Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The pandemic years have been a very active time for Corporate Bonds, many companies tried to raise cash at record-low rates. For example, AT&T

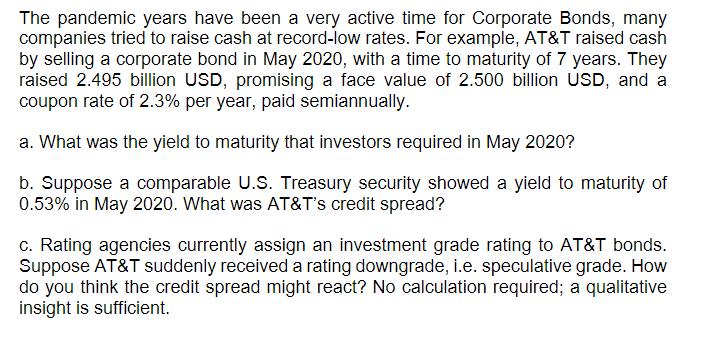

The pandemic years have been a very active time for Corporate Bonds, many companies tried to raise cash at record-low rates. For example, AT&T raised cash by selling a corporate bond in May 2020, with a time to maturity of 7 years. They raised 2.495 billion USD, promising a face value of 2.500 billion USD, and a coupon rate of 2.3% per year, paid semiannually. a. What was the yield to maturity that investors required in May 2020? b. Suppose a comparable U.S. Treasury security showed a yield to maturity of 0.53% in May 2020. What was AT&T's credit spread? c. Rating agencies currently assign an investment grade rating to AT&T bonds. Suppose AT&T suddenly received a rating downgrade, i.e. speculative grade. How do you think the credit spread might react? No calculation required; a qualitative insight is sufficient.

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a What was the yield to maturity that investors required in May 2020 ANS WER The yield to maturity t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started