Question

The Pirate Company has just completed its December 31, 2021 fiscal year. Management is reviewing its present absorption costing accounting method and is considering the

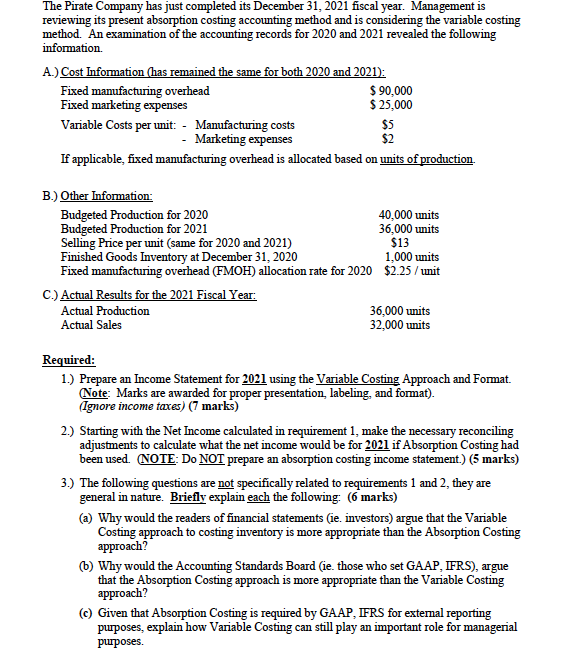

The Pirate Company has just completed its December 31, 2021 fiscal year. Management is reviewing its present absorption costing accounting method and is considering the variable costing method. An examination of the accounting records for 2020 and 2021 revealed the following information.

The Pirate Company has just completed its December 31, 2021 fiscal year. Management is reviewing its present absorption costing accounting method and is considering the variable costing method. An examination of the accounting records for 2020 and 2021 revealed the following information.

A.) Cost Information (has remained the same for both 2020 and 2021):

Fixed manufacturing overhead $ 90,000

Fixed marketing expenses $ 25,000

Variable Costs per unit: - Manufacturing costs $5

- Marketing expenses $2

If applicable, fixed manufacturing overhead is allocated based on units of production.

B.) Other Information:

Budgeted Production for 2020 40,000 units

Budgeted Production for 2021 36,000 units

Selling Price per unit (same for 2020 and 2021) $13

Finished Goods Inventory at December 31, 2020 1,000 units

Fixed manufacturing overhead (FMOH) allocation rate for 2020 $2.25 / unit

C.) Actual Results for the 2021 Fiscal Year:

Actual Production 36,000 units

Actual Sales 32,000 units

Required:

1.) Prepare an Income Statement for 2021 using the Variable Costing Approach and Format.

(Ignore income taxes)

2.) Starting with the Net Income calculated in requirement 1, make the necessary reconciling adjustments to calculate what the net income would be for 2021 if Absorption Costing had been used. (NOTE: Do NOT prepare an absorption costing income statement.)

3.) The following questions are not specifically related to requirements 1 and 2, they are general in nature. Briefly explain each the following:

(a) Why would the readers of financial statements (ie. investors) argue that the Variable Costing approach to costing inventory is more appropriate than the Absorption Costing approach?

(b) Why would the Accounting Standards Board (ie. those who set GAAP, IFRS), argue that the Absorption Costing approach is more appropriate than the Variable Costing approach?

(c) Given that Absorption Costing is required by GAAP, IFRS for external reporting purposes, explain how Variable Costing can still play an important role for managerial purposes

The Pirate Company has just completed its December 31, 2021 fiscal year. Management is reviewing its present absorption costing accounting method and is considering the variable costing method. An examination of the accounting records for 2020 and 2021 revealed the following information A.) Cost Information (has remained the same for both 2020 and 2021): Fixed manufacturing overhead $ 90,000 Fixed marketing expenses $ 25,000 Variable Costs per unit: - Manufacturing costs $5 - Marketing expenses $2 If applicable, fixed manufacturing overhead is allocated based on units of production. B.) Other Information: Budgeted Production for 2020 40,000 units Budgeted Production for 2021 36,000 units Selling Price per unit (same for 2020 and 2021) $13 Finished Goods Inventory at December 31, 2020 1,000 units Fixed manufacturing overhead (FMOH) allocation rate for 2020 $2.25 / unit C.) Actual Results for the 2021 Fiscal Year: Actual Production 36,000 units Actual Sales 32,000 units Required: 1.) Prepare an Income Statement for 2021 using the Variable Costing Approach and Format. Note: Marks are awarded for proper presentation, labeling, and format). Ignore income taxes) (7 marks) 2.) Starting with the Net Income calculated in requirement 1, make the necessary reconciling, adjustments to calculate what the net income would be for 2021 if Absorption Costing had been used. NOTE: Do NOT prepare an absorption costing income statement.) (5 marks) 3.) The following questions are not specifically related to requirements 1 and 2, they are general in nature. Briefly explain each the following: (6 marks) (a) Why would the readers of financial statements (ie. investors) argue that the Variable Costing approach to costing inventory is more appropriate than the Absorption Costing approach? 6) Why would the Accounting Standards Board (ie. those who set GAAP, IFRS), argue that the Absorption Costing approach is more appropriate than the Variable Costing approach? (0) Given that Absorption Costing is required by GAAP, IFRS for external reporting purposes, explain how Variable Costing can still play an important role for managerial purposesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started