4% 5% 7% 8% 993 10% 1256 1 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 2 0.980 0.961 0.943 0.925 0.907 0.890 0.873 0.857 0.842 0.B26 0.812 0.797 3 0.971 0.942 0915 0.889 0.864 0.840 0.816 0.794 0.772 0.751 0.731 0.712 4 0961 0.924 0888 0.855 0.823 0.792 0.763 0.735 0.708 0.683 0.659 0.636 5 0.951 0.906 0.863 0.822 0.7B4 0.747 0.713 0.681 0.650 0.621 0.593 0.567 6 0.942 0.888 0837 0.790 0.746 0.705 0.666 0.630 0.596 0.564 0.535 0.507 7 0.933 0.871 0.813 0.760 0.711 0.665 0.623 0.583 0.547 0.513 0.482 0.452 0.923 0.853 0.789 0.731 0.677 0.627 0,582 0.540 0.502 0.467 0.434 0.404 8. 9 0.914 0.837 0766 0.703 0.645 0.592 0.544 0.500 0.460 0.424 0.391 0.361 10 0.905 0.820 0.744 0.676 0.614 0.558 0.50B 0.463 0.422 0.386 0.352 0.322 11 0.896 0.804 0.722 0.650 0.585 0.527 0.475 0.429 0388 0.350 0.317 0.287 12 0.887 0.788 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.257 0.286 0.258 13 0.879 0.773 0681 0.601 0.530 0,469 0,415 0.368 0.326 0.290 0.229 14 0870 0.758 0.661 0.577 0.505 0.442 0.388 0.340 0.299 0.263 0.232 0.205 15 0.861 0.743 0.642 0.555 0.481 0.417 0.362 0.315 0.275 0.239 0.209 0.183 16 0.853 0.728 0.623 0.534 0.458 0.394 0.339 0.292 0.252 0218 0.188 0.163 17 0.844 0.714 0.605 0.513 0.436 0.371 0.317 0.270 0.231 0.198 0.170 0.146 18 0.836 0.700 0587 0.494 0.416 0.350 0.296 0.250 0.212 0.180 0.153 0.130 19 0.828 0.686 0.570 0.475 0.396 0.331 0.277 0.232 0.194 0.164 0.13B 0.116 20 0.820 0.673 0.554 0.456 0.377 0.312 0.258 0.215 0.17B 0.149 0.124 0.104 25 0.780 0.610 0.478 0.375 0295 0.233 0.184 0.146 0.116 0.092 0.074 0.059 30 0.742 0.552 0.412 0.308 0.231 0.174 0.131 0.099 0.075 0.057 0.044 0.033 40 0.672 0.453 0.307 0.200 0.142 0.097 0.067 0.046 0.032 0.022 0.015 0.011 50 0.608 0.372 0.228 0.141 0.007 0.054 0.034 0.021 0.013 0.009 0.005 0.003 Appendix B (concluded) Present value of $1 Percent Period 13% 15% 16% 17% 18% 19% % 20% 25% 30% 35% 40% 50% 1 0.885 0.177 0.870 0.862 0.855 0.847 0.840 0.833 0.800 0.769 0.741 0.714 0.667 2 0.783 0.769 0.756 0.743 0.731 0.718 0.706 0.694 0.640 0.592 0.549 0.510 0.444 3 0.693 0.675 0.658 0.641 0.624 0.609 0.593 0.579 0,512 0.455 0.406 0.364 0.296 4. 0.613 0.592 0.572 0.552 0.534 0.515 0.499 0.482 0.410 0.350 0.301 0.260 0.198 5 0.543 0.519 0.497 0.476 0.456 0.437 0.419 0.402 0.328 0.269 0.223 0.186 0.13 0.480 0456 0.432 0,410 0 390 0.370 0.352 0.335 0.262 0.207 0.165 0.133 0088 7 0.425 0.400 0.376 0.354 0.333 0.314 0.296 0.210 0.159 0.122 0.095 0.059 0.279 0.233 9 0.376 0351 0.327 0.305 0.285 0.266 0.249 0.168 0.123 0,091 0.068 0.039 9 0.333 0.308 0.2B4 0.263 0.243 0.225 0.209 0.194 0.134 0.094 0.067 0.048 0.026 10 0.295 0.270 0.247 0.227 0208 0.191 0.176 0.162 0.107 0073 0.050 0.035 0.017 11 0.261 0.237 0.215 0.195 0.178 0.162 0.148 0.135 0,086 0.056 0.037 0.025 0.012 12 0.231 0.208 0.187 0.168 0.152 0.137 0.124 0.112 0.069 0.043 0.027 0.018 0.000 13 0.204 0.182 0.163 0.145 0.130 0.116 0.104 0.093 0.055 0.033 0.020 0.013 0.005 14 0.181 0.160 0.141 0.125 0.111 0.099 0.088 0.078 0.044 0.025 0.015 0.009 0.003 15 0.160 0.140 0.123 0.108 0.095 0.084 0.074 0.065 0.035 0.020 0.011 0.006 0.002 16 ... 0.141 0.123 0.107 0.093 0.081 0071 0.062 0.054 0.028 0015 0.008 0.005 0.002 17 0.125 0.108 0.093 0.080 0.069 0.060 0.052 0.045 0.023 0.012 0.006 0.003 0.001 18 ELLER 0.111 0095 0.081 0.069 0.059 0.051 0.044 0.038 0.018 0.009 0.005 0.002 0.001 19 0.09B 0.083 0.070 0.060 0.051 0.043 0.037 0.031 0.014 0.007 0.003 0.002 0 20 0.087 0.073 0.061 0.051 0.043 0.037 0.031 0.026 0.012 0.005 0.002 0.001 25 0.047 0.038 0.030 0.024 0.020 0.016 0.013 0.010 0.004 0.001 0.001 0 o 30 0.026 0.020 0.015 0.012 0.009 0.007 0.005 0.004 0.001 0 0 40 0.008 0005 0.004 0.003 0.002 0.001 0.001 0.001 0 0 0 0 0 50 0.002 0.001 0.001 0.001 0 0 0 o 0 0 0 1 Appendix D Present value of an annuity of $1, PVwa PV =A1. 11+ IY Percent Period 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 1 ....... 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 2 1.970 1.942 1.913 1.886 1.859 1.833 1.808 1.783 1.759 1.736 1.713 1.690 3. 2941 2.884 2.829 2.775 2.723 2.673 2.624 2.577 2.531 2.487 2.444 2.402 3.902 3.80B 3.717 3.630 3.546 3.465 3.312 3.240 3.170 3.102 3.037 3.387 4 100 5 4.853 4.713 4.580 4,452 4212 3.993 3.890 3.791 3.696 3.605 6 5.795 5.601 5.417 5.242 5.076 4.917 4.767 4.623 4.486 4.355 4.231 4.111 2 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.712 4.564 8 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 5.146 4.968 9 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.995 5.759 5.537 5.328 10 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.889 5.650 11 10.368 9,787 9.253 8.760 8.306 7.897 7.499 7.139 6.805 6.495 6.207 5.938 12 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.161 6.814 6.492 6.194 13 12.134 11.348 10.635 9.986 9.394 8.853 8.35B 7.904 7.487 7.103 6.750 6.424 14 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 7.367 6.982 6.628 15 13.865 12.849 11.938 11.11B 10.30 9.712 9.10B 2.559 8.061 7.606 7.191 6.811 16 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.313 7.824 7.379 6.974 17 15.562 14.292 13.166 12.166 11.274 10.477 9.763 9.122 9.544 8.022 7.549 7.120 18 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 9.756 8.201 7.702 7.250 19 17 226 15.678 14.324 13.134 12.065 11.158 10.336 9.604 8.950 8.365 7.839 7.366 20 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.129 8.514 7.963 7.469 25 22.023 19.523 17.413 15.622 14,094 11.654 10.675 9 823 9.077 8.422 7.843 12.733 13.765 30 25.808 22 396 19,600 17.292 15.372 12.409 11258 10274 9.427 8,694 8.055 40 32.135 27.355 23.115 19.793 17.159 15.046 13.332 11.925 10.757 9.779 8.951 8.244 50 39.196 31.424 25.730 21.482 18.256 15.762 13.801 12.233 10.962 9.915 9.042 2.304 Appendix D (concluded) Present value of an annuity of $1 Percent Period 13% 14% 15% 16 17% 18% 19% 20% 25% 30% 35% 40% 50% 1 0.895 0.877 0.870 0.862 0.855 0.847 0.840 0.833 0.800 0.769 0.741 0.714 0.667 1.668 1.647 1.626 1.605 1.585 1.566 1.547 1.528 1.440 1.361 1.289 1.224 1.111 3 2.361 2.322 2.283 2.246 2.210 2.174 2.140 2.106 1.952 1.816 1.696 1.589 1.407 4 2.974 2.914 2.855 2.798 2.743 2.690 2.639 2.589 2.362 2.166 1.997 1.849 1.605 5 3.517 3.433 3.352 3.274 3.199 3.127 3.058 2.991 2.689 2.436 2.220 2.035 1.737 6 3.998 3.889 3.784 3.498 3.410 3.32 2.951 2.643 2.385 2.168 1824 3.685 4.039 3.589 3.922 7 4,423 4.288 4.160 3.812 3.706 3.605 3.161 2.802 2.508 2.263 1.883 8 4.799 4.639 4.487 4.344 4.207 4.078 3.954 3.837 3.329 2.925 2.598 2.331 1.922 9 5.132 4.946 4.772 4.607 4.451 4.303 4.163 4.031 3.463 3.019 2.665 2.379 1.948 10 5.426 5.216 5.019 4.833 4.659 4.494 4.339 4.192 3.571 3.092 2.715 2.414 1.965 11 5.687 5.45 5.234 5.029 4.836 4.656 4.486 4.327 3.656 3.147 2.752 2.438 1.977 12 5.918 5.660 5.421 5.197 4.9BB 4.793 4.611 4.439 3.725 3.190 2.779 2.456 1.985 13 6.122 5.842 5.583 5.342 5.118 4.910 4.715 4.533 3.780 3.223 2.799 2.469 1.990 14 6.302 6.002 5.724 5.468 5.229 5.00B 4.3oz 4.611 3.824 3.249 2.814 2.478 1.993 15 6.462 6.142 5.847 5.575 5.324 5.092 4.876 4.675 3.859 3.268 2.825 2.484 1.995 16 6.604 6.265 5.954 5.668 5.405 5.162 4.938 4.730 3.837 3.283 2.834 2.489 1.997 17 6.729 6.373 6.047 5.749 5.475 5.222 4.988 4.775 3.910 3.295 2.840 2.492 1.998 18 6.840 6.467 6.128 5.818 5.534 5.273 5.033 4.812 3.928 3.304 2.844 2.494 1.999 19 6.938 6.550 6.198 5.877 5.584 5.316 5.070 4.843 3.942 3.311 2.849 2.496 1.999 20 7.025 6.623 6.259 5.929 5.628 5.353 5.101 4.870 3.954 3.316 2.850 2.497 1.999 25 7.330 6.873 6.464 6.097 5.766 5.467 5.195 4.948 3.985 3.329 2.856 2.499 2.000 30 7.496 7.003 6.566 6.177 5.829 5.517 5.235 4.979 3.995 3.332 2.857 2.500 2.000 40 7.634 7.105 6.642 6.233 5.871 5.54B 5.258 4.997 3.999 3.333 2.857 2.500 2.000 50 7.675 7.133 6.661 6.246 5.880 5.554 5.262 4.999 4000 3,333 2.857 2.500 2.000