Question

The Paulson Company's year-end balance sheet is shown below. Its cost of common equity is 14%, its before-tax cost of debt is 11%, and its

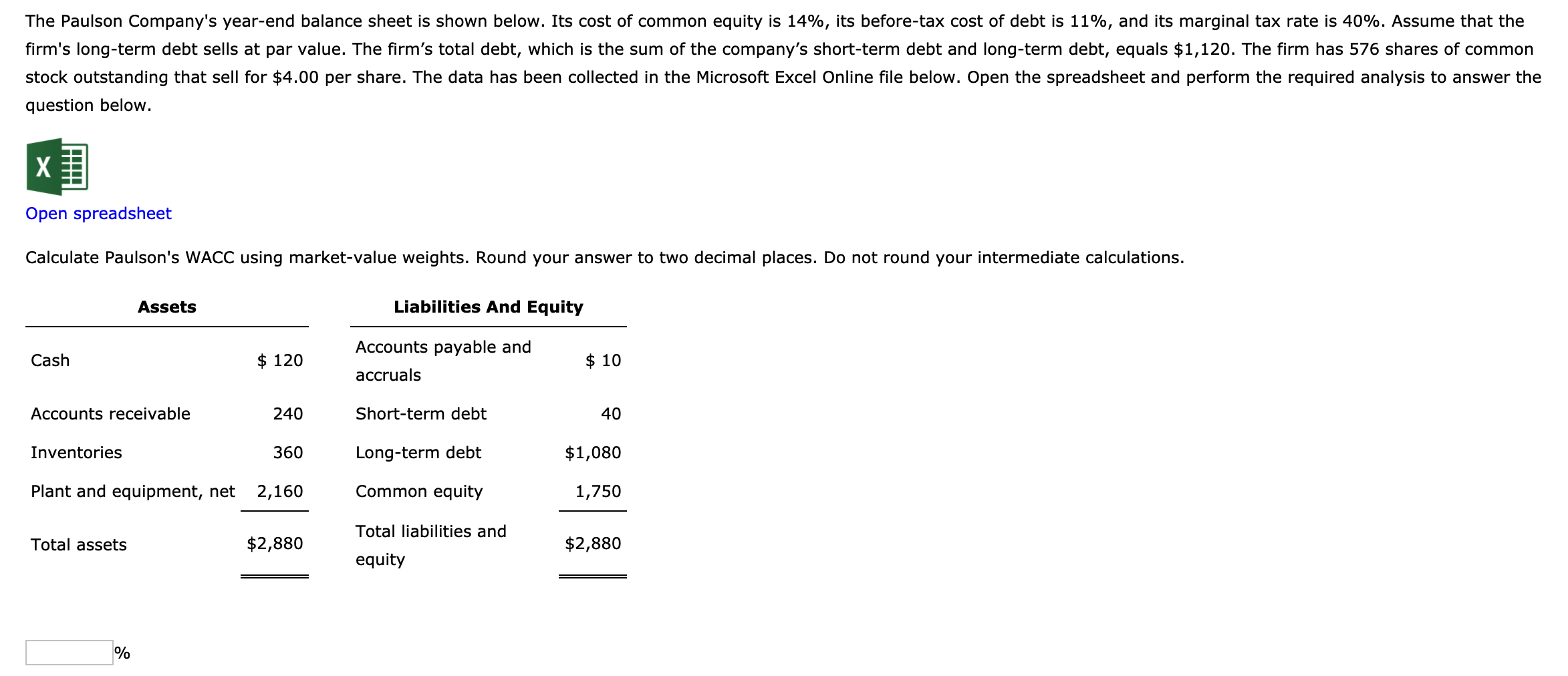

The Paulson Company's year-end balance sheet is shown below. Its cost of common equity is 14%, its before-tax cost of debt is 11%, and its marginal tax rate is 40%. Assume that the firm's long-term debt sells at par value. The firms total debt, which is the sum of the companys short-term debt and long-term debt, equals $1,120. The firm has 576 shares of common stock outstanding that sell for $4.00 per share. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. Calculate Paulson's WACC using market-value weights. Round your answer to two decimal places. Do not round your intermediate calculations.

Assets Liabilities And Equity Cash $ 120

Accounts payable and accruals $ 10

Accounts receivable 240

Short-term debt 40

Inventories 360

Long-term debt $1,080

Plant and equipment, net 2,160

Common equity 1,750

Total assets $2,880

Total liabilities and equity $2,880

The Paulson Company's year-end balance sheet is shown below. Its cost of common equity is 14%, its before-tax cost of debt is 11%, and its marginal tax rate is 40%. Assume that the firm's long-term debt sells at par value. The firm's total debt, which is the sum of the company's short-term debt and long-term debt, equals $1,120. The firm has 576 shares of common stock outstanding that sell for $4.00 per share. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. X Open spreadsheet Calculate Paulson's WACC using market-value weights. Round your answer to two decimal places. Do not round your intermediate calculations. Assets Liabilities And Equity Cash $ 120 Accounts payable and accruals $ 10 Accounts receivable 240 Short-term debt 40 Inventories 360 Long-term debt $1,080 Plant and equipment, net 2,160 Common equity 1,750 Total liabilities and Total assets $2,880 $2,880 equity %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started