Question

The pink diamonds company installs fire alarm systems for large manufacturing enterprises and golf courses due to the design of their systems, some projects frequently

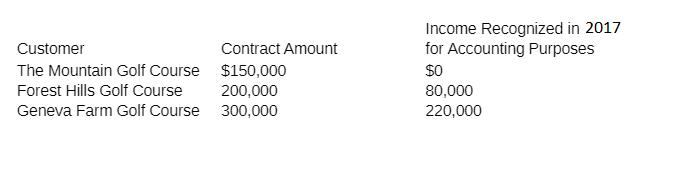

The pink diamonds company installs fire alarm systems for large manufacturing enterprises and golf courses due to the design of their systems, some projects frequently extend over a two-year period pink diamonds uses the percentage of completion method for financial accounting purposes and the completed contract method for tax purposes as of December 31, 2016, all projects were completed the following information relates to projects started but not completed as of December 31, 2017.

Assuming an income tax rate of 30%, what amount should be included in the deferred Tax liability account at December 31, 2017?

Income Recognized in 2017 for Accounting Purposes $0 Customer Contract Amount The Mountain Golf Course $150,000 Forest Hills Golf Course 200,000 80,000 Geneva Farm Golf Course 300,000 220,000

Step by Step Solution

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started