Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The particulars relating to 1,200 kgs. of a certain raw material purchased by a company during June, were as follows:- Lot prices quoted by

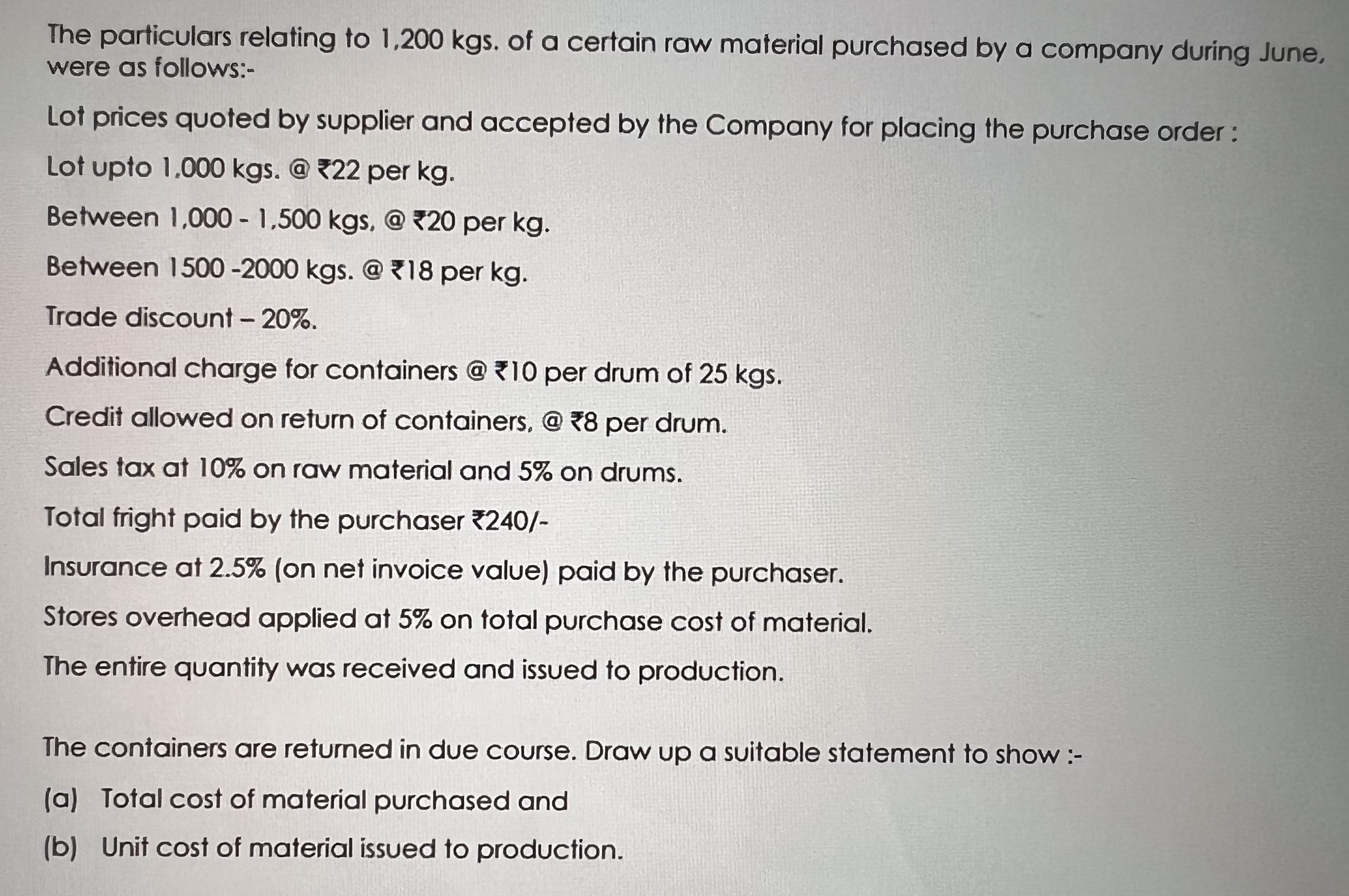

The particulars relating to 1,200 kgs. of a certain raw material purchased by a company during June, were as follows:- Lot prices quoted by supplier and accepted by the Company for placing the purchase order : Lot upto 1,000 kgs. @ 22 per kg. Between 1,000 - 1,500 kgs, @*20 per kg. Between 1500-2000 kgs. @ 18 per kg. Trade discount - 20%. Additional charge for containers @ 10 per drum of 25 kgs. Credit allowed on return of containers, @18 per drum. Sales tax at 10% on raw material and 5% on drums. Total fright paid by the purchaser *240/- Insurance at 2.5% (on net invoice value) paid by the purchaser. Stores overhead applied at 5% on total purchase cost of material. The entire quantity was received and issued to production. The containers are returned in due course. Draw up a suitable statement to show :- (a) Total cost of material purchased and (b) Unit cost of material issued to production.

Step by Step Solution

★★★★★

3.47 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a Calculation of Total Cost of Material Purchased Quantity purchased 1200 kgs Lot price for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started