Answered step by step

Verified Expert Solution

Question

1 Approved Answer

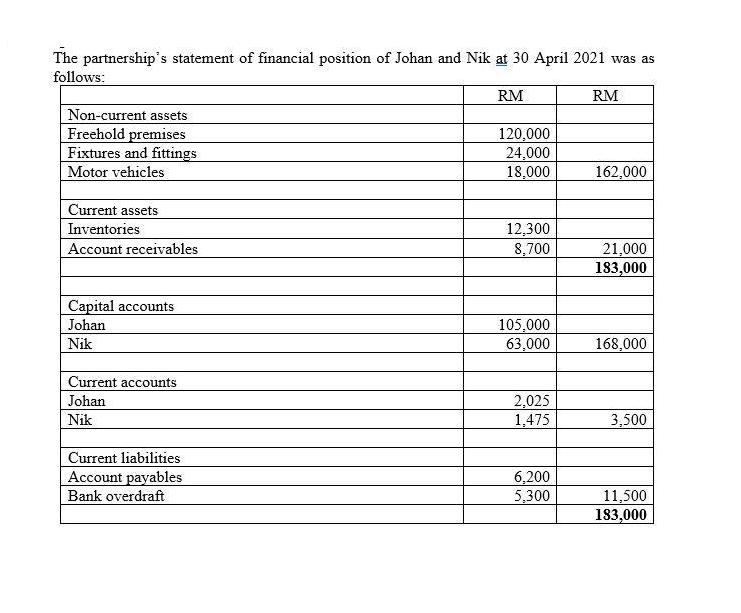

The partnership's statement of financial position of Johan and Nik at 30 April 2021 was as follows: Non-current assets Freehold premises Fixtures and fittings

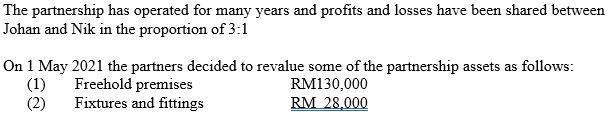

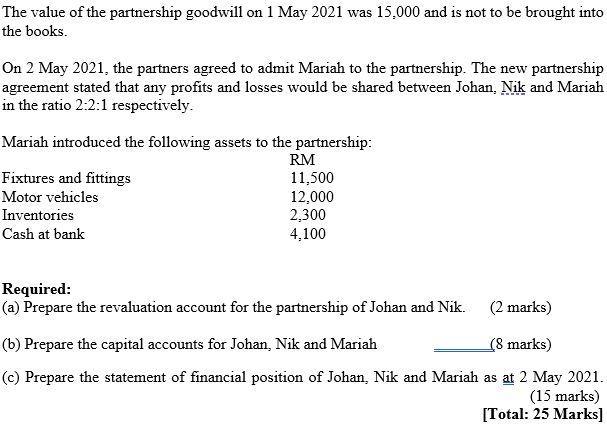

The partnership's statement of financial position of Johan and Nik at 30 April 2021 was as follows: Non-current assets Freehold premises Fixtures and fittings Motor vehicles Current assets Inventories Account receivables Capital accounts Johan Nik Current accounts Johan Nik Current liabilities Account payables Bank overdraft RM 120,000 24,000 18,000 12,300 8,700 105,000 63,000 2,025 1,475 6,200 5,300 RM 162,000 21,000 183,000 168,000 3,500 11,500 183,000 The partnership has operated for many years and profits and losses have been shared between Johan and Nik in the proportion of 3:1 On 1 May 2021 the partners decided to revalue some of the partnership assets as follows: (1) RM130,000 (2) RM 28,000 Freehold premises Fixtures and fittings The value of the partnership goodwill on 1 May 2021 was 15,000 and is not to be brought into the books. On 2 May 2021, the partners agreed to admit Mariah to the partnership. The new partnership agreement stated that any profits and losses would be shared between Johan. Nik and Mariah in the ratio 2:2:1 respectively. Mariah introduced the following assets to the partnership: RM 11,500 12,000 2,300 4,100 Fixtures and fittings Motor vehicles Inventories Cash at bank Required: (a) Prepare the revaluation account for the partnership of Johan and Nik. (2 marks) (b) Prepare the capital accounts for Johan, Nik and Mariah (8 marks) (c) Prepare the statement of financial position of Johan, Nik and Mariah as at 2 May 2021. (15 marks) [Total: 25 Marks]

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Profit on Revaluation Johns 14000x210 500 Niks 14000xY 3500 11 14000 Partners capital Account Johns ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started