Question

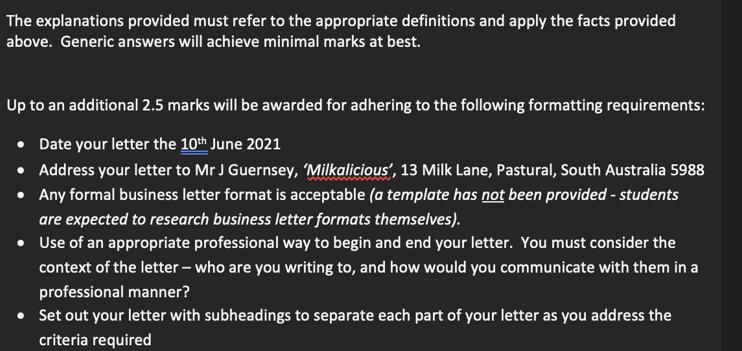

The partner has requested that you draft a letter to Jerry which explains how Jerry should have recorded the refrigerated van. The partner has asked

The partner has requested that you draft a letter to Jerry which explains how Jerry should have recorded the refrigerated van. The partner has asked that you refer to the going concern assumption, definitions for asset and how he should have recorded the refrigerated van based on both the assumption and asset definition.

In addition, he would like you to explain to Jerry the term 'depreciation' as it is used in accounting and how it should be applied to the refrigerated van. Please include the terms 'historic cost' and 'accounting period' in your answer.

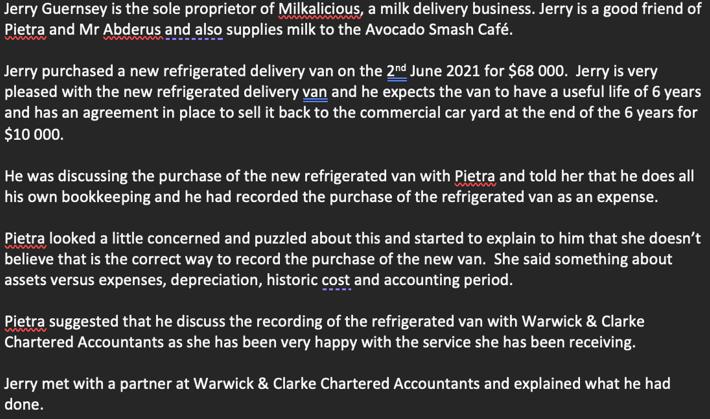

Jerry Guernsey is the sole proprietor of Milkalicious, a milk delivery business. Jerry is a good friend of Pietra and Mr Abderus and also supplies milk to the Avocado Smash Caf. Jerry purchased a new refrigerated delivery van on the 2nd June 2021 for $68 000. Jerry is very pleased with the new refrigerated delivery van and he expects the van to have a useful life of 6 years and has an agreement in place to sell it back to the commercial car yard at the end of the 6 years for $10 000. He was discussing the purchase of the new refrigerated van with Pietra and told her that he does all his own bookkeeping and he had recorded the purchase of the refrigerated van as an expense. Pietra looked a little concerned and puzzled about this and started to explain to him that she doesn't believe that is the correct way to record the purchase of the new van. She said something about assets versus expenses, depreciation, historic cost and accounting period. Pietra suggested that he discuss the recording of the refrigerated van with Warwick & Clarke Chartered Accountants as she has been very happy with the service she has been receiving. Jerry met with a partner at Warwick & Clarke Chartered Accountants and explained what he had done.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Mr J Guernsey Milkalicious 13 Milk Lane Pastural South Australia 5988 10th June 2021 Dear Mr Guernsey Subject Recording of Refrigerated Van and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started