Question

The percentage changes in prepaid expenses and other current assets jumped up 16.5% in scal 2014 and then fell by 35.2% in scal 2015. Did

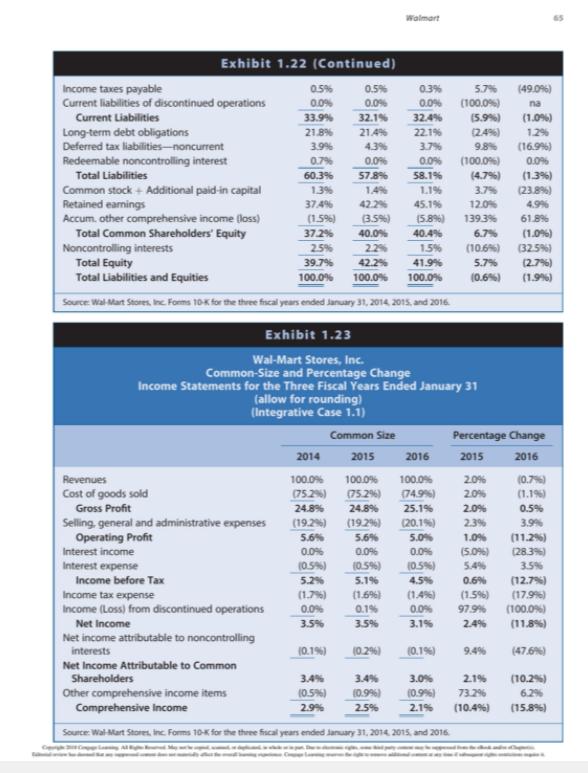

The percentage changes in prepaid expenses and other current assets jumped up 16.5% in fiscal 2014 and then fell by 35.2% in fiscal 2015. Did the changes in the dollar amounts of this account have a huge impact on total assets (see Exhibit 1.22)? Explain.

a. During this three-year period, how did the proportion of total liabilities change relative to the proportion of shareholders’ equity? What does this imply about changes in Wal-mart’s leverage?

b. How did net income as a percentage of total revenues change from fiscal 2013 to fiscal 2015? Identify the most important reasons for this change.

c. Does Walmart generate high or low profit margins? How do Walmart’s profit margins relate to the company’s strategy?

Walmart Exhibit 1.22 (Continued) 05% 0.5% 0.3% 5.7% (49.06) Income taxes payable Current liabilities of discontinued operations 0.0% 0.0% 0.0% (100.0%) na Current Liabilities 33.9% 32.1% 32.4% (5.9%) (1.0%) Long-term debt obligations Deferred tax liabilities-noncurrent Redeemable noncontrolling interest 21.8% 21.4% 22.1% (2.4%) 12% 3.9% 4.3% 3.7% 98% (16.9%) 0.7% 0.0% 0.0% (100.0%) 0.0% Total Liabilities 60.3% 57.8% 58.1% (4.7%) (1.3%) 1.3% 14% Common stock + Additional paid-in capital Retained earnings Accum. other comprehensive income (loss) Total Common Shareholders' Equity 1.1% 3.7% (23.8%) 37.4% 42.2% 45.1% 12.0% 4.9% (1.5%) (3.5%) (5.8%) 139.3% 61.8% 37.2% 40.0% 40.4% 6.7% (1.0%) Noncontrolling interests Total Equity Total Liabilities and Equities 2.5% 22% 15% (10.6%) (325%) 39.7% 42.2% 41.9% 5.7% (2.7%) 100.0% 100.0% 100.0% (0.6%) (1.9%) Source Wal-Mart Stores, Inc Forms 10K for the three fiscal years ended January 31, 2014, 2015, and 2016. Exhibit 1.23 Wal-Mart Stores, Inc. Common-Size and Percentage Change Income Statements for the Three Fiscal Years Ended January 31 (allow for rounding) (Integrative Case 1.1) Common Size Percentage Change 2014 2015 2016 2015 2016 Revenues 100.0% 100.0% 100.0% 2.0% (0.7%) Cost of goods sold (75.2%) (75.2%) (74.96) 2.0% (1.1%) Gross Profit 24.8% 24.8% 25.1% 2.0% 0.5% Selling, general and administrative expenses Operating Profit (20.1%) 2.3% 3.9% (19.2%) 5.6% (19.2%) 5.6% 5.0% 1.0% (11.2%) 0.0% 0.0% (5.0%) 5.4% Interest income 0.0% (28.3%) Interest expense (0.5%) (0.5%) (0.5%) 3.5% Income before Tax 5.2% 5.1% 4.5% 0.6% (12.7%) Income tax expense (1.7%) (1.66) (1.4%) (1.5%) (17.996) Income (Loss) from discontinued operations 0.0% 0.1% 0.0% 97.9% (100.0%) Net Income 3.5% 3.5% 3.1% 2.4% (11.8%) Net income attributable to noncontrolling interests (0.1%) (0.2%) (0.1%) 9.4% (47.6%) Net Income Attributable to Common Shareholders 3.4% 3.4% 3.0% 2.1% (10.2%) Other comprehensive income items Comprehensive Income (0.5%) (0.996) (0.96) 73.2% 6.2% 2.9% 2.5% 2.1% (10.4%) (15.8%) Source: Wal-Mart Stores, inc. Forms 10-K for the three fiscal years ended January 31, 2014. 2015, and 2016.

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

A During this threeyear period the proportion of total assets financed by total liabil...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started