Answered step by step

Verified Expert Solution

Question

1 Approved Answer

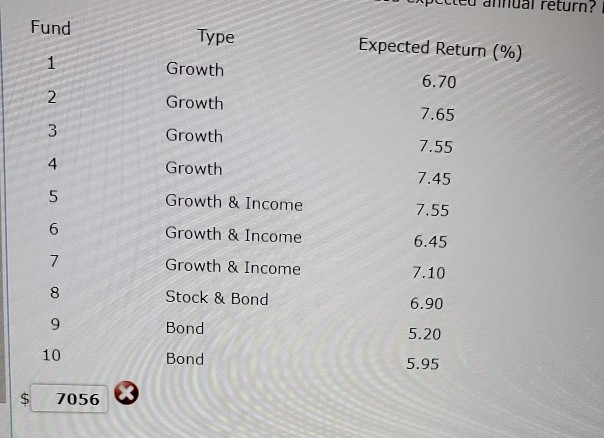

The Pictures are part of the same question. opccleu dimual return? Fund Type Growth Expected Return (%) 6.70 Growth 7.65 7.55 7.45 7.55 6 o

The Pictures are part of the same question.

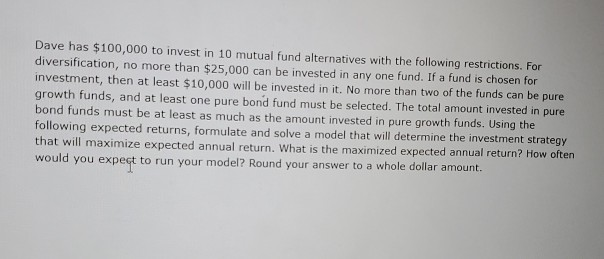

opccleu dimual return? Fund Type Growth Expected Return (%) 6.70 Growth 7.65 7.55 7.45 7.55 6 o ovou AwN Growth Growth Growth & Income Growth & Income Growth & Income Stock & Bond Bond Bond 6.45 7.10 6.90 5.20 5.95 $ 7056 Dave has $100,000 to invest in 10 mutual fund alternatives with the following restrictions. For diversification, no more than $25,000 can be invested in any one fund. If a fund is chosen for investment, then at least $10,000 will be invested in it. No more than two of the funds can be pure growth funds, and at least one pure bond fund must be selected. The total amount invested in pure bond funds must be at least as much as the amount invested in pure growth funds. Using the following expected returns, formulate and solve a model that will determine the investment strategy that will maximize expected annual return. What is the maximized expected annual return? How often would you expect to run your model? Round your answer to a whole dollar amountStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started