The payroll records of Brownlee Company provided the following information for the weekly pay period ended March 23, 20 Required: 1. Enter the relevant

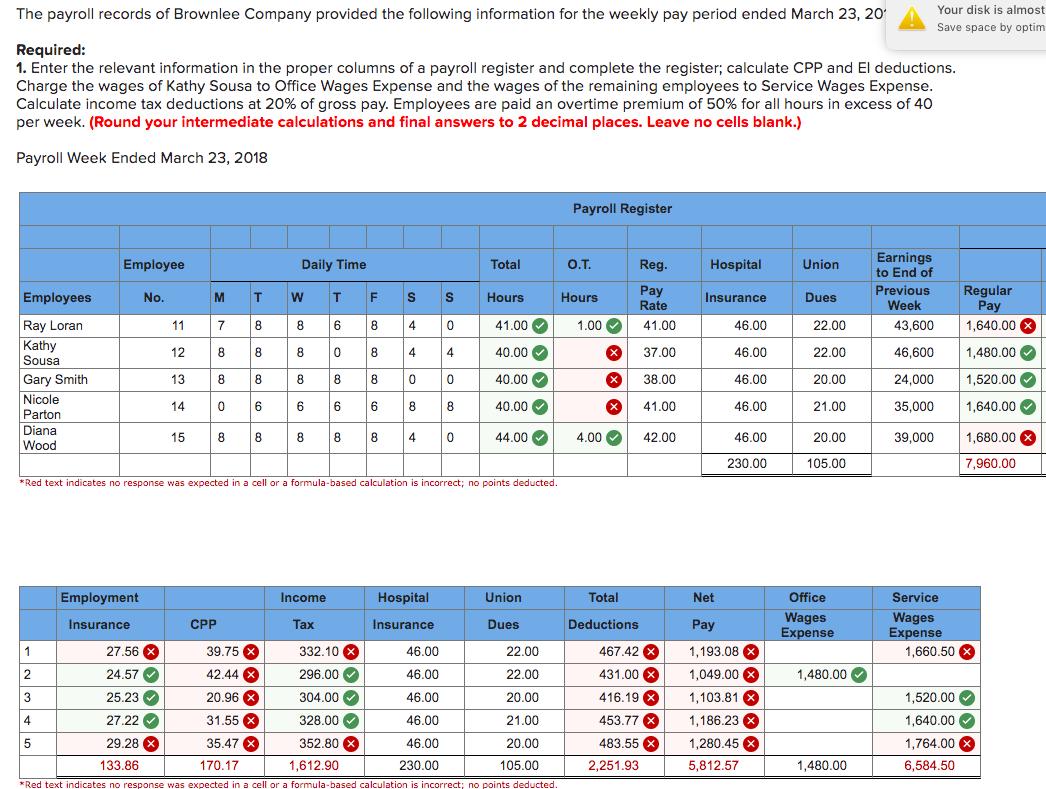

The payroll records of Brownlee Company provided the following information for the weekly pay period ended March 23, 20 Required: 1. Enter the relevant information in the proper columns of a payroll register and complete the register; calculate CPP and El deductions. Charge the wages of Kathy Sousa to Office Wages Expense and the wages of the remaining employees to Service Wages Expense. Calculate income tax deductions at 20% of gross pay. Employees are paid an overtime premium of 50% for all hours in excess of 40 per week. (Round your intermediate calculations and final answers to 2 decimal places. Leave no cells blank.) Payroll Week Ended March 23, 2018 Employees Ray Loran Kathy Sousa Gary Smith Nicole Parton Diana Wood Employee 1 2 3 4 5 No. Employment Insurance 27.56 X 24.57 25.23 27.22 29.28 X ***** 11 12 13 14 15 M 7 8 CPP 8 0 T 8 8 8 8 8 Daily Time T 6 0 39.75 X 42.44 x 20.96 X 31.55 X 35.47 x W 8 8 8 8 6 Income Tax F 8 8 8 332.10 X 296.00 304.00 328.00 352.80 x SS 4 4 0 8 8 4 0 4 0 8 Hospital Insurance 0 *Red text indicates no response was expected in a cell or a formula-based calculation is incorrect; no points deducted. Total Hours 41.00 3 3 3 3 3 40.00 40.00 46.00 46.00 46.00 46.00 46.00 133.86 170.17 1,612.90 230.00 *Red text indicates no response was expected in a cell or a formula-based calculation is incorrect; no points deducted. 40.00 44.00 Union Dues 22.00 22.00 20.00 21.00 20.00 105.00 Payroll Register O.T. Hours 1.00 * * * * * 4.00 Total Deductions Reg. Pay Rate 2,251.93 41.00 37.00 38.00 41.00 42.00 467.42 x 431.00 x 416.19 X 453.77 x 483.55 X Hospital Insurance 46.00 46.00 46.00 46.00 46.00 230.00 Net Pay 1,193.08 x 1,049.00 X 1,103.81 x 1,186.23 X 1,280.45 x 5,812.57 Union Dues 22.00 22.00 20.00 21.00 20.00 105.00 Office Wages Expense 1,480.00 1,480.00 Earnings to End of Previous Week 43,600 46,600 24,000 35,000 Your disk is almost Save space by optim 39,000 Service Wages Expense Regular Pay 1,640.00 X 1,480.00 1,520.00 1,640.00 1,680.00 x 7,960.00 1,660.50 x 1,520.00 1,640.00 1,764.00 x 6,584.50

Step by Step Solution

3.38 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

1 Completion of the Payroll Register for the payroll week ended March 23 2018 Employees Ray Loran Ka...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started