Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The partnership deed of a firm consisting of 3 partners - P, Q and R (profit sharing ratio being 2:1:1) and whose fixed capitals

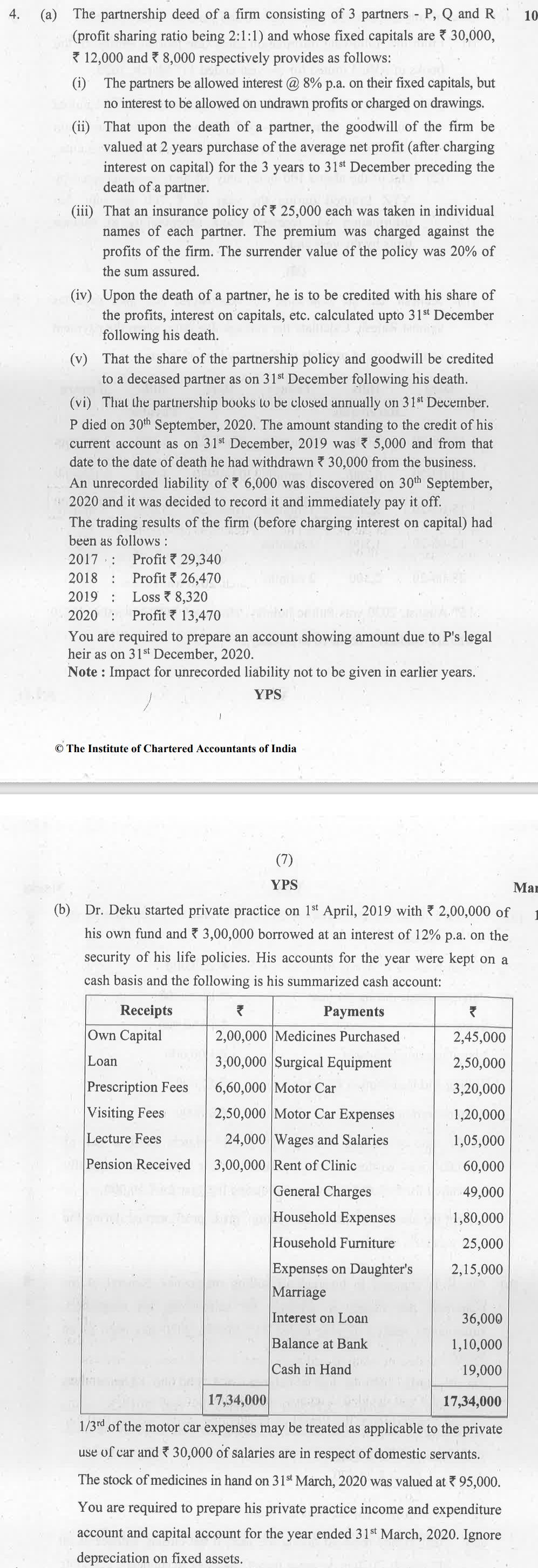

The partnership deed of a firm consisting of 3 partners - P, Q and R (profit sharing ratio being 2:1:1) and whose fixed capitals are 30,000, 12,000 and 8,000 respectively provides as follows: (i) The partners be allowed interest @ 8% p.a. on their fixed capitals, but no interest to be allowed on undrawn profits or charged on drawings. (ii) That upon the death of a partner, the goodwill of the firm be valued at 2 years purchase of the average net profit (after charging interest on capital) for the 3 years to 31st December preceding the death of a partner. (iii) That an insurance policy of 25,000 each was taken in individual names of each partner. The premium was charged against the profits of the firm. The surrender value of the policy was 20% of the sum assured. (iv) Upon the death of a partner, he is to be credited with his share of the profits, interest on capitals, etc. calculated upto 31st December Iglesian filmayd following his death. (v) That the share of the partnership policy and goodwill be credited to a deceased partner as on 31st December following his death. (vi) That the partnership books to be closed annually on 31st December. P died on 30th September, 2020. The amount standing to the credit of his current account as on 31st December, 2019 was 5,000 and from that date to the date of death he had withdrawn 30,000 from the business. An unrecorded liability of 6,000 was discovered on 30th September, 2020 and it was decided to record it and immediately pay it off. The trading results of the firm (before charging interest on capital) had been as follows: 2017 : Profit 29,340 2018 : Profit * 26,470 2019 : Loss 8,320 2020 : Profit 13,470 You are required to prepare an account showing amount due to P's legal heir as on 31st December, 2020. Note: Impact for unrecorded liability not to be given in earlier years. YPS The Institute of Chartered Accountants of India (b) Dr. Deku started private practice on 1st April, 2019 with 2,00,000 of his own fund and 3,00,000 borrowed at an interest of 12% p.a. on the security of his life policies. His accounts for the year were kept on a cash basis and the following is his summarized cash account: Receipts Own Capital Loan (7) YPS Prescription Fees Visiting Fees Lecture Fees Pension Received Payments 2,00,000 Medicines Purchased 3,00,000 Surgical Equipment 6,60,000 Motor Car 2,50,000 Motor Car Expenses 24,000 Wages and Salaries 3,00,000 Rent of Clinic General Charges po Household Expenses Household Furniture Expenses on Daughter's Marriage Interest on Loan Balance at Bank Cash in Hand 2,45,000 2,50,000 3,20,000 1,20,000 1,05,000 60,000 im 49,000 1,80,000 25,000 2,15,000 36,000 1,10,000 19,000 17,34,000 17,34,000 1/3rd of the motor car expenses may be treated as applicable to the private use of car and * 30,000 of salaries are in respect of domestic servants. The stock of medicines in hand on 31st March, 2020 was valued at 95,000. You are required to prepare his private practice income and expenditure account and capital account for the year ended 31st March, 2020. Ignore depreciation on fixed assets. 10 Mar

Step by Step Solution

★★★★★

3.28 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started