Question

The percentage of receivables approach to estimating bad debts expense is used by Ivanhoe Company. On February 28 (the fiscal yearend), the firm had accounts

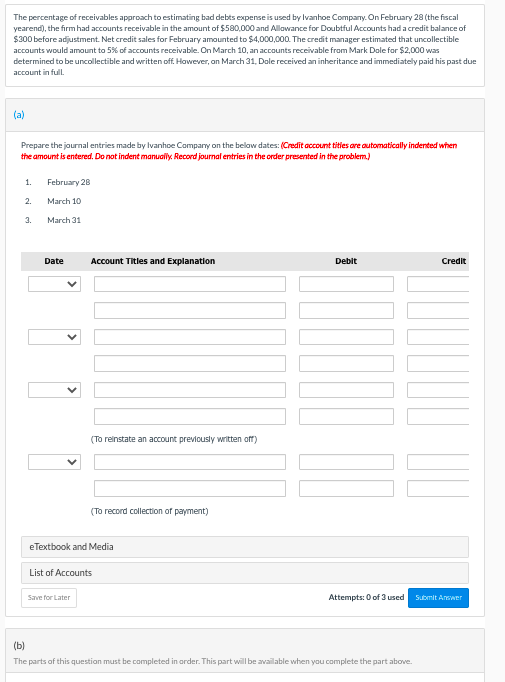

The percentage of receivables approach to estimating bad debts expense is used by Ivanhoe Company. On February 28 (the fiscal yearend), the firm had accounts receivable in the amount of $580,000 and Allowance for Doubtful Accounts had a credit balance of $300 before adjustment. Net credit sales for February amounted to $4,000,000. The credit manager estimated that uncollectible accounts would amount to 5% of accounts receivable. On March 10, an accounts receivable from Mark Dole for $2,000 was determined to be uncollectible and written off. However, on March 31, Dole received an inheritance and immediately paid his past due account in full

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started