Answered step by step

Verified Expert Solution

Question

1 Approved Answer

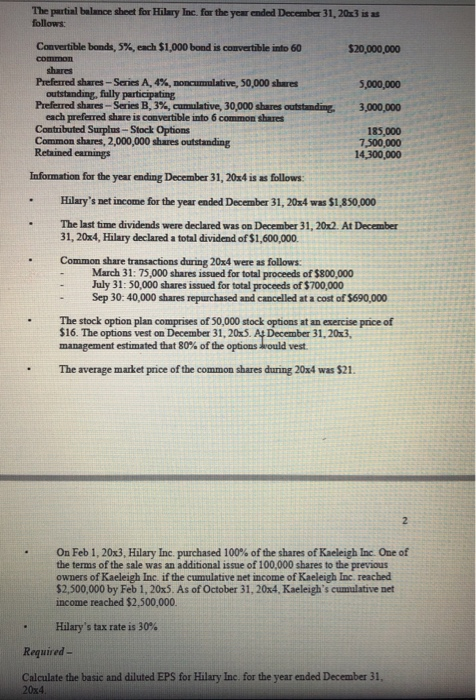

rn . The partial balance sheet for Hilary Inc. for the year ended December 31, 20x3 is as follows: . Convertible bonds, 5%, each $1,000

rn

rn

. The partial balance sheet for Hilary Inc. for the year ended December 31, 20x3 is as follows: . Convertible bonds, 5%, each $1,000 bond is convertible into 60 common . shares Preferred shares-Series A, 4%, noncumulative, 50,000 shares outstanding, fully participating Preferred shares-Series B, 3%, cumulative, 30,000 shares outstanding each preferred share is convertible into 6 common shares Contributed Surplus-Stock Options Common shares, 2,000,000 shares outstanding Retained earnings Information for the year ending December 31, 20x4 is as follows: Hilary's net income for the year ended December 31, 20x4 was $1,850,000 The last time dividends were declared was on December 31, 20x2. At December 31, 20x4, Hilary declared a total dividend of $1,600,000. $20,000,000 Common share transactions during 20x4 were as follows: 5,000,000 3,000,000 185,000 7,500,000 14,300,000 March 31: 75,000 shares issued for total proceeds of $800,000 July 31: 50,000 shares issued for total proceeds of $700,000 Sep 30: 40,000 shares repurchased and cancelled at a cost of $690,000 The stock option plan comprises of 50,000 stock options at an exercise price of $16. The options vest on December 31, 20x5. At December 31, 20x3, management estimated that 80% of the options would vest. The average market price of the common shares during 20x4 was $21. 2 On Feb 1, 20x3, Hilary Inc. purchased 100% of the shares of Kaeleigh Inc. One of the terms of the sale was an additional issue of 100,000 shares to the previous owners of Kaeleigh Inc. if the cumulative net income of Kaeleigh Inc. reached $2,500,000 by Feb 1, 20x5. As of October 31, 20x4, Kaeleigh's cumulative net income reached $2,500,000. Hilary's tax rate is 30% Required- Calculate the basic and diluted EPS for Hilary Inc. for the year ended December 31, 20x4.

Step by Step Solution

★★★★★

3.24 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Basic EPS Net Income Dividends on Preferred Shares Number of Outst...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started