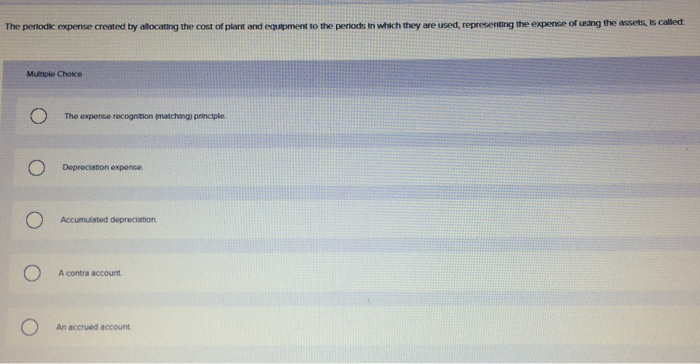

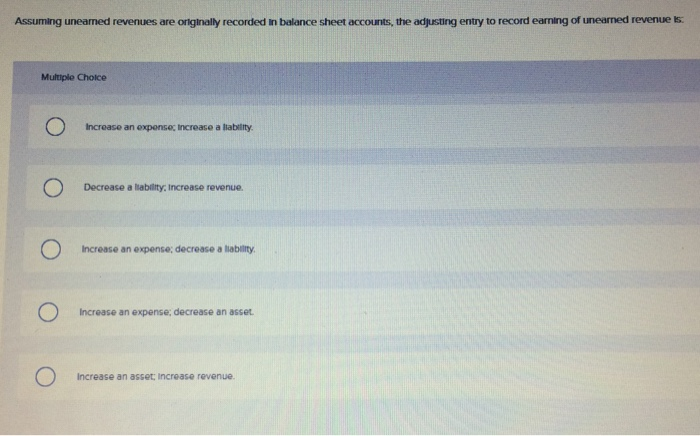

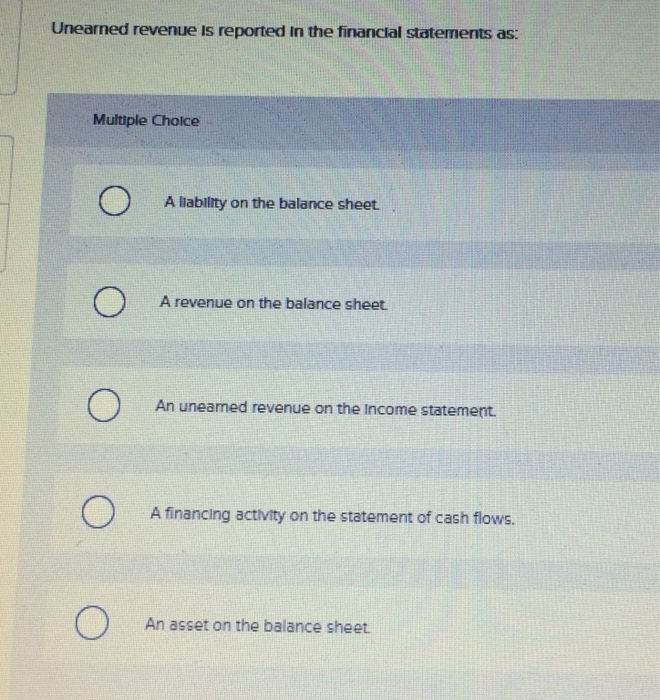

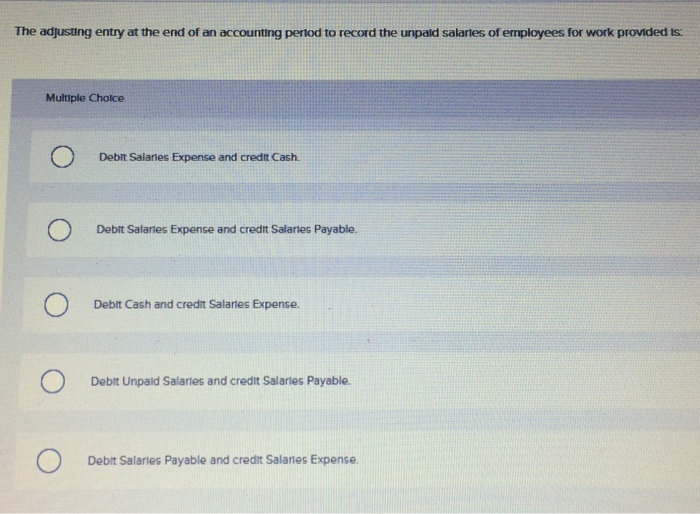

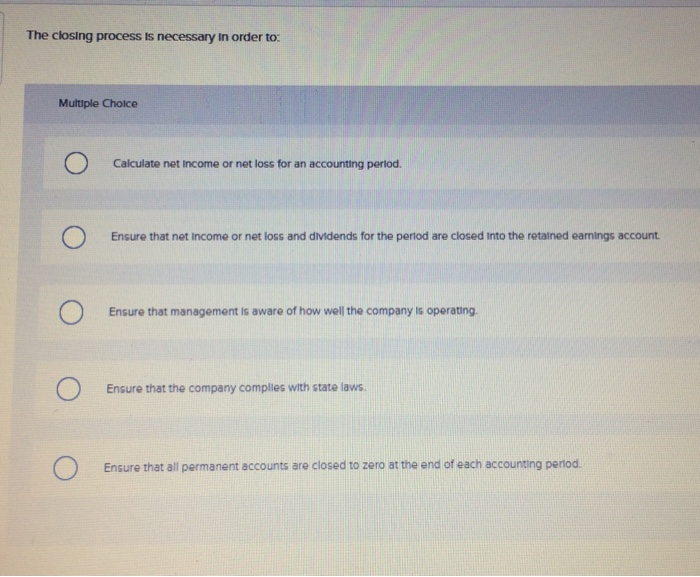

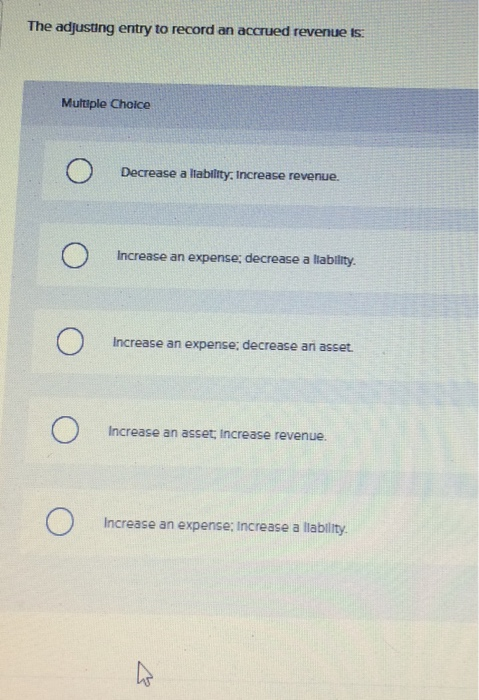

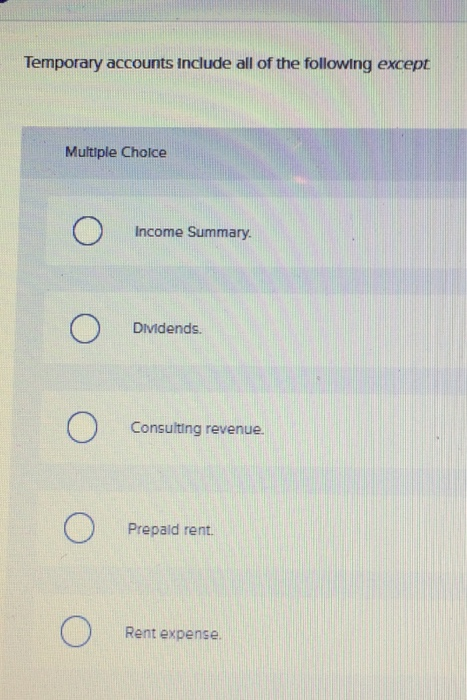

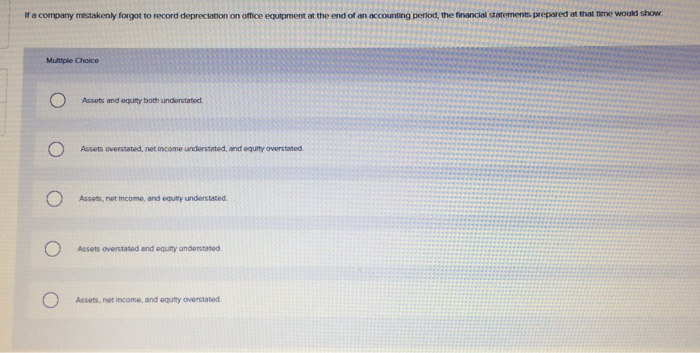

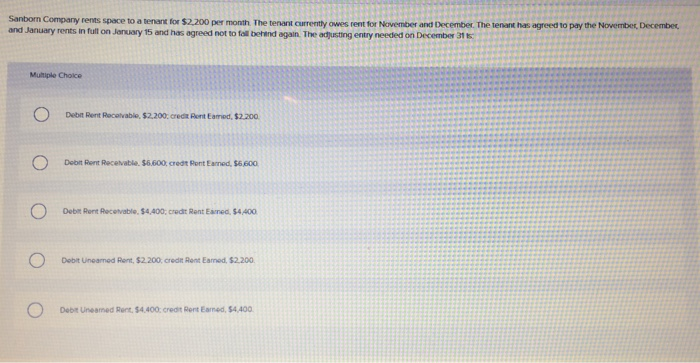

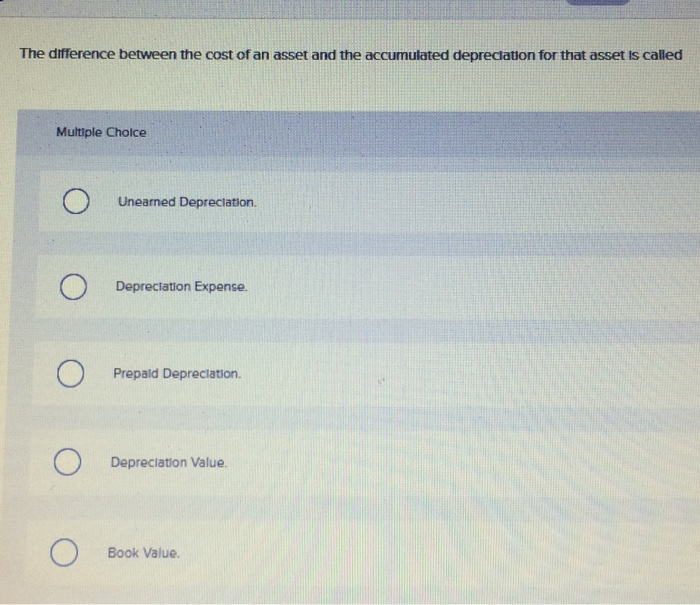

The pernodic expense created by allocating the cost of plant and equipment to the peniods in whach they are used, representing the expense of using the assets, is called Mutaple Choice The expence recognition matching) panciple A contra account An accrued account Assuming uneaned revenues are originally recorded in balance sheet accounts, the adjusting entry to record earning of unearned revenue is Multiple Choice Increase an exponse Increase a lability Decrease a liability, Increase revenue. Increase an expense: decrease a liability Increase an expense, decrease an asset Increase an asset: increase revenue Unearned revenue is reported In the financial statements as: Multiple Choice A liability on the balance sheet. A revenue on the balance sheet An uneaned revenue on the Income statement. A financing activity on the statement of cash flows. An asset on the balance sheet The adjusting entry at the end of an accounting pertod to record the unpald salartes of employees for work provided is Multiple Choice Debit Salaries Expense and credit Cash. Debit Salarles Expense and credit Salaries Payable. Deblt Cash and credit Salartes Expense. Debit Unpald Salartes and credit Salaries Payable. Debit Salaries Payable and credit Salarles Expense The closing process Is necessary in order to: Multiple Choice Calculate net income or net loss for an accounting perlod. Ensure that net income or net loss and dividends for the period are closed Into the retained earnings account Ensure that management is aware of how well the company is operating Ensure that the company comples with state laws Ensure that all permanent accounts are closed to zero at the end of each accounting penod. The adjustng entry to record an accrued revenue ts: Multiple Choice Decrease a Itability, Increase revenue. Increase an expense; decrease a llability Increase an expense; decrease an asset Increase an asset Increase revenue Increase an expense; Increase a lablity. Temporary accounts Include all of the following except Multiple Choice Income Summary. DiMdends. Consulting revenue. Prepald rent Rent expense If a company mistakenly forgot to record deprectation on office equtpment at the end of an accounting penod, the financial statements prepared at that te wouka show Multipio Choice Assets and equty both understated Assets overstated, net income understated, and equity averstated Assets, net income, and equity understaced Assets overstated and equity undenstated Assets, net income, and equity overstated Sanborn Company rents space to a tenant for $2,200 and January rents in full on January 15 and has agreed not to tol behand again. The adjusting entry needed on Decembes 31 s per month. The tenant currently owes rent for November and December. The tenant has agreed to pay the November, December Multiple Choice Debit Rent Rocalvable, $2.200. credit Rent Eamed, $2200 Debit Rent Recevable. $6.600, credt Pont Eamed, $6.600 Debit Rent Recevable. $4,400, credit Rent Eamed, $4.400 Debit Uneamed Rent, $2.200, credit Rent Eamed $2.200 Debit Uneamed Rent, $4.400 credit Rent Earned, $4,400 The difference between the cost of an asset and the accumulated depreclation for that asset is called Multiple Choice Unearned Depreciation. Depreciation Expense. Prepaid Depreclation. Depreclation Value. Book Value