Answered step by step

Verified Expert Solution

Question

1 Approved Answer

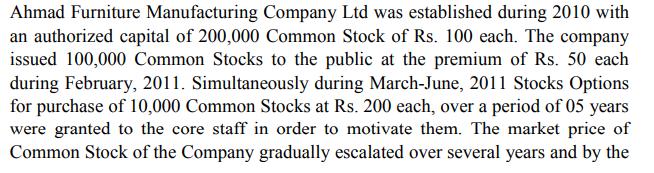

Ahmad Furniture Manufacturing Company Ltd was established during 2010 with an authorized capital of 200,000 Common Stock of Rs. 100 each. The company issued

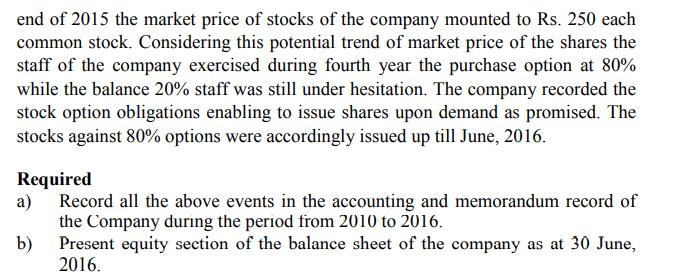

Ahmad Furniture Manufacturing Company Ltd was established during 2010 with an authorized capital of 200,000 Common Stock of Rs. 100 each. The company issued 100,000 Common Stocks to the public at the premium of Rs. 50 each during February, 2011. Simultaneously during March-June, 2011 Stocks Options for purchase of 10,000 Common Stocks at Rs. 200 each, over a period of 05 years were granted to the core staff in order to motivate them. The market price of Common Stock of the Company gradually escalated over several years and by the end of 2015 the market price of stocks of the company mounted to Rs. 250 each common stock. Considering this potential trend of market price of the shares the staff of the company exercised during fourth year the purchase option at 80% while the balance 20% staff was still under hesitation. The company recorded the stock option obligations enabling to issue shares upon demand as promised. The stocks against 80% options were accordingly issued up till June, 2016. Required a) Record all the above events in the accounting and memorandum record of the Company during the period from 2010 to 2016. b) Present equity section of the balance sheet of the company as at 30 June, 2016.

Step by Step Solution

★★★★★

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Answer Required a Record all the above events in the accounting and memorandum record of the Company ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started