Question

The Pizza Company acquired 90% of the outstanding voting common stock of the Salsa Company on June 30, 2017. The Pizza Company had effective control

The Pizza Company acquired 90% of the outstanding voting common stock of the Salsa Company on June 30, 2017. The Pizza Company had effective control over the Salsa Company, however, the Pizza Company uses the Cost Method to account for its Investment in the Salsa Company. The purchase price was $426,000 and on the acquisition date the Salsa Company had Capital Stock of $300,000, Additional Paid in Capital of $50,000 and Retained Earnings of $60,000. On the acquisition date, the fair value of Salsa Company’s building was in excess of its cost value and therefore, the entire excess of implied cost over the fair value of the recorded net assets was attributed to the building. As of the acquisition date, the building had an estimated useful life of 5 years, and the straight-line method for depreciation is used. Between the date of acquisition, June 30, 2017 and December 31, 2019, the two companies had the following intercompany transactions:

1. On December 31, 2017, Pizza Company sold equipment (with an original cost of $100,000 and accumulated depreciation of $50,000) to Salsa Company for $97,500. This equipment has since been depreciated at an annual rate of 20% of the purchase price.

2. During 2018, Salsa Company sold land to Pizza Company at a profit of $15,000.

3. During 2018, the Salsa Company sold $17,500 of inventory to the Pizza Company. As of December 31, 2018, the remaining inventory from this intercompany sale had a profit of $7,500.

4. During 2019, Salsa Company sold inventory to the Pizza Company for $375,000, of which $60,000 was unpaid on December 31, 2019. The December 31, 2019, inventory of Pizza Company included goods acquired from Salsa Company on which Salsa Company recognized a profit of $10,500.

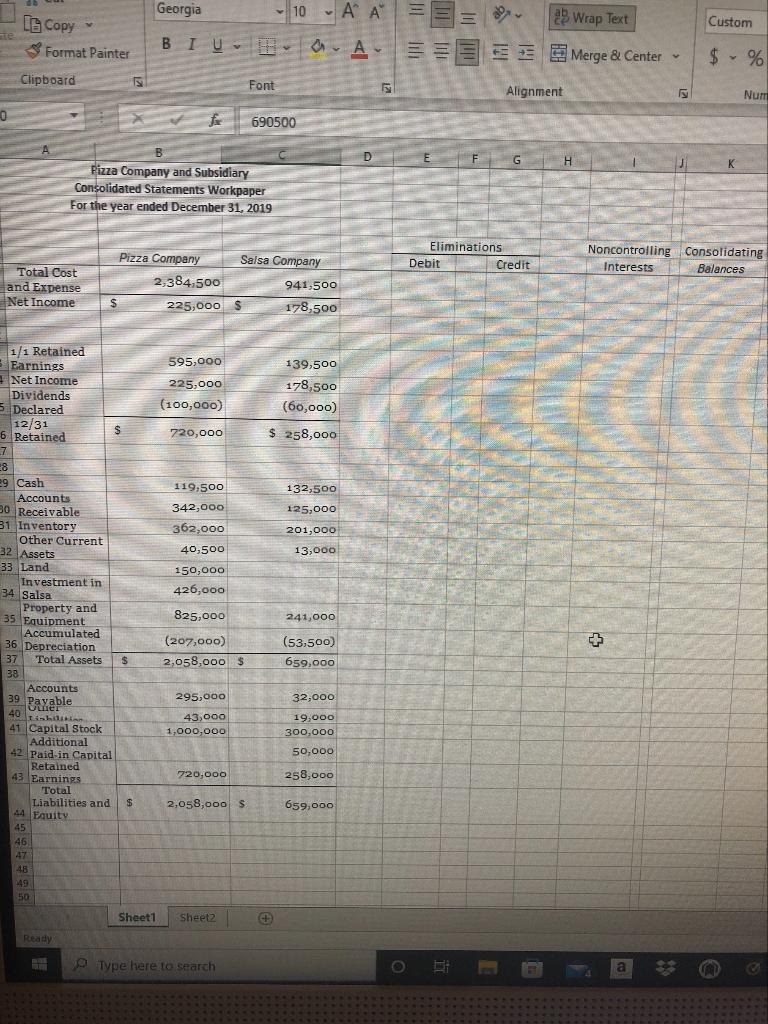

1. Using the Excel workpaper provided, complete a consolidated financial statements workpaper for the year ended December 31, 2019.

te 0 Georgia BI U. x B Pizza Company and Subsidiary Consolidated Statements Workpaper For the year ended December 31, 2019 Pizza Company 2,384,500 $ Copy Format Painter Clipboard Total Cost and Expense Net Income 1/1 Retained Earnings Net Income Dividends 5 Declared 12/31 6 Retained 7 28 29 Cash Accounts 30 Receivable 31 Inventory Other Current 32 Assets 33 Land Investment in 34 Salsa Property and 35 Equipment Accumulated 36 Depreciation 37 Total Assets 38 Accounts 39 Payable 40 Tishilikion 41 Capital Stock Additional 42 Paid-in Capital Retained 43 Earnings Total Liabilities and 44 Equity 45 46 47 48 49 50 Ready $ $ S 225,000 $ 595,000 225,000 (100,000) 720,000 119,500 342,000 362,000 40,500 150,000 426,000 825,000 (207,000) 2,058,000 $ 295,000 43,000 1,000,000 720,000 2,058,000 $ $ Sheet1 Sheet2 Type here to search 10 A A V 1-A- D Font 690500 Salsa Company 941,500 178,500 139,500 178,500 (60,000) $ 258,000 132,500 125,000 201,000 13,000 241,000 (53,500) 659,000 32,000 19,000 300,000 50,000 258,000 659,000 + E O E F Eliminations Debit Alignment G Credit Wrap Text Merge & Center Num 1 Noncontrolling Consolidating Interests Balances + H 5 Custom $%

Step by Step Solution

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Consolidated financial statements are financial statements that present the assets liabilitie...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started